What is Loan Account Number (LAN) - How to Check It Online

Have you noticed how every time you try to download a statement, check an EMI, or raise a query, you are first asked for your loan account number? It is the one detail that ties your entire loan journey together.

The catch? Most borrowers do not remember it until they actually need it. But once you understand what it is and how to check it online, most loan-related tasks become effortless. Let's show you the simplest way to do that.

What Is a Loan Account Number?

Your loan account number or LAN is a unique alphanumeric code assigned to each loan you take. Think of it as your loan's identity number that connects every detail of your borrowing to the right account.

Here is what makes your LAN genuinely useful:

- Tracks your EMIs, outstanding balance, interest updates, and repayment history.

- Helps customer support resolve issues faster by pulling up your file instantly.

- Provides access to statements, NOCs, interest certificates, and other loan documents.

- Supports quick updates like EMI changes, contact revisions, and top-up loan requests.

- Keeps multiple loans organised so nothing gets mixed up.

Personal loan on your mind? Download the Hero FinCorp app on Android or iOS for a seamless digital journey and one-tap access to your LAN, EMIs, and other details.

Types and Formats of Loan Account Numbers

Loan account numbers differ across lenders because they use different systems. You may come across formats such as:

| Type of LAN | What It Means | Why Lenders Use It |

|---|---|---|

| Sequential Numbers | Straight numeric series where each new loan gets the next number | Simple, scalable system for lenders handling large volumes |

| Alphanumeric Codes | Mix of letters and numbers, often reflecting loan type, branch, or category | Helps classify accounts clearly and reduces identification errors |

| Customer Identification Integrated Codes | Includes a portion of the borrower's customer ID or profile data | Helps lenders quickly match the loan to the correct customer |

| System-Generated Algorithm Codes | Auto-generated using internal software patterns | Ensures high security and eliminates manual errors |

| Customised Codes | Unique prefixes, patterns, or symbols based on lender policy | Helps lenders organise different loan types or regions more efficiently |

| External Reference Numbers | Codes assigned by government schemes or third-party agencies | Standardises loans under external programs or partnerships |

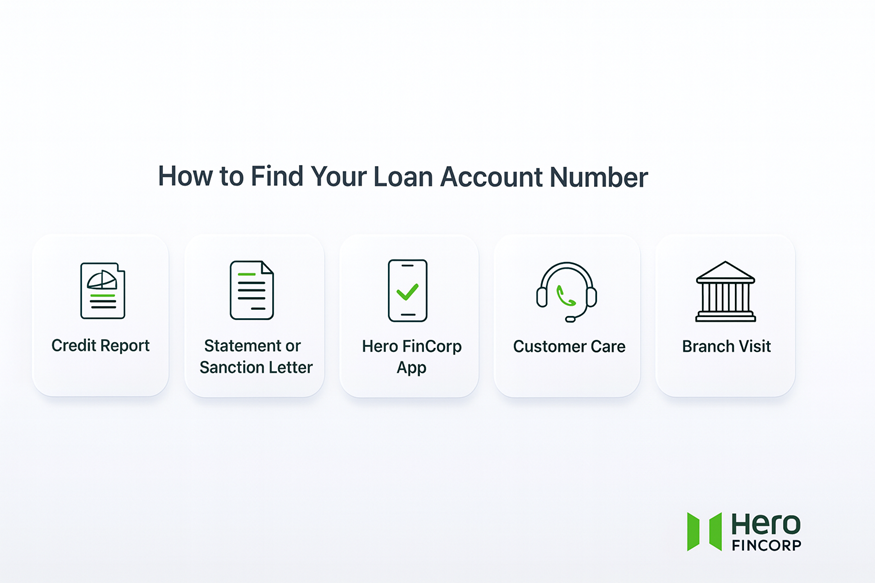

How to Find Your Loan Account Number

Wondering how to check a loan account number without digging through endless emails or old files? Start with the methods that work every single time.

1. Check Your Credit Report

If you want to know your loan account number quickly, your credit report is the easiest place to look. Here is what to do:

- Go to any RBI-approved bureau, like CIBIL, Experian, CRIF High Mark, or Equifax.

- Log in or register using your PAN and basic details.

- Download your free annual credit report.

- Scroll to the "Active Loans" or "Credit Accounts" section.

- Look for your lender's name. Your LAN will be listed right beside the loan entry.

This works for most borrowers because bureaus fetch data directly from lenders and update it almost in real time, supported by the RBI's push for faster reporting.

2. Review Your Loan Statement or Sanction Letter

Your sanction letter, welcome email, or monthly statement clearly mentions your LAN at the top. If you applied online, check your email inbox for the approval or disbursal letter.

3. Log in to the Hero FinCorp Website or Mobile App

Took a personal loan from Hero FinCorp? You can view your loan account number online at any time. It's simple, quick, and perfect when you need your loan details on the go.

- Visit the Hero FinCorp website or open the digital lending app.

- Go to your dashboard to view your active loan.

- Your LAN will appear along with your EMI amount, due date, and statements.

4. Call Customer Service or WhatsApp Support

You can call Hero FinCorp customer care and verify your details to get your loan account number. Keep your registered mobile number and basic KYC details ready.

5. Visit the Nearest Branch

If you prefer offline help, walk into any Hero FinCorp branch and request your LAN. Carry a valid ID like PAN or Aadhaar for quick verification.

Tips to Manage and Secure Your Loan Account Number

A little organisation goes a long way in keeping your loan experience smooth. These quick habits help more than you think:

- Store it in a secure notes app or password manager, not in random screenshots.

- Share your LAN only when you are sure the person or platform is genuinely from your lender.

- Update your mobile number and email to receive loan alerts on time.

- Check your EMIs regularly to make sure everything is running as it should.

- Report anything that looks odd the moment you spot it, even a small mismatch.

When Will You Receive Your Loan Account Number

You usually receive your loan account number immediately after approval. It appears on your sanction letter, welcome email, in a follow-up SMS after disbursal, or on the app dashboard once the loan is activated.

Steps to Apply for a Personal Loan Online with Hero FinCorp

Hero FinCorp's personal loan application process is quick and fully digital. Here is how the online journey works from start to finish:

- Head to Hero FinCorp's site or app and log in with your mobile number.

- Share your basic information and upload your PAN, Aadhaar, and income proofs.

- Complete the digital journey through video KYC or Account Aggregator flow.

- Review your loan offer, e-sign the agreement, and receive the funds shortly after approval.

- Set up auto-debit and track EMIs directly in the app. Your personal loan account number will be generated instantly.

Managing your loan gets much easier when your details are just a tap away. Your LAN, EMIs, and statements should feel effortless, and with Hero FinCorp, they do.

Check your eligibility in minutes and see how simple borrowing can truly feel.

Frequently Asked Questions

1. Can I find my loan account number without visiting a branch?

Yes. You can get it through your credit report, app login, email, or customer care.

2. How is the loan account number different from the bank account number?

A bank account number belongs to your savings account. A loan account number belongs to your loan.

3. Does the loan account number change after prepayment or foreclosure?

No. The number remains the same until the loan is closed.

4. What if I lose my loan account number?

You can retrieve it using your registered mobile number through customer care or app login.

5. How many digits are there in a loan account number?

It varies by lender. Some use 10-16 digits, and others use alphanumeric formats.