Gold Loan Vs Personal Loan: Which one is better

- Instant Loan vs Gold Loan: Which Is Better For You?

- Understanding Instant Loans

- Understanding Gold Loans

- Instant Loan vs Gold Loan: Detailed Comparison

- Interest Rates and Processing Fees: What Should You Expect?

- Gold Loan vs Personal Loan: Which Loan Is Better for Different Financial Needs?

- Loan Repayment Options and Flexibility

- Application Process and Documentation

- Tax Benefits on Gold Loans and Personal Loans

- Risks and Considerations Before Taking a Loan

- Why Choose Hero FinCorp for Your Loan Needs

- Frequently Asked Questions

Some weeks really test your patience, don’t they? The fridge stops cooling without any warning, the kids need new school items, and there’s a family function you can’t avoid.

Soon, your expenses start piling up, and savings tap out. That’s when you start comparing quick-cash options like an instant loan vs gold loan, to cover this gap.

But before you make that call, let’s decode how each works and which one’s right for you.

Understanding Instant Loans

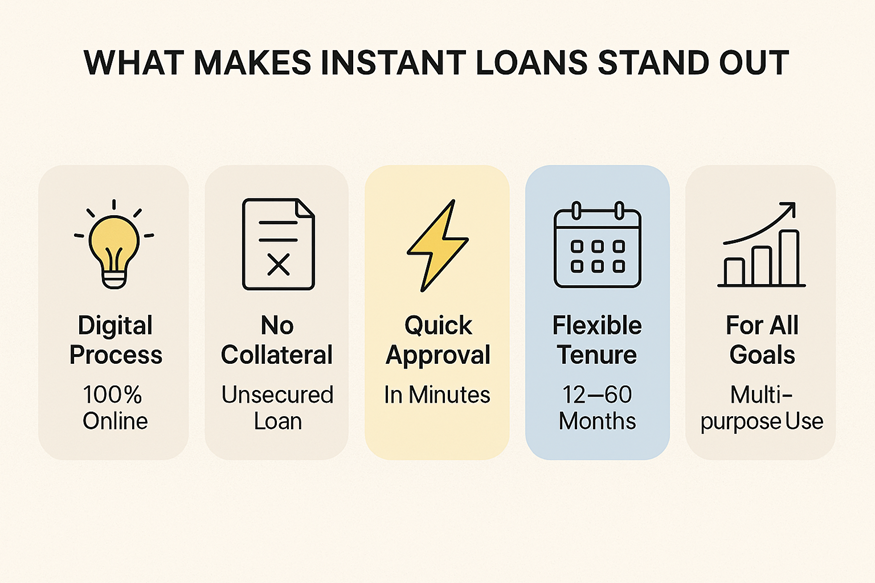

An instant loan is a quick, digital-first personal loan that helps you meet short-term money needs without pledging any collateral. Apply online, upload the required documents, and get approval in minutes. Once verified, the funds hit your account almost instantly.

Here’s what makes it stand out:

- Not tied to one goal—use it to fund big moments, handle surprises, or clear old dues

- Fully unsecured, so approval depends on your income and credit score, not on assets

- 100% digital journey from application to disbursal, often done within hours

- Interest rates are higher, and repayments start almost immediately

- Flexible tenure options (12 to 60 months) to keep EMIs within your comfort zone

In FY 24, Indians took nearly 14 crore personal loans, with most being first-time borrowers under 35. No wonder instant loans are stealing the spotlight: they’re fast, paperless, and just a few taps away.

With Hero FinCorp, you can join this new wave of confident, digital borrowers and get up to ₹5 lakhs hassle-free.

Understanding Gold Loans

A gold loan lets you borrow money by pledging your gold jewellery or coins as security. The amount depends on the purity and market value of your gold, typically up to 75% (smaller loans can go up to 80–85% under RBI’s latest norms).

Here’s why it works for many borrowers:

- Instant approval, since your gold itself acts as collateral

- Simple to qualify, even if you’re new to credit or rebuilding your score

- Lower interest rates compared to most unsecured loans

- Minimal paperwork, with funds often credited the same day

- Short tenures (3 to 24 months) for quick repayment

- Fully regulated and secure, with your gold safely stored and returned within seven working days after repayment

Recent trends show more borrowers turning to gold loans as a trusted, quick source of credit.

Also Read: types of personal loan

Instant Loan vs Gold Loan: Detailed Comparison

You’ve got the basics down, but the real question is: gold loan or personal loan, which is better? Let’s break it down side by side.

| Feature | Instant Loan | Gold Loan |

|---|---|---|

| Collateral Required | None (unsecured) | Yes, gold ornaments or coins |

| Who Can Apply | Salaried or self-employed individuals with a steady income | Anyone owning gold, including new-to-credit borrowers |

| Eligibility | Based on KYC, income proof, credit score, and repayment history | Only basic KYC and gold evaluation |

| Loan Amount | Up to ₹5–25 lakh, depending on your profile | Up to 75%–85% of gold’s market value |

| Interest Rates | Typically higher, starting from 18% p.a. | Lower, usually from 8% p.a. |

| Processing Time | Fully digital, approval often within minutes | Same day after gold purity and value check |

| Repayment Tenure | 12 to 60 months with fixed EMIs | 3 to 24 months with flexible or bullet repayment options |

| Credit Score Impact | Key factor for approval and interest rate | Minimal impact; suitable even with lower scores |

| Risk Factor | Missing EMIs may affect your credit score | Gold may be auctioned if repayment is delayed |

Interest Rates and Processing Fees: What Should You Expect?

When you apply for a personal loan, your rate isn’t just a random number. It’s a reflection of your profile and the lender’s risk lens. Here’s what matters:

- Credit score: A score above 750 shows discipline and secures better terms. Lower scores may lead to higher rates or stricter conditions.

- Income stability: Regular paychecks build lender confidence. Irregular income adds risk.

- Debt load: Multiple EMIs signal strain. The higher your debt, the pricier your next loan may get.

- Tenure choice: Longer equals more total interest, while shorter ones bring better rates but higher EMIs.

You’ll also pay a processing fee (usually 1-3% of the loan amount) to cover verification and setup, a one-time cost before disbursal.

With a gold loan, lenders focus on the metal’s purity and market value, not your credit score. The result? Lower rates (around 8% p.a.) and smaller processing fees (0.5%–2%).

Gold Loan vs Personal Loan: Which Loan Is Better for Different Financial Needs?

When comparing an instant loan vs gold loan, it all comes down to what you value more: flexibility or affordability.

When an Instant Loan Works Better

- You don’t want to pledge gold or other assets

- You need a larger loan amount (₹50,000 to ₹10 lakh)

- You have a strong credit score and want quick, 100% digital approval

- You prefer longer tenures with fixed, predictable EMIs

When a Gold Loan Makes More Sense

- You need a smaller, short-term credit (₹10,000 to ₹2 lakh)

- You have a low or no credit score

- You want minimal paperwork and no income proof

- You prefer lower interest rates

Loan Repayment Options and Flexibility

Both loans offer repayment flexibility, but the right choice depends on how you plan your cash flow.

Personal Loan Repayment

- Fixed EMIs spread across your chosen tenure (12-60 months)

- Prepayment or foreclosure allowed after a few months (small charges may apply)

- Best for salaried borrowers with steady monthly income

Gold Loan Repayment

- Pay only interest during the term, principal at maturity

- Bullet repayment option (clear the full amount in one go)

- Preclosure anytime with minimal or no fees

- Shorter tenures (3–24 months) suit quick or seasonal credit needs

Application Process and Documentation

In the instant loan vs gold loan debate, both are quick to get, but the difference lies in ease of application.

Instant personal loans offer the convenience of a 100% digital process.

- Apply online through the lender’s website or app

- Complete KYC, upload necessary documents, and share bank details

- Complete quick digital verification and e-signature

- Get approval within minutes and funds credited directly to your account

In contrast, gold loans require in-person verification. You’ll have to visit a branch or partner centre with your jewellery and ID proof. The lender checks purity, weight, and value before approval, and funds are usually disbursed the same day.

Also Read: Instant Personal Loans on WhatsApp—The Rise of Conversational Credit

Tax Benefits on Gold Loans and Personal Loans

Wondering about tax benefits on loans in India? Neither gold nor personal loans offer deductions for general use. However:

- Personal loans used for home renovation or business can qualify under Sections 24(b) or 36(1)(iii) of the Income Tax Act.

- Gold loans taken for business expansion can also offer tax benefits on the interest paid.

Keep proof of how you use the loan and consult a tax advisor before claiming deductions.

Risks and Considerations Before Taking a Loan

Missed personal loan EMIs can lower your credit score, invite penalties, and affect future eligibility. The risks of gold loans are different; delayed repayments can result in the auction of your pledged asset. Borrow smart, read the fine print, and repay consistently.

Also Read: Which Loan Is Best For Home renovation

Why Choose Hero FinCorp for Your Loan Needs

Still weighing an instant loan vs gold loan? With Hero FinCorp, you can skip the collateral and get quick, paperless access to funds.

As one of India’s most trusted NBFCs, we offer seamless instant loan journeys with flexible EMIs, transparent terms, top-tier security, and real-time digital tracking. That way, you experience true convenience and confidence at every step.

Frequently Asked Questions

1. Is it better to take a gold loan or a personal loan?

Both work well for urgent money needs. If you want a fully digital, paperless process and don’t wish to pledge assets, a personal loan is the smarter choice.

2. Is a gold loan instant?

Almost. Once your gold’s purity and value are verified, funds usually arrive the same day.

3. Can a gold loan increase a credit score?

Not directly, but repaying on time helps build healthy credit behaviour.