What is FOIR: Meaning, Full Form and Calculation Explained

India’s loan delinquency rate shot up from 3.3% to 3.6% in March 2025. What does this suggest? Borrowers are increasingly defaulting on loan repayments these days. As a result, getting loan approvals has become tougher. Any hint of default risk, and your application is rejected.

To improve their chances, borrowers usually focus on credit score and debt-to-income ratio, since these directly impact creditworthiness. But that’s not all; FOIR also plays a key role.

Keen to learn more? Read this blog as we decipher the FOIR full form, how it’s calculated, and how you can improve it.

What Is FOIR? Meaning and Full Form

Before we set off to discuss what FOIR is, let’s understand what it stands for:

FOIR full form: Fixed Obligation to Income Ratio

As the name suggests, FOIR or Fixed Obligation to Income Ratio is a financial metric that highlights the percentage of your monthly income that goes toward paying your fixed monthly expenses. This includes EMIs, credit card bills, co-borrowed loans, etc.

Despite its similarities with Debt-to-Income Ratio (DTI), it’s worth noting that FOIR and DTI are different from each other. Unlike DTI, FOIR also accounts for rental expenses. So, it has a broader scope and gives a more accurate depiction of one’s financial obligations. Hence, Indian banks and NBFCs prioritise FOIR to assess an individual’s loan repayment capacity.

Want to check if you’re eligible for a personal loan? Try our Personal Loan Eligibility Calculator now - it’s free!

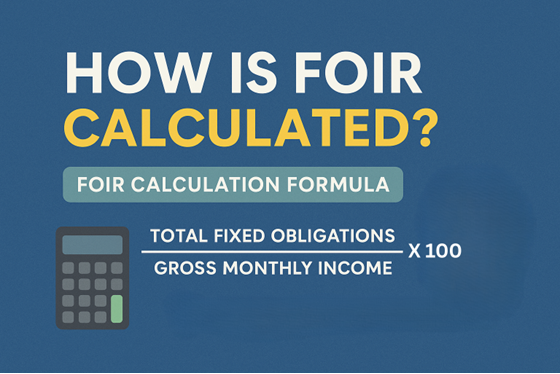

How Is FOIR Calculated? FOIR Calculation Formula

If you want to understand how lenders ascertain FOIR, start by determining these two figures:

If you want to understand how lenders ascertain FOIR, start by determining these two figures:

- The sum total of your fixed monthly expenses (EMIs, rent, credit card bills, insurance premiums, and other recurring payments)

- Your gross monthly income (before taxes and deductions)

Then, apply the following formula:

FOIR calculation formula = (Total Fixed Obligations / Gross Monthly Income) x 100

Here’s an example:

Suppose you apply for a personal loan of ₹5 lakhs. Your fixed monthly obligations (car loan EMI, credit card bill, rent, and health insurance premium) are ₹25,000, and your gross monthly income is ₹80,000. As per the formula, your FOIR will be;

FOIR = (Total Fixed Obligations / Gross Monthly Income) x 100

FOIR = (25,000 / 80,000) x 100

FOIR = 0.3125 x 100

FOIR = 31.25%

Note: Non-obligatory payments, like taxes or savings contributions, are not considered in the FOIR calculation.

Monitor all your loan EMIs in just a few clicks-download the Hero Digital Lending App now!

Tips to Improve and Maintain a Healthy FOIR

If your FOIR is between 40% to 55%, your loan application will most probably be approved. But if it’s higher than this, implement the following tips to reduce FOIR and boost your approval chances:

1. Pay off Existing Debt

If your fixed debt liability is high, your FOIR will also be high. So, pay off your EMIs, clear your credit card bills, and get rid of other such recurring obligations to bring down your FOIR.

2. Avoid New Loan Applications

If your FOIR is already high, avoid applying for new loans. This will only increase your debt burden and worsen your FOIR.

3. Ensure Timely Repayments

Pay all EMIs, credit card bills, and other obligations on time. This prevents penalties and extra interest, keeps your credit history strong, and over time reduces your fixed obligations to lower your FOIR.

4. Add a Co-Applicant

When you add a co-applicant, their income is combined with yours. This reduces your FOIR and strengthens your application. However, keep in mind that NBFCs and banks may have different rules on a co-applicant’s eligibility, income, credit profile, etc. So, ensure they meet the lender’s criteria.

5. Increase Income Sources

Build passive income sources through part-time gigs, freelancing, or investments to supplement your earnings. Make sure to disclose all your income sources properly. This will help lenders accurately assess your repayment capacity.

6. Consider Loan Refinancing

Refinancing existing loans can reduce your EMIs, which lowers your FOIR and improves your loan eligibility. But in India, NBFCs and banks often have varying interest rates and evaluation processes. So, compare all your options to ensure you get the best refinancing terms.

7. Prioritize Budgeting

Last but not least, create a comprehensive budget to keep track of your monthly income and expenses. Although this won’t instantly lower your FOIR, it will help you control your spending and reduce your obligations to fix your FOIR over time.

Need funds immediately, without the typical hassle? Try our Instant Loan App today!

FOIR in Context: Why Choose Hero FinCorp for Your Loan Needs?

FOIR is a crucial metric for loan approval, and you know why. But more often than not, lenders make the FOIR assessment process slow and complicated, adding more stress to an already tiring loan journey.

This is where Hero FinCorp, India’s most trusted NBFC, comes in. All Hero FinCorp loan products, from personal loans and two-wheeler loans, follow a simple, streamlined FOIR assessment process to ensure your loan approval journey is as smooth as it can get.

Still on the fence? See what one of our customers has to say!

The app is very user-friendly and guides you through the process step-by-step. I borrowed ₹3.5 lakh for a family trip, and everything, eligibility check, approval, and disbursal were completed digitally. I now recommend the app to colleagues whenever they need quick, trustworthy financial assistance.

- Nikhil

Want a seamless loan approval process? Apply for a personal loan with Hero FinCorp and get FOIR-friendly evaluations that make borrowing easier and faster.

Frequency Asked Questions

1. What is the difference between FOIR and debt-to-income ratio?

Both FOIR and DTI ratio measure how much of your income goes toward debt. But FOIR is mainly used by Indian banks and may include rent, while DTI is a more global term focusing only on formal debt obligations.

2. Does FOIR include variable expenses like utilities or groceries?

No, FOIR doesn’t include variable expenses.

3. Can self-employed individuals calculate FOIR differently?

Yes. Since self-employed income can fluctuate, banks usually take the average monthly income over the past 1–2 years when calculating FOIR.

4. What happens if my FOIR is higher than the acceptable limit?

If your FOIR is higher than the acceptable limit, lenders mark you as a high-risk borrower. This can lead to stricter loan terms, lower approved amounts, or even loan application rejection.

5. How often should I check my FOIR before applying for a loan?

You should check your FOIR immediately before applying for a loan.

6. Can adding a co-applicant help improve FOIR for better eligibility?

Yes, adding a co-applicant can improve your FOIR for better loan eligibility.