Supply Chain Finance: Meaning, Process, Features, & Benefits

- What is Supply Chain Finance (SCF)?

- How Does Supply Chain Finance Work?

- Key Features of Supply Chain Finance

- Types of Supply Chain Finance Solutions

- Benefits of Supply Chain Finance for Businesses

- Supply Chain Finance in India: Current Trends

- Challenges in Implementing Supply Chain Finance

- Steps to Avail Supply Chain Finance for Your Business

- Frequently Asked Questions

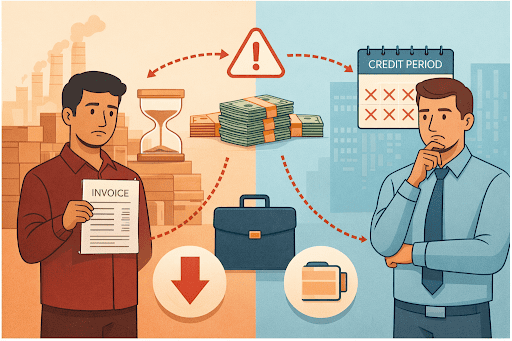

Cash flow plays a central role in any business. Suppliers look for prompt payment, while buyers often use credit periods to manage expenses. When payment cycles fall out of sync, pressure builds on working capital and day-to-day operations can feel the strain.

Supply chain finance addresses this mismatch. Suppliers can receive payment earlier, while buyers continue with their agreed credit terms. Funds are released against verified invoices, so suppliers do not have to wait through the full credit period. This improves liquidity and reduces pressure on internal funds across the supply chain.

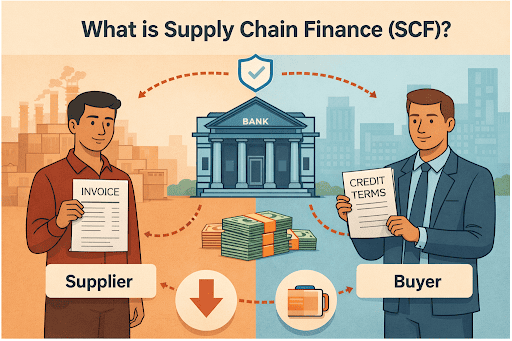

What is Supply Chain Finance (SCF)?

Supply chain finance describes financing methods that align payment timing between buyers and suppliers. Suppliers receive early access to invoice payments, and buyers settle dues later according to agreed terms. A financial institution funds the early payment based on the buyer’s credit strength.

This model improves payment timing across the supply chain. Suppliers receive early funds against approved invoices, while buyers honour the original due dates. It is known as reverse factoring because the buyer drives the financing arrangement.

How Does Supply Chain Finance Work?

The supply chain finance process follows a clear sequence. First, a buyer partners with a bank or NBFC to set up an SCF arrangement. Suppliers are then invited to participate in the programme.

After delivering goods or services, the supplier issues an invoice to the buyer. Once the buyer verifies and approves the invoice, the supplier can opt for early payment through the financier. The financier pays the supplier most of the invoice amount upfront after deducting a financing fee.

On the original due date, the buyer pays the full invoice amount to the financier. This structure allows suppliers to access funds earlier, while buyers retain their existing credit terms.

Key Features of Supply Chain Finance

Supply chain finance includes several important features:

- Buyer-led structure: The programme is typically initiated by the buyer

- Invoice-based funding: Financing is provided against approved invoices

- Improved liquidity: Suppliers receive funds earlier than scheduled

- Flexible payment terms: Buyers continue with agreed credit periods

- Credit strength advantage: Financing costs often reflect the buyer’s credit profile

Types of Supply Chain Finance Solutions

Supply chain finance includes a few common models used for working capital support:

- Reverse factoring: After the buyer confirms the bill, payment can be released to the supplier ahead of time, with settlement coming from the buyer on the due date

- Factoring: The supplier transfers outstanding receivables to a finance company and receives most of the amount immediately

- Invoice discounting: The supplier takes funding against invoices but continues to collect the dues from the buyer

- Dynamic discounting: The buyer settles early and the supplier reduces the invoice amount as a trade-off

Benefits of Supply Chain Finance for Businesses

Supply chain finance benefits both buyers and suppliers. Suppliers gain quicker access to cash, which helps them manage operating expenses and reduce dependence on high-cost borrowing. This improves working capital management and supports business continuity.

Buyers maintain liquidity by paying on scheduled dates while still supporting their suppliers. Stronger payment reliability can improve supplier relationships and supply chain stability.

For additional short-term funding needs, you can also explore Hero FinCorp’s personal loan app on Android and iOS for quick, digital access to funds.

Supply Chain Finance in India: Current Trends

In India, supply chain finance is no longer limited to large corporates. Many MSMEs use it to ease short-term cash pressure, particularly when payments are delayed. Digital platforms and specialised lenders have made invoice funding simpler to access.

TReDS, developed under the RBI’s regulatory framework, enables MSMEs to auction receivables raised on established buyers. The system is now used across industries such as retail, automotive and manufacturing.

Challenges in Implementing Supply Chain Finance

The idea of SCF is simple; the rollout is not always. Suppliers may need time to understand how payments flow through the arrangement, and concerns around fees can slow decisions. Technical alignment with internal systems can add another layer of work.

Buyers must weigh their financing options carefully and ensure the framework fits their supply chain. When expectations are clearly laid out, hesitation usually reduces.

Steps to Avail Supply Chain Finance for Your Business

To get started with SCF in India, businesses can take the following route:

- Study cash movement: Examine where delays or gaps typically occur

- Shortlist providers: Consider lenders offering supply chain finance suited to your industry

- Arrange paperwork: Submit financial statements and supporting trade documents

- Coordinate with suppliers: Ensure they understand the process and benefits

- Connect systems: Sync internal invoicing and approval flows with the lender’s platform

- Track impact: Review changes in liquidity and financing costs over time

Clear preparation helps avoid disruptions later.

If you require extra financial support, Hero FinCorp’s personal loans come with an easy application process and basic documentation requirements. You can review our personal loan options or check the personal eligibility calculator online.

Frequently Asked Questions

What is supply chain finance?

Supply chain finance is a financing arrangement that allows suppliers to receive early payment on approved invoices, funded by a bank or NBFC, while buyers pay later as per agreed terms.

How does SCF differ from factoring?

In SCF, the buyer initiates the arrangement, and financing is based on the buyer’s credit profile. In factoring, the supplier independently sells receivables to a financier.

Who can avail SCF in India?

Businesses with established trade relationships and approved invoices, including MSMEs supplying to larger corporates, can explore SCF solutions.

Is SCF suitable for small businesses?

Small suppliers benefit from faster access to funds, especially when working with creditworthy buyers.

What are the typical costs involved in SCF?

Costs usually include a financing fee or discount charged by the lender, which depends on transaction value, tenure and credit profile.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.