How to Transfer Money Without UPI: An Essential Guide

- The Rise of Digital Payments and the Need for UPI

- Why You Might Need Non-UPI Methods for Money Transfer

- Traditional Banking Methods to Transfer Money Without UPI

- Mobile Wallets and Digital Payment Apps

- Popular Wallet Services and Their Transfer Mechanisms

- Net Banking: A Direct Way to Send Money Without UPI

- Step-by-Step Guide for Net Banking Funds Transfer

- Debit and Credit Card Transactions

- Offline Methods: For Those Who Prefer the Traditional Route

- Hero FinCorp: Your Partner in Smart Financial Solutions

- Frequently Asked Questions

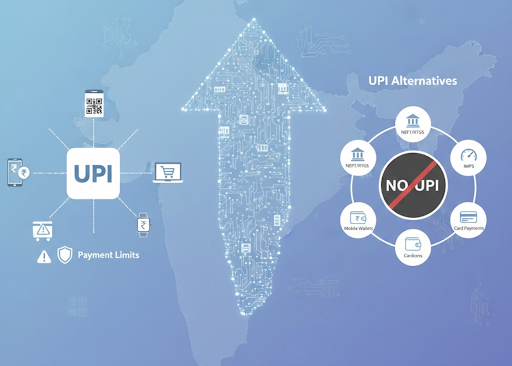

UPI may feel unavoidable today, but it is not the only way to move money in India. People regularly face situations where UPI simply doesn’t work; apps fail, banks restrict transactions, or payment limits get in the way.

That’s when knowing how to transfer money without UPI becomes useful, not optional. India’s banking ecosystem still holds a handful of dependable methods that simply do their work in the background, often with more control and less disruption. Knowing these ways would allow you to select the right tool rather than making every transaction via UPI.

The Rise of Digital Payments and the Need for UPI

Digital payments in India have grown extremely fast, and this trend is already the focus of the government and the banking sector.

By 2025, digital transactions accounted for 99.8% of the total volume, indicating the growing popularity of cashless transactions. UPI has been the most important factor in this growth, but there are others as well.

Being aware of alternative payment methods without UPI is essential, as one may encounter issues with the system being down, security concerns, or transaction limits. This is where UPI alternatives quietly prove their importance.

Why You Might Need Non-UPI Methods for Money Transfer

There are several practical reasons why users explore alternative payment methods instead of relying only on UPI.

- You need to send money without UPI during app outages

- Transaction limits make UPI impractical

- Bank maintenance disrupts payments

- Certain payments require formal banking channels

- You prefer alternative payment methods for clearer records

Traditional Banking Methods to Transfer Money Without UPI

Despite the rise of apps, traditional money transfer systems remain dependable. Bank transfers such as NEFT, IMPS, and RTGS continue to be trusted for their structure and security.

These secure payment methods are widely used when people want to transfer money without UPI while maintaining accuracy and traceability. Businesses handling such transfers often align their cash flow planning with a business loan app to maintain operational stability.

National Electronic Funds Transfer (NEFT)

NEFT remains one of the most commonly used banking channels for planned and routine transfers.

- NEFT transfer works through scheduled settlement batches

- The NEFT payment process suits non-urgent transfers

- Available via net banking and bank branches

- A common choice to transfer funds securely via NEFT

Immediate Payment Service (IMPS)

IMPS is designed for situations where speed matters more than settlement cycles.

- IMPS transfer enables real-time fund movement

- Useful for urgent requirements

- Supports instant money transfer IMPS across banks

- IMPS payment limits depend on bank policies

Real Time Gross Settlement (RTGS)

RTGS is primarily used for high-value payments where immediate settlement is critical.

- RTGS transfers transactions individually

- Funds move in real time without batching

- Best suited for high-value transactions, RTGS

- Widely used by businesses and institutions

- Operates during fixed RTGS timings

- Usually has a minimum transaction threshold

Read More: Advantages of Using UPI for Everyday Transactions

Mobile Wallets and Digital Payment Apps

Mobile wallets in India still serve a practical purpose, especially for smaller payments.

These digital payment apps allow users to store funds and make transfers without having to access their bank accounts each time. Some users also rely on an instant loan app to cover urgent expenses while continuing to use wallet-based payments. For online money transfer without UPI, wallets can act as a temporary bridge when banking apps are slow or unavailable.

Mobile wallets accounted for more than 14% of non-UPI digital transactions in 2025, showing that these payment methods are still popular.

Popular Wallet Services and Their Transfer Mechanisms

Different wallet providers support transfers in slightly different ways, depending on their platform rules.

- Paytm wallet transfer supports internal wallet payments

- PhonePe wallet enables balance-based transfers

- Google Pay without UPI bank transfer options may exist via linked services

- Limits and charges vary by provider

Net Banking: A Direct Way to Send Money Without UPI

Net banking money transfer remains one of the most controlled ways to move funds online. Through online bank transfers, users can access NEFT, IMPS, and RTGS directly. Many still prefer this route for secure online payments, especially when managing beneficiaries or larger amounts.

Step-by-Step Guide for Net Banking Funds Transfer

Using net banking for transfers follows a clear and predictable process across most banks.

- Log in to your bank’s net banking portal

- Choose how to use net banking for transfer

- Add and verify beneficiary details

- Select the required internet banking payments option

- Review and confirm the transaction

Debit and Credit Card Transactions

Debit card money transfers and credit card payments online offer another layer of flexibility. Some platforms allow card-to-account transfer services, while others focus on merchant or bill payments. Although charges may apply, cards remain useful when bank transfers are delayed or temporarily unavailable.

Offline Methods: For Those Who Prefer the Traditional Route

Offline money transfer methods still matter, particularly for users who value in-person verification. Cash deposits, bank services, and cheque payment options continue to be used for their simplicity and familiarity, especially in areas with inconsistent internet access.

Bank Branch Visits and Cheques

For users comfortable with traditional banking services, branch visits remain a reliable option.

- Use bank deposit cash facilities for direct credit

- Follow the standard cheque payment process

- Suitable for traditional banking services

- Provides physical documentation

Hero FinCorp: Your Partner in Smart Financial Solutions

Hero FinCorp's financial services are designed to support both digital and traditional financial needs.

From enabling secure loan payments to offering flexible digital finance company solutions, Hero FinCorp helps customers manage money with confidence. For those planning expenses or managing liquidity, access to a personal loan app further supports structured financial decision-making.

Frequently Asked Questions

What are the charges for NEFT, IMPS, and RTGS transactions?

Charges vary by bank. NEFT is usually free or very cheap, IMPS may have small fees, and RTGS charges generally relate to high-value transfers.

Is there a daily limit for transferring money using non-UPI methods?

Yes, the limits vary depending on the transfer mode and bank. Typically, RTGS permits larger amounts.

How long does it take for money transferred via NEFT, IMPS, or RTGS to reflect?

IMPS and RTGS facilitate transactions immediately or almost instantaneously. On the other hand, NEFT may take some time because it operates on a batch-processing model.

Can I use these methods to pay my Hero FinCorp loan EMIs?

Yes. NEFT, IMPS, RTGS, and net banking are commonly used for Hero FinCorp EMI payments.

Are mobile wallets secure for large money transfers without UPI?

Wallets provide security but generally have lower limits, making them more suitable for smaller transfers.

What information is required to transfer money via IMPS or NEFT?

Usually, it is necessary to provide the recipient's name, account number, IFSC code, and the chosen transfer mode.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.