Consumer Loan Vs Personal Loan: What’s the Difference?

- Understanding Consumer Loans

- Understanding Personal Loans

- Consumer Loan Vs Personal Loan

- Benefits of Consumer Loans

- Advantages of Personal Loans

- Eligibility Criteria and Documentation

- When to Choose a Consumer Loan and Personal Loan?

- How to Apply for A Consumer Loan and a Personal Loan with Hero FinCorp

- Manage Your Purchases With A Consumer or Personal Loan

- Frequently Asked Questions

Whether it's a TV, an air conditioner, or a bigger fridge, upgrading your home is necessary. But these things often come with a heavy cost.

Research shows that after adjusting for inflation, real wage growth has ranged between -0.4% to 3.9%. This means reduced purchasing power. Using up all your savings to buy these is not a wise choice. Because what if there's a financial emergency?

So, what are your options? A consumer loan and a personal loan offer a practical option to buy these without putting a burden on your pocket.

But which one to choose? Let's compare consumer loans and personal loans to determine the best option.

Understanding Consumer Loans

A consumer loan refers to a loan that you take to purchase consumer durable products, such as appliances or gadgets. With a consumer loan, you can purchase these products on EMI, spreading the cost over several months. You can use the loan amount to buy the particular product only.

Understanding Personal Loans

A personal loan is an unsecured loan that can be used for various purposes as needed. You can use it to pay medical bills, buy lifestyle products, or for any other purpose.

Remember, while both consumer loans and personal loans help you manage expenses without draining your savings, the key difference lies in their purpose, flexibility, and usage.

A personal loan is more versatile, allowing you to use the funds for multiple needs, from medical expenses and travel to home upgrades, usually with higher loan amounts and flexible repayment options.

Emergency funds needed? Apply now on our instant loan app!

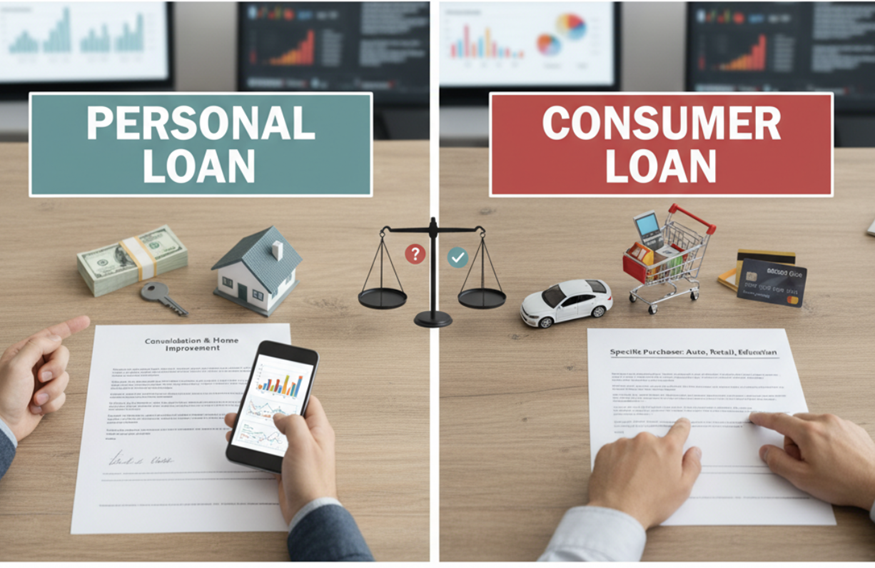

Consumer Loan Vs Personal Loan

To find out which one is the right option for you, you need to know the difference between a consumer loan and a personal loan.

Here's a quick consumer loan Vs personal loan overview:

| Point of Difference | Consumer Loan | Personal Loan |

|---|---|---|

| Purpose / Usage | For specific consumer durable products such as furniture, appliances, or gadgets | Can be used for any legitimate purpose, including travel, medical costs, or home upgrades |

| Loan Amount | Limited to the cost of the product you are buying | You can get a higher loan amount to manage multiple needs with one loan |

| Flexibility | Less flexible. You can use the funds for a specific purpose only | Offers good flexibility. You can use the funds for multiple needs |

| Processing Time | Quick approval, as no complex documentation is involved | Takes slightly more time as the lender needs to assess financial stability before confirming |

| Tenure | Shorter repayment tenure | Longer repayment period |

| Collateral Requirement | These loans may or may not require collateral. It depends on the lender | These are unsecured loans, so you do not need to offer any collateral |

| Interest Rate | Lower interest rates on secured loans and higher rates on unsecured ones | The interest rate depends on your creditworthiness |

A personal loan is the right choice if you need a flexible option or want to bundle multiple purchases. If you need loans for a specific loan, a consumer loan is the right choice.

Also Read: gold loan vs personal loan

Benefits of Consumer Loans

Let's find out how a consumer loan benefits you:

- A lot of vendors offer consumer loans at affordable interest rates. This makes it easy for you to buy specific products

- There are lower foreclosure charges, which are the charges when you close the loan before the designated time

- Minimal paperwork and documentation are required, which makes it a seamless process

Advantages of Personal Loans

Here are the benefits of a personal loan:

- You don't need to put in collateral. So, your assets won't be seized if you fail to pay the loan

- A personal loan is versatile. You can use it for any legitimate need, be it loan consolidation, travelling, or buying lifestyle products

- The borrowing limit is not restricted to the product cost. You can borrow the amount you require

Eligibility Criteria and Documentation

The eligibility criteria and documentation required for a personal loan and a consumer loan differ slightly.

Let's see the eligibility requirements and documentation for personal and consumer loans:

Personal Loan Eligibility

- 21-58 years old

- Indian citizenship

- Minimum 6 months of work experience for salaried individuals and 2 years of stable operations for self-employed

- Minimum income of Rs 15,000 per month

- A credit score of 700/750+ is preferred

Consumer Loans Eligibility

- Age should be between 21-58 years

- Should be a citizen of India

- Minimum 6 months of work experience for salaried persons and 2 years of stable operations for self-employed

- Minimum monthly income of Rs 15,000

Documentation Required

- Duly filed the loan application form and a passport-size photo

- Identity proof

- Residence proof

- Residence Ownership Proof

- Income proof

- Job continuity proof

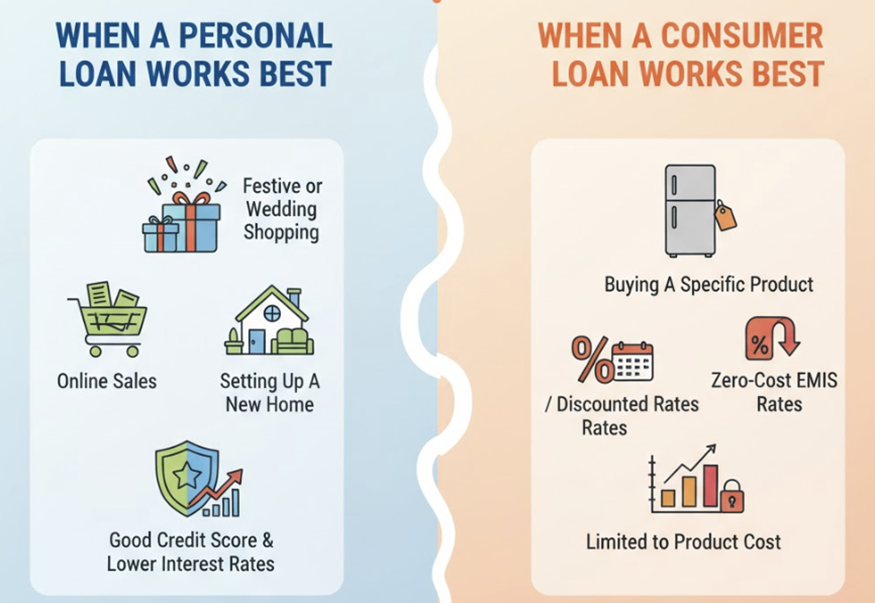

When to Choose a Consumer Loan and Personal Loan?

When should you choose a consumer loan and when a personal loan? Let's explore the differences between personal loans and consumer loans.

When A Personal Loan Works Best

- Festive or wedding shopping to bundle costs and maintain one EMI

- Online sales, so you have the money to buy a range of products

- Setting up a new home to avoid multiple loans

- If you have a good credit score, as you can get lower interest rates

When A Consumer Loan Works Best

- A consumer loan is an ideal option when you want a loan to buy a specific product

- When retailers or banks offer zero-cost EMIs or discounted interest rates for a specific product

- A consumer loan is limited to the cost of the product. So, when you want a simple financing option, a consumer loan is the right choice

Wondering how much your personal loan EMI will be? Use Hero FinCorp's Personal Loan EMI Calculator to calculate EMIs and plan your finances effortlessly quickly.

How to Apply for A Consumer Loan and a Personal Loan with Hero FinCorp

The application process for both consumer and personal loans through the personal loan app is simple and quick.

Here's how to apply:

- Open the Hero Fincorp Personal Loan App

- Search for the instant loan option and click on "Apply Now"

- Enter your mobile number and verify it with the OTP received

- Select the loan amount you need

- Complete KYC verification and check income eligibility

- Click on "submit" to complete your application

Read More: 5 Tips to Get Your Personal Loan Approved Instantly

Manage Your Purchases With A Consumer or Personal Loan

Both consumer loans and personal loans help you manage expenses without draining your savings. In essence, if you need funds for a specific product, a consumer loan would be the ideal option. But if you want the flexibility to cover multiple needs, choose a personal loan.

Hero Fincorp makes it simple for you to apply for both consumer and personal loans. With a simple application process and quick approval, you get approval within minutes.

So why wait? Check out the Hero Fincorp Instant Loan App today, apply in minutes, and manage your purchases without straining your finances!

Frequently Asked Questions

1. Can a personal loan be used to buy consumer durables?

Yes, you can use a personal loan to buy consumer durables.

2. Are interest rates on consumer loans lower than those on personal loans?

For a secured consumer loan, the interest rates are lower, but they may go higher for an unsecured one.

3. What is the maximum loan amount offered under consumer loans?

The maximum amount offered under consumer loans is limited to the cost of the consumer durable you are buying.

4. Can self-employed individuals apply for personal loans at Hero FinCorp?

Yes, self-employed individuals can apply for a personal loan at Hero Fincorp with the required documents.

5. How fast can I get my consumer or personal loan approved?

The approval duration depends on the lender. At Hero Fincorp, you get fast approval within minutes.

6. Is collateral always required for consumer loans?

No, you don't always need collateral for consumer loans.