Instant Personal Loans for Building a Strong Credit Mix—Do They Help?

Your credit score isn't built on one factor alone. Among repayment history and loan amounts, there's another piece that matters: your credit mix.

A balanced mix demonstrates to lenders that you can handle various types of debt responsibly. But here's the question: can taking an instant personal loan help you improve this mix? Let's find out.

Understanding Credit Mix

Credit mix is simply the variety of loans and credit accounts you hold. Think of it as the balance between different kinds of borrowing. For example:

- Secured loans like home loans, car loans, or loans against property (where you pledge an asset).

- Unsecured personal loans like credit cards or personal loans (where no collateral is required).

Credit bureaus in India, such as CIBIL, consider this mix when calculating your credit score. A healthy balance signals that you're capable of managing multiple credit types, not just one.

Components of a Healthy Credit Mix

A good credit mix isn't about how many loans you take, but the balance you maintain. Key elements include:

- Variety of Credit Types: A mix of secured (home loan) and unsecured (personal loan, credit card) accounts.

- Repayment History: Timely EMIs across accounts show financial discipline.

- Length of Credit History: Older accounts build trust with lenders.

- Credit Utilisation Ratio: Using too much of your credit limit can hurt your score.

- Number of Active Accounts: Not too many, not too few, just enough to demonstrate responsible usage.

Using Personal Loan to Improve Credit Mix: How It Works

Taking a personal loan just for the sake of variety may not be the right approach. But when planned well, an instant personal loan can support your credit profile. Here's how:

Add Variety

If your credit history is primarily based on credit cards, adding a personal loan demonstrates that you can handle instalment-based borrowing as well. This balance makes your profile stronger in the eyes of lenders. Plus, they're fairly accessible.

With Hero FinCorp, you can get instant personal loans online with approvals in just 10 minutes! Get our quick loan app now!

Build Repayment Record

Regular, on-time EMIs create a positive repayment trail. Over time, this improves both your mix and your credit score. Use tools like Hero FinCorp's personal loan EMI calculator to discover the magic number that you can manage seamlessly.

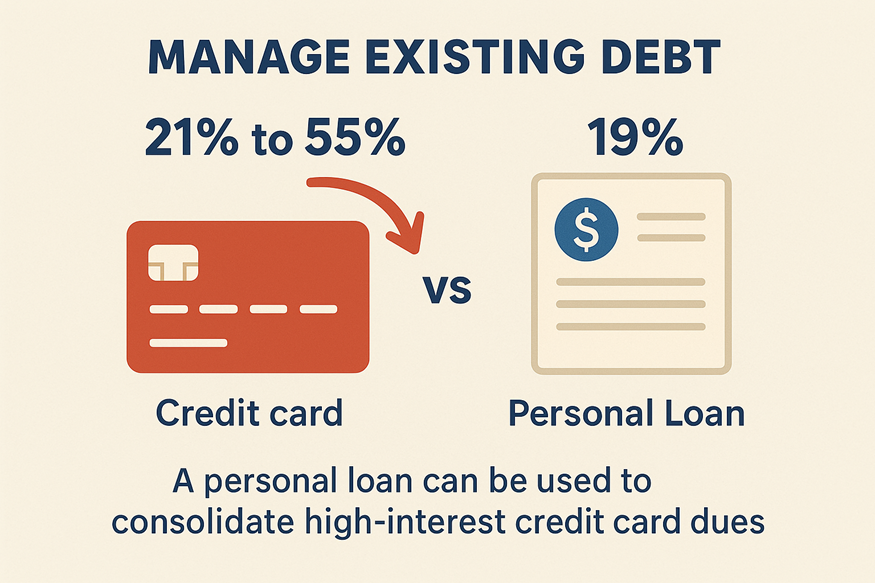

Manage Existing Debt

A personal loan helps consolidate high-interest credit card debt, offering lower rates that ease your repayment burden and improve your credit structure. This not only lowers your interest burden but also improves the structure of your credit.

Improve Eligibility

With a better mix, lenders may be more open to approving higher loan amounts in the future. Keep a close eye on your CIBIL score. If you notice gaps, a personal loan can be a smart way to balance your portfolio.

Conclusion

A personal loan won't magically fix your credit score. Nonetheless, if used wisely, it can strengthen your credit mix and demonstrate your credibility. This is helpful for one who has been limited to using credit cards.

With Hero FinCorp's instant personal loans, you don't have to wait to take that step. So why wait? Apply online, receive instant approvals, plan your EMIs wisely, and confidently march towards a healthier credit profile.

Frequently Asked Questions

1. Does credit mix really affect my CIBIL score?

Yes. Credit mix contributes to your score, though it isn't the largest factor. A balance of secured and unsecured loans improves your profile.

2. Can taking too many personal loans hurt my credit score?

Yes. Multiple loans taken in a short period are red flags for lenders, indicating stress. It is best to borrow only when absolutely necessary and repay on time.

3. How does a personal loan differ from a credit card in a credit mix?

A personal loan is one that is paid in fixed EMIs, whereas a credit card remains a revolving type of credit. Holding both implies that you can handle varied borrowing types.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.