What Are The Pros And Cons Of Taking Multiple Loans

You’re already managing a home loan, but six months later, your child’s education costs rise and your car starts showing its age. And now you’re tempted to take a personal loan or maybe a car loan. Sound familiar?

With credit options now just a few taps away, adding one more EMI feels almost effortless. But before you do, ask yourself: Is taking multiple loans a good idea?

In this blog, we’ll unpack the advantages and disadvantages of taking multiple loans so you can make a confident decision and manage finances stress-free.

What Does It Mean to Take Multiple Loans?

It means you’ve got more than one active loan, either from the same lender or different sources. Each has a distinct purpose. Put together, they shape your overall debt profile.

Consider Anamika, a 32-year-old interior designer from Pune. She’s already paying home loan EMIs, recently took a personal loan for her Dubai getaway, and is now eyeing business loan options for her design studio.

Her choices reflect how India borrows today. More people use credit to fast-track goals, thanks to NBFCs and banks that offer quick, digital journeys. In FY25, NBFCs drove 36% of personal loan disbursements, while banks continued to lead high-value home loans.

Numbers tell one story. Your financial readiness tells the rest. Learn the pros and cons of taking multiple loans before you start borrowing on autopilot.

Eligibility Criteria for Taking Multiple Loans in India

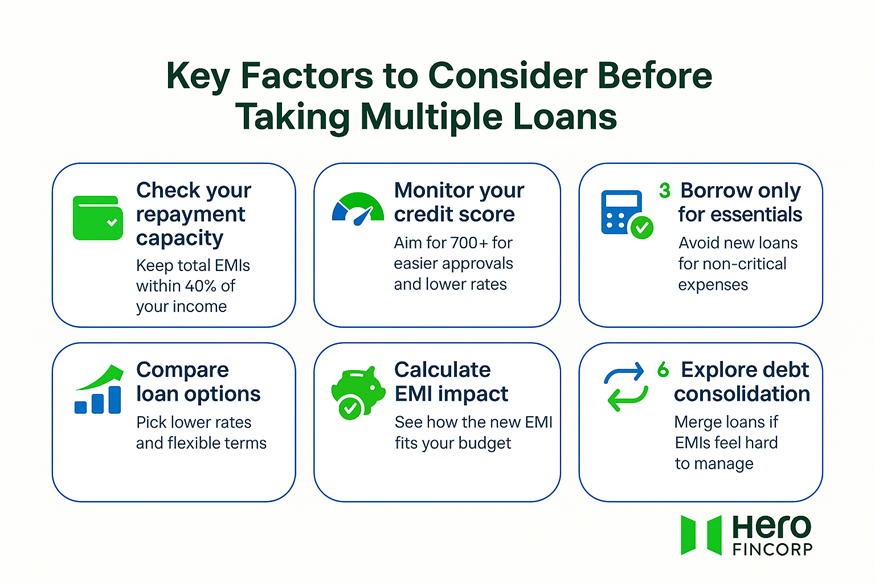

If you’re wondering if taking multiple loans is a good idea, start by thinking like a lender. They focus less on the ‘why’ and more on your repayment strength by assessing the following factors -

• Credit score - A 700+ score shows you’re reliable and have managed credit well in the past, boosting your approval odds.

• Income Stability - Regular earnings (from salary or business) show consistency and assure lenders you can handle repayments smoothly.

• Debt-to-Income ratio (DTI): When total EMIs stay within 40% of income, it signals healthy repayment capacity.

• Current obligations: A large number of active loans may limit eligibility even with a strong credit score.

The rules are the same, but the approach isn’t. Banks rely more on credit reports and income proof before saying yes. NBFCs move faster with digital checks and alternate data (UPI payments, bills, or digital spends), making lending more inclusive.

Ready to borrow on your terms? Apply with Hero FinCorp and explore flexible credit options tailored to your goals.

Advantages of Taking Multiple Loans

Taking more than one loan can work in your favour when you plan it right. Here are the key benefits of taking multiple loans and how they can support your financial footing.

1. Get Flexibility to Meet Different Needs

A home loan gives you stability, a personal loan covers sudden needs, and a business loan helps you grow. Keeping them separate helps you achieve different goals simultaneously without dipping into your savings.

2. Build and Strengthen Your Credit Score

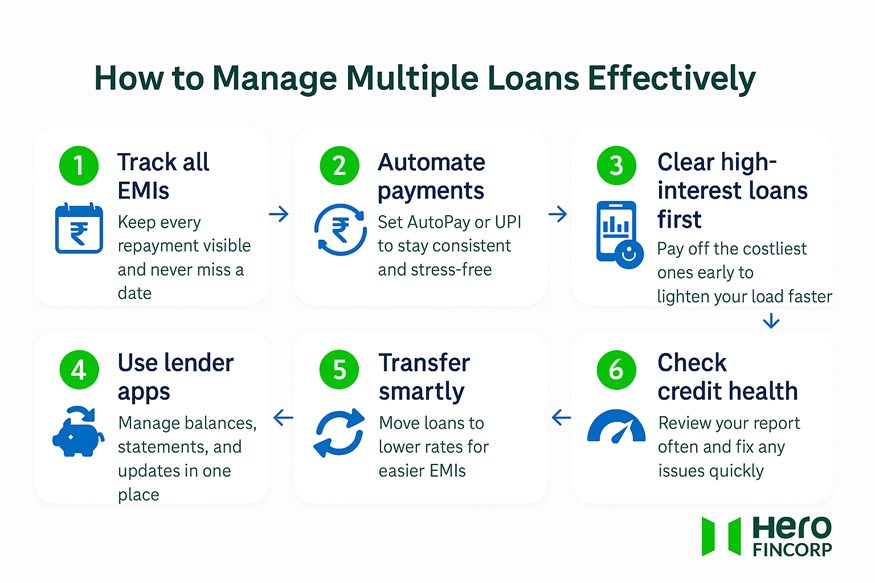

Each on-time EMI proves your reliability. And with the RBI’s push for near real-time credit reporting, your good repayment habits now reflect even faster. The result? A stronger score and access to better loan terms.

3. Access Funds Quickly When Needed

Managing multiple loans responsibly builds lender confidence. When you apply again, approvals move faster. Digital NBFCs like Hero FinCorp further simplify the process with instant checks, minimal paperwork, and quick disbursals.

4. Choose loan terms tailored to your life

With multiple loans, you’re in charge of how you borrow. Looking to upskill? A short-term loan offers quick funds but at a higher interest rate. For bigger goals like business expansion, longer, lower-rate loans work better. The right credit mix keeps EMIs easy and cash flow steady.

Also Read: What are the Advantages and Disadvantages of Short-Term Loans?

5. Manage Money More Strategically

When planned wisely, multiple loans make your finances more resilient. You can spread risk, tweak EMIs as income changes, and keep long-term goals on track even when expenses shift. It’s about using credit to move forward with confidence.

Pro Tip - Keep your repayment streak strong. It can also unlock pre-approved or loyalty loans, giving you quicker access to funds when you need them most.

Also Read: pros and cons of personal loans

Disadvantages of Taking Multiple Loans

The benefits are clear, but so are the risks of taking multiple loans. Let’s look at what can go wrong and how to stay one step ahead.

1. Increased Debt Load and EMI Stress

Every new loan adds to your outflow. As EMIs line up, your budget tightens, and even a small income dip or emergency can strain your finances.

2. Higher Total Interest Outgo

Every new loan adds interest over time. If you juggle too many, your total interest cost may outweigh the benefit of short-term liquidity.

3. Risk of Falling Into a Debt Cycle

Taking fresh credit to cover old EMIs can quickly become a habit. As repayments overlap and interest grows, breaking the cycle gets harder.

4. Negative Impact on Credit Score

A single missed or delayed EMI can dent your credit score. With multiple loans running, this risk grows unless you set up AutoPay or UPI mandates.

5. Complex Loan Management

Each loan follows its own timeline. When you’re tracking several, a single missed EMI can snowball into penalties or late fees.

6. Difficulty in Getting Future Loans

High outstanding debt can make lenders cautious. That could lead to tighter checks, higher rates, or smaller sanctioned amounts next time you apply.

Thinking of another loan? First, see what it means for your monthly budget. Our EMI Calculator helps you plan better and keep multiple EMIs manageable.

Debt Consolidation: Is It a Good Solution for Multiple Loans?

Too many EMIs? Debt consolidation can be your smart reset. It merges two or more loans into one, often at a lower rate. The result? One EMI, easier tracking, and better control.

Suppose you’re juggling a few debts -

● Credit card - ₹80,000 at 36%, ₹7,400 EMI

● Two-wheeler loan - ₹1,00,000 at 15%, ₹4,900 EMI

● Personal loan - ₹2,00,000 at 22%, ₹7,638 EMI

That’s about ₹20,000 a month. Now you need ₹1 lakh more for a home upgrade.

Instead of adding a fourth EMI, take a ₹5 lakh personal loan at 20% for 36 months, pay one EMI of ₹18,582, clear all dues, and fund your goal.

However, weigh the pros and cons of having multiple loans rolled into one. Processing or foreclosure charges may apply. Shorter terms raise EMIs; longer ones increase total interest. Consolidate only if it truly eases your burden.

Multiple loans? One smart move. Track EMIs, plan repayments, and stay ahead with the Hero FinCorp Digital Lending App.

Frequently Asked Questions

1. Can I take multiple personal loans simultaneously from different lenders?

Yes, as long as your income and credit score meet what each lender looks for.

2. How does having multiple loans affect my CIBIL score?

Not if you pay on time. Missed EMIs, however, can hurt your score fast.

3. What are the risks if I default on one of my multiple loans?

Your credit score dips, future approvals get harder, and lenders may start recovery steps.