Dream Vacation, No Credit Card? Use a Personal Loan Without Regret

When you spot a flash sale to your dream destination, it's hard not to picture yourself on that flight—resorts, meals, and adventures all at a price too good to miss.

But if you don't have a credit card (or don't want to max one out), you don't have to put that trip on hold.

Choosing a personal loan can fund your travel without blowing up your budget. Read on as we explore how to use one for your dream vacation and what to remember to come back with souvenirs, not regrets.

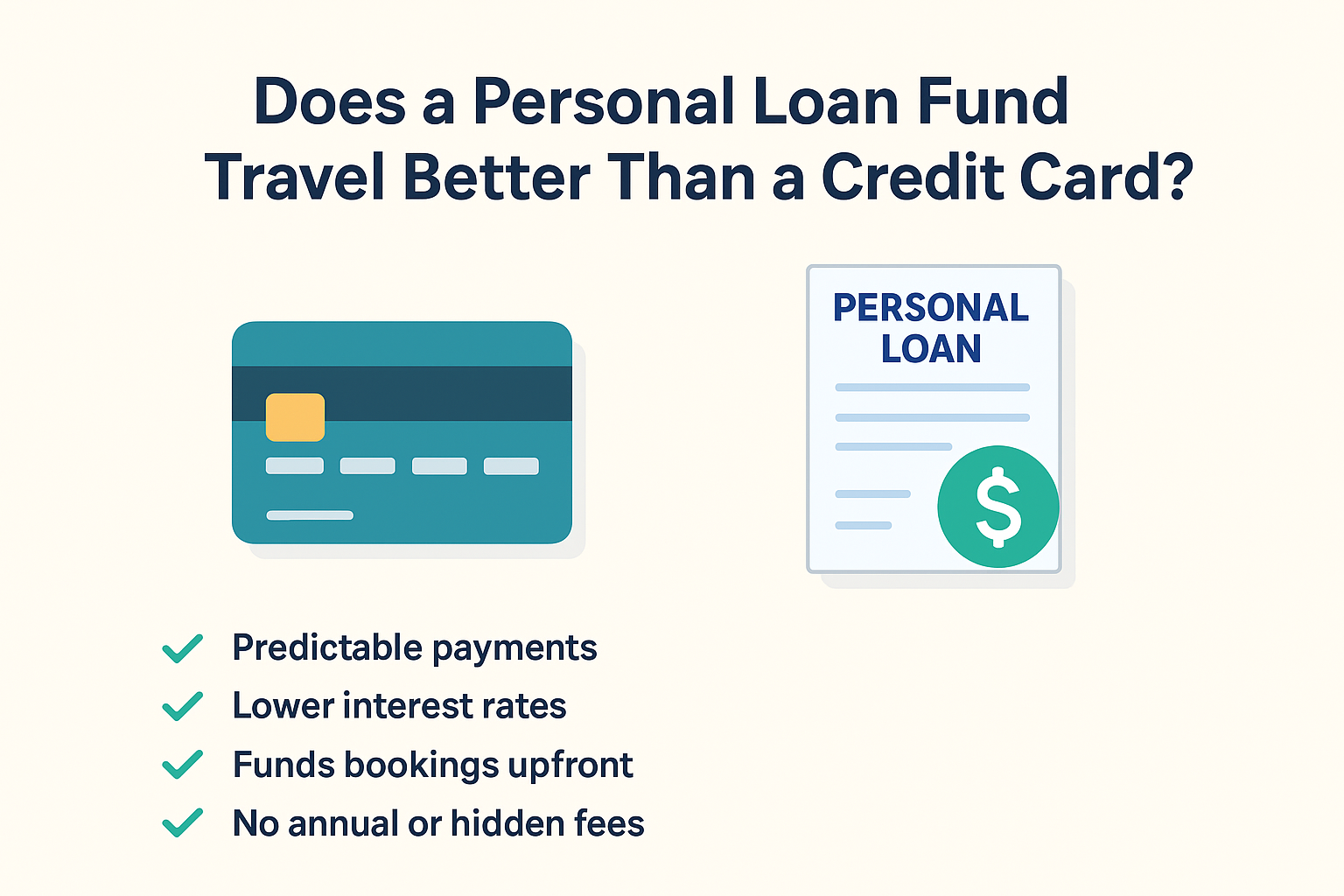

Does a Personal Loan Fund Travel Better Than a Credit Card?

At first glance, a credit card may seem like an easier option. But a personal loan offers some clear advantages. Its key highlight lies in predictable repayments and lower interest rates.

- Fixed EMIs: You know exactly what you'll pay each month, so no surprise bills.

- Lower Interest Rates: Many personal loans have rates far below typical credit card charges.

- Upfront Lump Sum: Covers all your bookings in one go—flights, hotels, tours, and more.

- No Annual or Hidden Card Fees: You only pay your EMI until the loan is cleared.

How Can I Be Eligible for A Personal Loan?

Before planning your trip, check if you qualify for a personal loan. Given that there are many factors involved, here are the key checks:

- Minimum Monthly Income: From ₹15,000 upwards

- Employment Stability: Minimum 6 months for salaried and 2 years for self-employed professionals

- Credit Score: 700+ preferred for best interest rates

- Basic KYC & Financial Documents: PAN, Aadhaar, salary slips, bank statements

Want to find out in a few clicks? Check your personal loan eligibility in minutes with Hero FinCorp's very own tool.

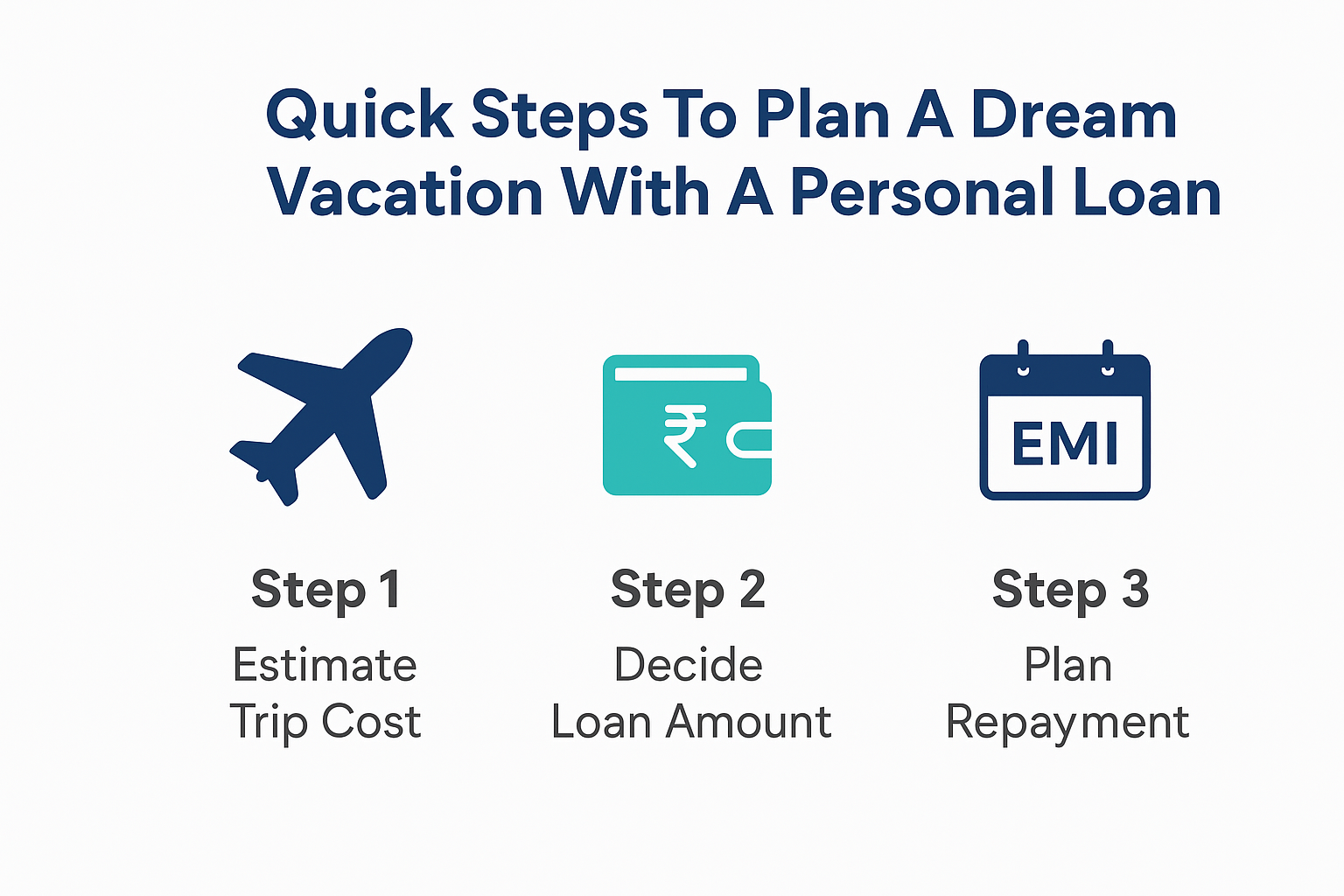

Quick Steps To Plan A Dream Vacation With A Personal Loan

Before you apply for the loan, plan your funds as comprehensively as possible.

Here are the three steps to execute a well-planned loan and trip.

Step 1: Estimate Your Total Trip Cost

Don't just look at what's on sale; factor in the full picture. List down all expected expenses, such as:

- Flights (including taxes, baggage fees and round-trip!)

- Accommodation (per night and service charges)

- Travel insurance (especially for international trips)

- Visa fees (it's often a hidden expense and comes as a surprise when flying to the USA and Europe)

- Local transport (rentals, airport transfers, ride shares)

- Food, excursions, and activities

- Shopping and souvenirs

Also, set aside a 10-15% buffer for emergencies or surprises. Spreadsheets or travel budget planners are best suited to keep the calculations structured.

Step 2: Decide How Much You Need

Once you know the costs, subtract what you can comfortably pay from your savings and borrow only the shortfall.

Remember not to pad the loan for 'just in case' splurges. That's what makes EMIs tough to repay later.

Step 3: Decide On A Repayment Strategy

This is where your planning meets peace of mind. To arrive at the right EMI schedule:

- Use a personal loan EMI calculator like the one Hero FinCorp offers to test repayment options

- Pick a term that suits your cash flow. Longer tenures may have smaller EMIs, but shorter ones have lower interest costs.

Want things fast and transparent? Using the Hero Digital Lending App disburses funds in minutes. So, once you choose your travel deal, all that's on your mind is packing.

Key Tips For Effortless and Affordable Travel On Personal Loans

Along with travelling worry-free, don't forget to keep borrowing smart. Stick to these smart practices when planning your loan:

- Account for processing, documentation, and insurance fees before choosing a loan

- Review your pre-payment options and foreclosure charges

- Keep your overall EMIs under 40% of your net monthly income to keep repayment easy to manage

- Align auto-debits with your salary credit dates for effortless payments

Wrapping Up

A holiday shouldn't leave you dreading the bills. With a well-planned personal loan, you can say yes to travel opportunities without depending on a credit card.

Plus, personal loans don't force you to tap into your savings. With Hero FinCorp, there's flexibility to match those last-minute package deals. Think loans of ₹5 lakhs for a minimum monthly salary of ₹15,000. All in as little as 10 minutes.

Ready to explore your options? Check your eligible loan amount and apply for Hero FinCorp's personal loan to fund that irresistible travel deal today!

Frequently Asked Questions

1. Can I get a personal loan without a credit card?

Yes. A credit card is not required for a personal loan. Lenders assess your income, credit score, and repayment history instead.

2. What costs can a personal loan cover for my trip?

Your entire travel budget! Personal loans can cover flights, accommodation, meals, activities, travel insurance, and even visa fees.

3. How are personal loans better than using a credit card?

Personal loans often have lower interest rates than credit cards. They also come with fixed EMIs, making repayment predictable and budget-friendly.

4. How do I choose the right loan amount?

Remember to calculate your total travel cost, add a small buffer for emergencies, and reduce what you can comfortably pay for from your savings.