The Rise of Embedded Lending—Borrowing While Shopping Online

Suppose you’re buying a new laptop online or booking tickets for a family holiday. Just as you are about to pay, a button pops up: “Buy Now, Pay Later” or “Get an instant loan with easy EMIs.” In that moment, the purchase feels far less overwhelming.

That’s embedded lending: credit built directly into your shopping journey. For families juggling multiple expenses, it promises speed and convenience right when you need it most.

But while it looks effortless, does it always work in your best interest? Here’s what to know.

What Is Embedded Lending?

Embedded lending means borrowing right at the point of purchase. Instead of visiting a bank or filling out long forms, you’re offered credit while you shop, book, or pay online, powered by digital checks and partnerships between merchants, tech providers, and lenders.

Here’s how it might look in real life -

• Browsing a Rs30,000 refrigerator and choosing to spread the cost over 3, 6, or 12 EMIs

• Booking a family holiday and comparing loan options for flights and hotels without draining savings

• Paying bills through a digital wallet and getting a short-term credit line to bridge the gap

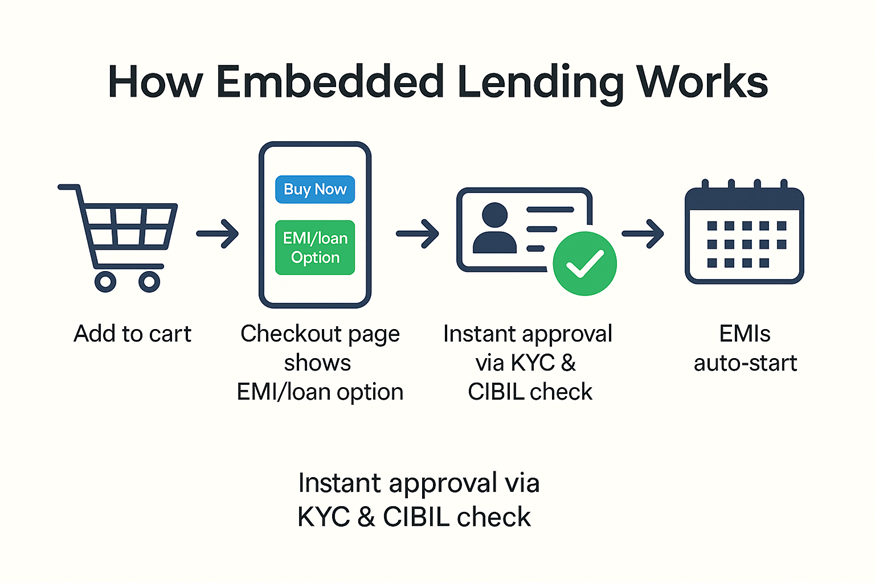

What makes this different from a traditional personal loan is timing. You don’t apply in advance. The offer appears during checkout, you confirm on the same screen, and if it’s approved, your repayment cycle kicks in right away.

Behind this smooth experience is a lot of fast work. The merchant’s system connects to the lender through secure APIs, pulling details like Aadhaar, PAN, and your CIBIL score. In just a few seconds, those checks decide whether the loan goes through or not.

Check your loan eligibility in advance and run the numbers to see what truly fits your monthly budget.

Why Is Embedded Lending Growing in India?

Now that you know what embedded lending is, the next question is obvious: why is it everywhere?

Because it’s not a passing trend. It is a fundamental shift in how people access credit. And the growth speaks for itself. The global embedded lending market is on track to hit USD 28.43 billion by 2032, expanding at almost 21% CAGR.

So, what exactly is driving this surge? Let’s see the forces making embedded lending part of everyday life in India.

1. The Boom in Digital Payments and E-Commerce

India’s e-commerce market crossed USD 147.3 billion in FY24, and UPI is now clocking over 18 billion monthly transactions. With shopping and payments happening on such a scale, lenders see the checkout page as the perfect place to step in.

And for borrowers? You get instant loans right where you shop, making big purchases easier to manage without upfront stress.

2. RBI’S Push for Financial Inclusion

The RBI has been nudging lenders and credit bureaus to adopt real-time credit reporting and digital-first loan journeys. The aim is clear: make small-ticket loans faster, safer, and free from endless paperwork.

Embedded lending lines up perfectly with this vision. It helps you secure short-term credit digitally, with clear terms and minimal friction.

3. A new borrower mindset

Millennials and Gen Z want credit that moves as fast as their apps. Gig workers and SMEs often lack traditional credit records but still need working capital. Even salaried families are opting for bite-sized loans for school fees, weddings, or festive shopping.

Embedded lending uses alternative data and instant checks to open the door for these segments, bringing more people into the formal credit fold.

4. Partnerships Between Lenders and Platforms

Retailers, travel portals, and fintech apps are increasingly tying up with NBFCs and banks. For merchants, it reduces checkout drop-offs and boosts sales. For lenders, it is a chance to reach new customers at scale without traditional acquisition costs.

5. Security, Privacy, and Compliance are a Priority

When money and personal data move across apps, lenders, and merchants, safety is just as important as speed. That’s why regulators have introduced stricter digital lending rules, and responsible lenders are strengthening encryption, consent, and oversight.

Hero FinCorp takes this seriously. We follow RBI’s Fair Lending Practices, comply with the DPDP Act 2023, and enforce strict data-sharing policies. The result? Your details stay protected while your loan journey stays hassle-free.

Which Works Better: Embedded Lending or a Personal Loan?

Both options unlock credit, but the right choice depends on why you’re borrowing and how much breathing room you want in repayments. Here’s how the two stack up:

Aspect | Embedded Lending | Personal Loan |

Where you apply | At checkout on a shopping site, app, or digital wallet | Directly through a lender’s website or mobile app |

Loan amount | Smaller sums, typically Rs5,000–Rs1,00,000 | Larger amounts, from Rs50,000 up to Rs5,00,000 |

Flexibility | Tied to a specific purchase or bill | Free to use for multiple needs |

Interest rates | Can vary, sometimes promotional, not always transparent | Structured, with clearer terms and repayment plans |

Repayment | Short-term EMIs, often just a few months | Longer repayment periods with manageable EMIs |

Small Spends vs. Big Dreams: Finding the Right Fit

Embedded lending is handy for smaller, planned spends that fit in your budget. But when life calls for bigger or urgent funds like medical bills, school fees, or a wedding, a personal loan offers higher limits, flexibility, and repayment ease.

With Hero FinCorp, you get the best of both worlds. From instant embedded credit at partner platforms to instant personal loans tailored to your needs, we make borrowing transparent, secure, and simple. Apply for one today!

Frequently Asked Questions

1. Is embedded lending the same as Buy Now, Pay Later (BNPL)?

Not quite. BNPL usually splits small spends into zero-cost EMIs. Embedded lending goes wider with varied tenures, interest rates, and quick eligibility checks.

2. I need a Rs 50,000 loan urgently. Should I use embedded lending?

For small purchases, embedded lending works beautifully. But for urgent needs, a personal loan online gives you more flexibility and structured repayment.

3. Do I need a high credit score for embedded lending?

Not always. Lenders do check your CIBIL score, but many, including Hero FinCorp, also use alternative data. Even first-time borrowers may get approved for smaller ticket sizes.

4. Are there hidden charges in embedded lending?

No. Trusted NBFCs like Hero FinCorp show you the EMI, tenure, and interest upfront before you hit confirm. What you see is what you repay.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.