What is Collateral Loan? Meaning, Types, & How it Works

Planning major expenses often requires substantial funding. Maybe you're expanding your business, funding education abroad, or managing unexpected medical costs. When amounts cross ₹20-30 lakhs, regular personal loans might fall short.

Collateral loans solve this by letting you mortgage assets like property or gold to access larger amounts at better rates. This blog explains what collateral loans mean, the types available, and how the process actually works.

Collateral loans are secured financing where you mortgage valuable assets to back your borrowing. The collateral loan meaning is simple: you use something you own to reduce the lender's risk. When people ask what is a collateral loan, think of it as borrowing that's backed by real assets.

This security creates several advantages:

- Borrow 60-90% of your asset's current value

- Pay 3-8% lower interest than unsecured loans

- Get longer repayment periods up to 15-20 years

- Qualify more easily, even with average credit scores

Common assets in India include residential properties, commercial real estate, gold jewellery and coins, and fixed deposits. Your mortgaged asset stays with the lender during repayment. Complete all payments, and it returns to you.

Need smaller amounts without mortgaging assets? Hero FinCorp's personal loan offers up to ₹5 lakhs digitally.

Types of Collateral Loans

Different collateral structures work for different needs. The collateral meaning in loan terms varies depending on what you mortgage.

Loan Against Property (LAP)

Property owners can access their real estate value without selling.

Hero FinCorp's LAP features:

- Loan up to ₹7.5 crores

- Interest from 11% annually

- Tenure up to 15 years

- LTV of 60-75%

Property worth ₹1 crore unlocks ₹60-75 lakhs. Works well for business expansion, education costs, or debt consolidation.

What you need:

- Clear property title

- Ownership papers

- Income proof

- Sale deed and tax receipts

- Encumbrance certificate

Loan Against Gold

Gold loans solve urgent needs fast. Visit a branch, get a valuation, and receive funds the same day.

How it works:

- Accept 18-24 carat gold

- Loan up to 75% of the value

- Process in 2-4 hours

- Repay over 3 months to 3 years

Why choose gold loans:

- Same-day funding

- Minimal papers needed

- Credit score less important

- Rates beat unsecured loans

Watch out for:

- Daily gold price changes

- Risk losing jewellery if you miss payments

- The amount depends on the gold quantity and purity

So, ₹2 lakhs of gold gets you roughly ₹1.5 lakhs.

Loan Against Securities

Hold stocks or mutual funds? Borrow against them without selling.

What qualifies:

- Listed company shares

- Mutual fund units

- Government bonds

- Corporate debentures

Features:

- LTV of 50-70%

- Process in 3-5 days

- Best for short-term needs

Risk factor: Market drops can trigger margin calls. Lenders may ask for more collateral or partial repayment. Works best when you're confident about recovery.

Alos Read: What is Loans Against Shares? How to Leverage it for Financial Emergencies

Loan Against Fixed Deposit

FD loans are the safest option. Access funds without breaking your deposit.

Key benefits:

- Get 90-95% of the FD value

- Pay just 1-2% above the FD rate

- Instant approval

- FD keeps earning

₹10 lakh FD gives you ₹9-9.5 lakhs immediately. Your deposit stays intact.

Machinery and Equipment Loans

Businesses mortgage operational assets for growth capital.

Common uses:

- Manufacturing machinery

- Commercial vehicles

- Medical equipment

- Heavy construction equipment

Terms:

- LTV of 50-70%

- Tenure of 3-7 years

- Based on the current market value

Machinery worth ₹50 lakhs can fetch ₹25-35 lakhs without draining working capital.

How Do Collateral Loans Work?

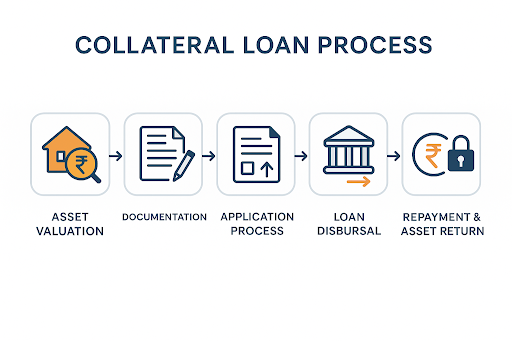

Understanding what a collateral loan process is helps you prepare better.

Asset Valuation

Lenders send professionals to evaluate your asset. Property valuers inspect and verify titles. Gold appraisers test purity and check rates. This determines your maximum loan.

Documents Required

Basic papers:

- Identity proof (Aadhaar, PAN, passport)

- Address verification

- Income documents

- Asset ownership papers

Property loans need extra:

- Sale deed

- Tax receipts

- Encumbrance certificate

- Building approvals

Gold loans stay simple: just gold plus ID proof.

Application at Hero FinCorp

- Visit Hero FinCorp's website

- Check the document list

- Click 'Apply now'

- Fill online form

- The relationship manager contacts you

Or visit a branch for face-to-face help.

How Long It Takes

- Gold: Same day (2-4 hours)

- FD: Instant to 24 hours

- Securities: 3-5 days

- Property: 7-15 days

Property takes longer for thorough verification.

After Getting Funds

Monthly EMIs start covering principal and interest. Your asset stays mortgaged until the final payment. Keep paying regularly, and everything returns to you.

Compare different loan options to pick what fits your needs.

Why Choose a Collateral Loan?

Collateral loans make sense when unsecured options fall short. Personal loans max at ₹5 lakhs. Need ₹50 lakhs for business or ₹40 lakhs for education? LAP goes up to ₹7.5 crores.

Interest rates matter hugely. At 19% on ₹50 lakhs over 10 years, you repay ₹1.16 crores total. At 12% secured rate, you pay ₹84 lakhs. That's ₹32 lakhs saved.

Credit scores below 700 block unsecured loans. Mortgaged assets reduce this barrier significantly. Usage stays flexible too.

But remember: defaulting means losing your asset. Borrow only what you can repay comfortably.

>Read customer stories to see how others decided.

Want unsecured options? Apply for personal loan up to ₹5 lakhs at 18% per annum.

Frequently Asked Questions

1. What assets can I use as collateral for a loan?

Properties, gold (18-24 carats), fixed deposits, and securities like stocks qualify. Assets need clear ownership and verifiable value.

2. Is property the best form of collateral for loans?

Property works for large amounts up to ₹7.5 crores. But gold processes faster, and FDs approve instantly. It depends on your needs.

3. What happens if I default on my collateral loan payments?

Lenders send reminders first. Early communication opens restructuring options. Continued default leads to legal proceedings and asset auction.

4. Can I get a collateral loan with a low credit score?

Yes, scores around 650-680 work because mortgaged assets reduce risk. Better scores still get lower rates, though.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.