How to get Instant Cash Loan in 1 Hour Without Documents

- What Is an Instant Cash Loan?

- Instant Cash Loan in 1 Hour Without Documents: Benefits to Explore

- Instant Cash Loan in 1 Hour Without Documents: Eligibility Criteria

- How to Get an Instant Cash Loan?

- Documents Required for Instant Cash Loans

- Interest Rates and Charges for Instant Loans

- Traditional Loans vs Instant Loans

- Risks and Precautions of Instant Cash Loans

- Get Instant Funds When It Matters Most

- Frequently Asked Questions

Unexpected costs, including medical emergencies, essential home or car repairs, or necessary travel, can catch you off guard. It might be challenging to wait for a loan under such circumstances.

At this point, an instant cash loan that may be obtained in an hour without the need for paperwork can be quite helpful. You receive the money you require virtually immediately with little paperwork and quick approval.

In this blog, we'll explore more about these loans, including eligibility criteria, benefits, risks, and the application process. Read on!

What Is an Instant Cash Loan?

An instant cash loan in 1 hour is a short-term, unsecured loan for quick financial assistance during emergencies. With traditional loans, you have to complete numerous forms and documents and have them verified. Instant cash loans are quicker and more convenient.

The verification and documentation process is primarily online, and you could receive your funds within an hour of approval. They are unsecured loans available to anyone with a regular source of income.

Also Read - What is Instant Personal Loan?

Instant Cash Loan in 1 Hour Without Documents: Benefits to Explore

Applying for an instant cash loan in 1 hour without documents comes with several advantages:

- Ideal for emergencies, as funds are credited within an hour

- Minimal or no paperwork

- Simple digital verification

- You don't need property or any collateral to apply.

- Cash is disbursed for any personal or emergency expense.

- Simple online forms and the instant loan app make the process hassle-free.

- Loan approval is based on proof of income.

- You can get an instant cash loan in 1 hour without a PAN card in some cases.

Instant Cash Loan in 1 Hour Without Documents: Eligibility Criteria

Understanding the requirements before applying for an instant cash loan makes the application process easier and prevents financial difficulties later.

| Age | Minimum 21 years Maximum 58 years. |

| Citizenship | Indian citizen. |

| Work Experience | Minimum 6 months for salaried Minimum 2 years for self-employed |

| Monthly Income | At least Rs 15,000/month |

| Credit Score | A score of 750+ is preferred |

Also Read: How Can I Get an Instant Cash Loan for Urgent Requirement?

How to Get An Instant Cash Loan?

It is tough to deal with financial worries, especially when you're in a hurry to get money. Here are the steps to get 1-hour instant cash loans.

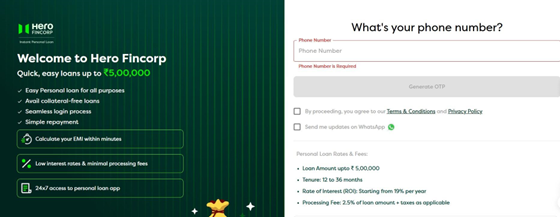

- Visit the lender's website and click on the personal loan page

- Please enter your mobile phone number to get an OTP. You can use it to verify your number.

- Choose the desired loan amount.

- Confirm your income eligibility by verifying your KYC details.

- Upload Aadhar or income proof if needed.

- Click 'Submit' to finish your application.

- Once verified, the loan is approved immediately.

- You get your funds in your bank account within an hour.

Alternatively, download the personal loan app to apply for an instant loan!

Documents Required for Instant Cash Loans

While instant cash loans in 1 hour often advertise minimal paperwork, some digital verification may still be needed. Most lenders require only electronic documents.

| Aadhaar Card | For identity verification |

| PAN Card | Optional in some cases |

Interest Rates and Charges for Instant Loans

Instant cash loans typically carry higher interest rates than traditional loans. Typical charges include

| Interest Rate | From 19% p.a. |

| Loan Processing Charges | Minimum 2.5% + GST (non-refundable) |

| Prepayment Charges | As per the loan agreement |

| Foreclosure Charges | Up to 5% + GST |

| EMI Bounce Charges | Rs 350/- |

| Interest on Overdue EMIs | 1% - 2% of the Overdue Amount Per Month |

| Cheque Bounce | Fixed Nominal Fine |

| Loan Cancellation | 1. No cancellation charges 2. The interest amount and processing charges are non-refundable |

Traditional Loans vs Instant Loans

Traditional loans are ideal for planned expenses, but instant loans are better when you need money quickly.

For example, Amit required ₹60,000 to repair his home. He initially went to a bank, but it involved a lot of paperwork and would take 5-7 days for the loan to be disbursed. When he realised the repair couldn't wait, he applied for an instant loan online. After a quick review of the details and digital KYC, the amount was credited to his account within an hour.

Also Read: Small Personal Loan or Mini Loan: How Are They Different?

Risks and Precautions of Instant Cash Loans

While instant cash loans offer convenience, borrowers should be aware of potential risks.

- These private loans charge higher interest rates than standard loans.

- Delayed loan repayment may attract heavy penalties.

- Get your loans only from authenticated, reliable lenders and sites to avoid fraud.

- Try not to get carried away by the easy process. Borrow funds that you can repay comfortably. You should calculate your EMI and plan your monthly repayments before applying for the loan.

Here are some precautions you need to consider before proceeding with an instant cash loan.

- Read the terms and conditions carefully before filling out your application

- Ensure that the lender is licensed and has good online reviews

- Follow repayment schedules to avoid additional charges

Get Instant Funds When It Matters Most

Instant cash loans in 1 hour without documents are an easy and trustworthy way to fulfil your urgent financial needs. Be it a medical emergency, home repair, or travel plans, these super-fast loans take care of your requirements without you having to use your savings.

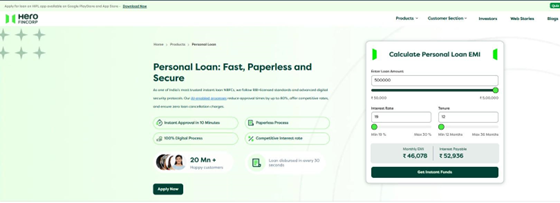

You can access an instant loan from verified lenders such as Hero FinCorp for amounts between Rs 50,000 and Rs 5 lakh. The entire loan process is online and paperless, with no physical documents or branch visits required.

So why wait? Explore our loan options today and get quick access to funds when you need them most.

Frequently Asked Questions

1. Can I get a cash loan within 1 hour without any documents?

Yes, many lenders now offer instant cash loans in one hour with minimal documentation. However, you may need to complete online KYC and basic identity verification.

2. How long does it take to receive the money once approved?

After approval, your loan amount is disbursed to your bank account within a few minutes to a few hours.

3. What is the preferred credit score for an instant cash loan?

The preferred score for instant loans is 700+.

4. Is a PAN card needed for these loans?

Yes, a PAN is required in most cases. Lenders use it to verify your identity and run a credit check.

5. How much money can I borrow instantly?

Your income and credit score determine loan amounts. Lenders often lend larger amounts to borrowers with strong credit histories.