Personal Loan Age Limit: Minimum and Maximum Age Criteria

- What Is the Personal Loan Age Limit?

- What Is the Minimum Age Limit for a Personal Loan in India?

- Why is Minimum Age Important for Loan Approval?

- Minimum Age Criteria Variation Among NBFCs and Banks

- What Is the Maximum Age Limit for a Personal Loan in India?

- Maximum Age and Personal Loan Tenure Relationship

- Differences in Maximum Age Criteria for Salaried vs Self-employed Applicants

- Tips to Improve Your Personal Loan Eligibility Regardless of Age

- Borrowing at the Right Stage of Your Financial Journey

- Frequently Asked Questions

Rohan was confident about his income, documents, and repayment plan when he took a personal loan for his sister's wedding. Nevertheless, his application was denied because of a reason that he could not have imagined: the personal loan age limit.

Age-related requirements help borrowers make more rational decisions, choose the right lenders, and have their applications reflect their age-appropriate level of financial stability. But how? Let's find out what the personal loan age limit is in India.

What Is the Personal Loan Age Limit?

The age limit for a personal loan in India refers to an age range during which an individual is permitted to apply for one. Financial institutions impose these limits as a way of having customers who possess legal capacity and a stable source of income to be able to repay the loan without any difficulties.

Understanding these limits before applying will help you to avoid rejections, choose the right tenure, and assess whether your age aligns with lenders’ eligibility framework.

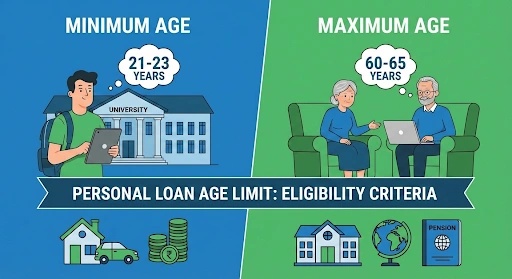

What Is the Minimum Age Limit for a Personal Loan in India?

The minimum age for a personal loan varies from lender to lender. But it is generally between 18 and 21 years.

While Indian law allows individuals aged 18 to enter into contracts, most banks and financial institutions set the minimum age for personal loans at 21. That's why lenders prefer borrowers who are more likely to be employed, earn regularly, and show stable income patterns, which reduces repayment risk.

Below are the common minimum age norms among major lending institutions.

Key Minimum Age Criteria by Lenders

| Lender Category | Minimum Age | Notes |

| Public Sector Banks | 21 years | Age threshold based on stable salaried profiles |

| Private Banks | 21 years | Proof of steady income required |

| NBFCs | 18–21 years | Flexible for early-career borrowers |

Note - If you are under the age limit, you can apply for a personal loan by having a co-applicant or a guarantor.

Why is Minimum Age Important for Loan Approval?

The minimum age for personal loan eligibility ensures that borrowers have the legal capacity to sign loan agreements and demonstrate dependable financial behaviour. From a lender’s viewpoint, younger applicants with minimal income history carry higher risk, making age a key indicator of repayment potential.

Also Read: Top Personal Loan Apps for Students Without Work Experience

Minimum Age Criteria Variation Among NBFCs and Banks

| Lender/ Institution | Minimum Age Requirement | Eligible Employment Type | Additional Notes |

| Hero FinCorp | 21 years |

| Standard minimum age for most personal loan products |

| State Bank of India (SBI) | 21 years | Salaried | Conservative risk profile; stable income required |

| HDFC Bank | 21 years | Salaried, Self‑employed | Requires proof of steady income |

| ICICI Bank | 21 years | Salaried, Self‑employed | Moderate flexibility for young professionals |

| Axis Bank | 21 years | Salaried, Self‑employed | Similar to ICICI; depends on applicant profile |

| Digital/Fintech Lenders | 18 years | Salaried, Self‑employed, Students with income | Highest flexibility; may accept lower income thresholds |

What Is the Maximum Age Limit for a Personal Loan in India?

Maximum age limits for personal loan approvals are usually set as per the borrower's ability to have a stable income as they get closer to retirement. In most cases, maximum age limits vary from 60 to 80 years, depending on the type of work and the lender's risk policy.

People on the payroll are likely to be given more stringent upper limits, whereas those who are self-employed may be given more leeway, as their income source can last for a longer period.

Plus, older applicants may be offered shorter loan tenures to ensure their loan concludes within permissible age boundaries.

Below is a comparison of how different lender categories approach maximum age eligibility.

| Lender Category | Maximum Age at Loan Maturity | Notes |

| Public Sector Banks | 60–70 years | Strict alignment with retirement norms |

| Private Banks | 65 years | Slightly flexible for high-income borrowers |

| NBFCs | 70–80 years | More accommodating for self-employed profiles |

Maximum Age and Personal Loan Tenure Relationship

Lenders set a maximum age limit to ensure the borrower can comfortably repay the loan within their earning years. As a result, loan tenure is often linked to age.

Older applicants may be offered shorter tenures to ensure they repay the loan before retirement. This helps lenders manage risk while keeping repayment manageable for the borrower as well.

Differences in Maximum Age Criteria for Salaried vs Self-employed Applicants

The age limit for a personal loan is different for a salaried and a self-employed applicant, as the income cycle of both types of individuals varies considerably.

Usually, salaried applicants have to adhere to tighter maximum age limits, generally between 50 and 58 years. On the other hand, the maximum age limit for a personal loan for a self-employed applicant can be as high as 65 or 75 years.

Also Read - Instant Personal Loan for Housewife: How to Apply Easily

Tips to Improve Your Personal Loan Eligibility Regardless of Age

Understanding how the personal loan age limit impacts your financial profile makes it easier to improve your eligibility. And with the right steps, you can strengthen your application even if you are just meeting the minimum age requirement for a personal loan.

Here are some tips to improve your personal loan eligibility -

- Work on your credit score. Make on-time payments of credit bills and existing EMIs.

- Add a co-applicant to improve your profile.

- Provide income proof that is both stable and regular.

- Select a shorter loan tenure. This will make you appear less risky to the lender.

- Pay off any existing debts to increase your repayment capacity.

- Practice financial discipline and keep track of your monthly budgets.

Also Read - Find the Best Personal Loan for You: A Comprehensive Guide

Borrowing at the Right Stage of Your Financial Journey

Age limits in personal loans are not meant to restrict you, but to ensure borrowing stays comfortable and manageable. When you understand how age affects eligibility and tenure, you can plan better, choose suitable lenders, and apply with greater confidence and clarity.

Do not allow your age or financial planning to be the reasons for your failure! Hero FinCorp personal loans are easy, quick, and specially designed for your individual requirements. Take control of your finances.

Apply with Hero FinCorp today and turn your plans into reality!

Frequently Asked Questions

What is the minimum age to apply for a personal loan in India?

Normally, lenders ask for the applicant's age to be between 18 and 21 years.

Can a retired person apply for a personal loan?

Yes, retirees can become a good credit risk if they are within the lender's upper age limit and can provide a steady income, like a pension or rental.

Does the maximum age limit differ across lenders?

Yes, the maximum age requirement is different for each type of financial institution.

How does age affect the interest rate on personal loans?

Both younger applicants with stable incomes and older applicants nearing retirement may be charged higher rates due to perceived risk.

Can I get a personal loan if I cross the maximum age during the loan tenure?

Generally, lenders need the loan to be paid off before the maximum age.

Is the age limit for personal loans different for salaried and self-employed borrowers?

Generally, salaried borrowers have more limited conditions, whereas self-employed individuals are allowed to have a higher age for eligibility.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.