What Your CIBIL Score Says About You and What to Do About It

You've got EMIs piling up, school fees around the corner, and now a sudden medical expense adds to the pressure. In moments like these, a quick loan feels like the only way to breathe easy.

But instead of relief, you're left anxious when the application doesn't go through.

The good news is, there's usually a simple reason behind it: your CIBIL score. It is nothing but your financial report card.

Once you understand what it says about you, you can take charge, improve it, and open the door to that instant loan when you need it most.

What Is a CIBIL Score and Why Should You Care?

Think of your CIBIL score as your financial reputation in one number. It's put together by the Credit Information Bureau (India) Limited and can be anywhere between 300 and 900.

Your score is shaped by how you've handled money so far, whether you pay bills on time, how much of your credit limit you use, the types of loans you've taken, and even how often you apply for new credit. The closer you are to 900, the more you're telling lenders, "You can trust me with your money."

The Financial Report Card: What Does Your Score Mean?

Your CIBIL score tells lenders how reliable you are when it comes to repaying debt. Here's what your number really says about you:

| CIBIL Score Range | Credit Health | What It Means for You |

|---|---|---|

| 750 and above | Excellent | Lenders trust you. Expect quick approvals and low interest for personal loans |

| 650–749 | Good | You're doing fine. You'll get most loans, but not always at the best rates |

| 550–649 | Average to Low | Your credit history may worry lenders. Be ready for higher interest rates |

| Below 550 | Poor | Getting approved for a personal loan can be tough. Pay bills on time, clear overdue amounts, and avoid new debt to improve your score |

Why Your CIBIL Score Matters for a Personal Loan?

Thinking about applying for a personal loan? Your CIBIL score could play a big role in what happens next. It's one of the first things lenders check to understand how you manage your money.

Your score helps them figure out:

- Whether you're eligible for the loan

- How much interest you'll pay

- How much you can borrow

Both Deepa and Rohan got a personal loan, but their credit scores made all the difference. Deepa's score of 815 got her ₹5 lakh at 19% interest, with an EMI of ₹9,500.

Rohan's score of 670 only got him ₹3 lakh at 24% interest, with a monthly EMI of ₹8,600. Deepa paid slightly more per month for a much bigger loan, while Rohan paid nearly the same EMI for a loan that was almost half the size.

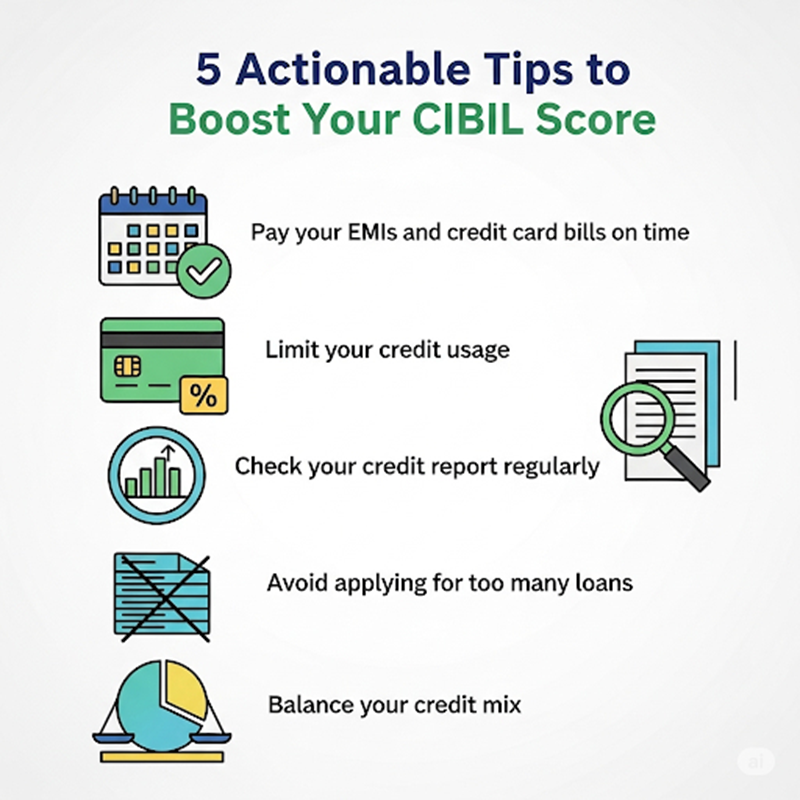

5 Actionable Tips to Boost Your CIBIL Score

A low CIBIL score isn't forever. With a few smart changes, you can improve it and increase your chances of getting that instant loan approval at better terms. Here's how:

- Pay your EMIs and credit card bills on time, as missing even one of them can hurt your score. Set reminders or automate payments so you never slip

- Limit your credit usage and try to keep your spending under 30% of your limit. If your card limit is ₹1 Lakh, try not to spend more than ₹30,000.

- Check your credit report regularly because errors do happen. A wrong entry can lower your score, so review your report and raise disputes if needed

- Applying for too many loans at once? It makes you look suspicious and lowers your score

- Balance your credit mix, like secured ones like home loans, and unsecured ones like instant personal loans

Track Your CIBIL Score, Build Credit and Borrow Better!

Your credit score is a reflection of your financial habits and your ticket to better loan options and lower interest rates. The good news is, you can improve it. Simple steps like paying your bills on time and managing your existing credit are all it takes.

At Hero Fincorp, we believe getting the funds you need should be simple and stress-free.

Ready to take control of your credit and borrow with confidence? Download our Instant loan app to see how quickly you can access the funds you need to move forward.

Frequently Asked Questions

1. How can I check my CIBIL score?

You can check your CIBIL score for free (once a year) online through the official CIBIL website or trusted financial platforms. You'll need basic details like your PAN and mobile number.

2. What's the minimum CIBIL score needed for a personal loan?

Lenders mostly prefer a score of 750 or above for easy approval. But some may still approve loans with lower scores if other factors like your income or employment are strong.

3. Can I still get a loan if I have a low CIBIL score?

Yes, you can, but maybe at higher interest rates. Lenders will also consider factors like your income, job stability, and repayment capacity, not just your score. Refer to our 5 actionable tips above to improve your score before applying.

4. How long does it take to improve my CIBIL score?

It depends on following good credit habits. With timely EMI payments, low credit usage, and no missed bills, you may see improvement in 6–12 months.