What Is Suit Filed and How To Remove it in CIBIL Report?

- What Does a Suit Filed Mean in CIBIL?

- Why Is Suit Filed Status Critical in Your CIBIL Report?

- How to Check if There Is a Suit Filed Against You in CIBIL

- Step-by-Step Process to Remove Suit Filed from Your CIBIL Report

- How to Dispute a Wrongly Filed Suit on Your CIBIL Report

- Consequences of Not Removing Suit Filed Status from CIBIL

- Your Credit Comeback Starts with the Right Action

- Frequently Asked Questions

Imagine applying for a personal loan and spotting “Suit Filed” next to your name in your credit report. Confused? You’re not alone.

Many borrowers discover this tag only after their loan application gets rejected or delayed. It means a bank or NBFC has taken legal action over unpaid dues or a loan default.

The good news? This status isn’t permanent. You can fix it.

In this guide, we’ll break down what Suit Filed means, why it matters, and how to remove it from your CIBIL report step by step.

What Does a Suit Filed Mean in CIBIL?

In simple terms, “Suit Filed” means your bank or NBFC has started legal action to recover unpaid dues and officially reported it to TransUnion CIBIL (Credit Information Bureau India Limited). It’s a red flag for future lenders as it shows a serious repayment issue in your past.

Let’s say you missed several EMIs on a personal loan and didn’t respond to reminders. The lender may report the account as “Suit Filed,” along with the date and outstanding amount. This entry stays visible in your credit report until it’s cleared, which can affect your future borrowing ability.

Remember - “Suit Filed” doesn’t always mean a court judgment has been passed. It can also show up when your lender includes the account in its mandatory recovery filings under RBI norms.

Also Read: How to Unlink UPI from Your Bank Account

Why Is Suit Filed Status Critical in Your CIBIL Report?

The Suit Filed status in your CIBIL report is a serious remark that can damage your creditworthiness and sharply lower your credit score. Here’s how -

- Loan rejections - Most banks and NBFCs treat this as a high-risk indicator and decline fresh applications.

- Reputation risk - A Suit Filed status typically coincides with overdue payments and defaults that pull down your rating.

- Limited negotiation power - Lenders may offer higher interest rates or lower amounts if you have this remark.

- Long-term impact - The record can remain visible for years, even after you clear dues, unless officially updated or disputed.

That’s why understanding the meaning of a Suit filed in CIBIL and resolving it quickly is essential for your financial recovery.

How to Check if There Is a Suit Filed Against You in CIBIL

Wondering if you have a Suit Filed in CIBIL? You can check it yourself in minutes, no bank visits needed. Here’s how -

Step 1 - Go to www.cibil.com and sign in with your details. If you’re new, create a quick account.

Step 2 - Download your latest credit report. You’ll find it under “My Account” or “Credit Reports.”

Step 3 - In the ‘Account Information’ section, open each loan or credit-card entry to see what’s written under “Status”.

Step 4 - Look for remarks like “Suit Filed,” “Wilful Default,” or “Written Off.”

Pro Tip - Save a copy of your report. It’ll come in handy later for tracking updates or fixing errors.

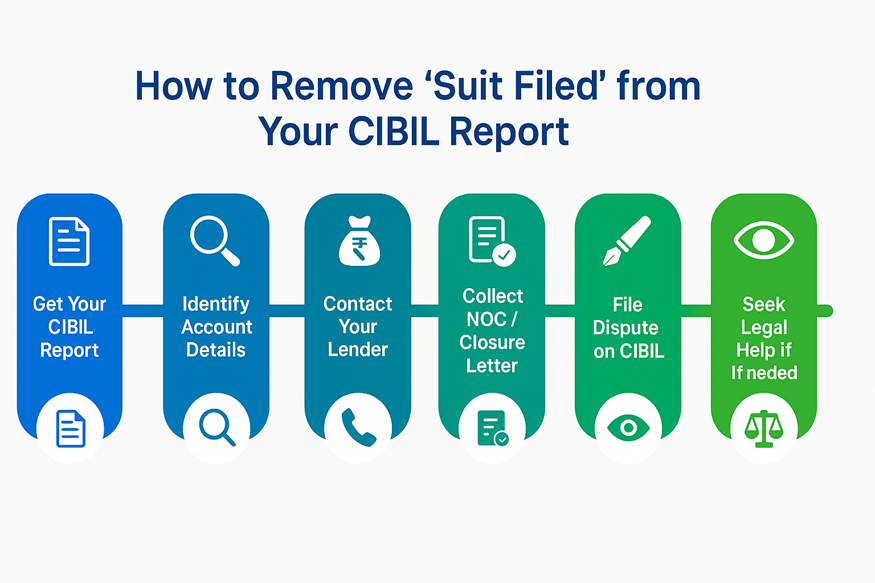

Step-by-Step Process to Remove Suit Filed from Your CIBIL Report

If you find a Suit Filed tag on your report, do not panic. Follow this structured approach to get it removed:

1. Get Your Latest CIBIL Report

Start by downloading the most recent version so you have accurate information before taking any action.

2. Identify the Account and Details

Write down the lender’s name, filing date, and total amount to reach the right branch later.

3. Speak to Your Lender

Contact your lender’s customer service or recovery department and ask:

- Why was your account marked “Suit Filed”?

- Whether the case is active or closed.

- The exact balance due, including any penalties or interest?

4. Clear or Settle Your Dues

Once you know how much you owe, either repay it in full or discuss a practical settlement with your lender. Get written proof of the final amount and terms.

5. Get No Dues Certificate (NOC) or Closure Letter

After full payment or settlement, ask your lender to issue a No Dues Certificate or Loan Closure Letter. It’s crucial evidence for CIBIL to update your record.

6. File a Dispute with CIBIL to Remove the Suit Filed Entry

Go to the CIBIL Dispute Resolution Portal and:

- Select “Dispute an Item” under “Credit Report Help.”

- Attach your NOC or closure proof.

- Explain that the loan is now settled or closed.

7. Keep an Eye on the Progress

Check your CIBIL account every few weeks. If nothing changes after 45 days, follow up with both your lender and CIBIL’s customer care.

8. Get Legal Advice if Challenges Persist

If updates are delayed or seem wrong, talk to a credit lawyer or finance professional for guidance.

How to Dispute a Wrongly Filed Suit on Your CIBIL Report

Sometimes, the remark may appear due to data entry errors or outdated records. In such cases, follow this process -

| Step | Action | Documents Required |

|---|---|---|

| 1 | Log in to your CIBIL account | PAN, registered email ID |

| 2 | Select “Raise a Dispute” | Credit report with marked entry |

| 3 | Choose “Incorrect Suit Filed Status” | Identity proof, PAN, and communication proof from the lender |

| 4 | Upload evidence that the account is active or cleared | NOC, bank statements, settlement letter |

| 5 | Submit and track a dispute | CIBIL will confirm with the lender before making changes |

If verified, CIBIL will delete or modify the “Suit Filed” status and send an updated report to you via email.

Consequences of Not Removing Suit Filed Status from CIBIL

Leaving a Suit Filed tag untouched can quietly stall your financial comeback. Here’s what can happen if you ignore it:

- Your score heals more slowly. Recovery takes longer, even with timely payments.

- Lenders stay cautious. The tag makes you look like a high-risk borrower on paper.

- Loans get costlier. Expect higher interest rates or smaller approved amounts.

- Credit cards freeze up. New or premium card offers often pause until the tag is gone.

- Opportunities slip away. One unresolved tag can hold you back from big goals like a home loan or emergency credit.

Your Credit Comeback Starts with the Right Action

A Suit Filed remark doesn’t mean your financial journey is over. It’s simply a signal to act quickly and responsibly. By clearing dues, obtaining NOCs, and filing disputes on time, you can restore your credit health and rebuild trust with lenders.

Turn your financial comeback into reality. Get instant personal loan approval online with Hero FinCorp.

Frequently Asked Questions

1. What is the meaning of Suit Filed in a CIBIL report?

It means your lender has initiated legal action to recover dues that remained unpaid for a long period.

2. Can the Suit Filed status be removed instantly from CIBIL?

No. CIBIL needs confirmation from your lender before making corrections. The process typically takes up to one month.

3. Can I get a loan with a Suit Filed remark on my credit report?

Chances are low until the tag is removed. Once resolved, your score and eligibility will improve.