Debt Service Coverage Ratio (DSCR): Meaning and Calculation

Loan approvals don’t happen by chance. Lenders study your income stability, credit history, and debt levels closely. For businesses, they go a step further and evaluate the Debt Service Coverage Ratio (DSCR), a powerful indicator of how financially strong and reliable your operations appear.

Understanding the Debt Service Coverage Ratio (DSCR)

A straightforward measure that contrasts a company's profits with its debt commitments is the Debt Service Coverage Ratio, or DSCR.

It tells:

- Business owners, if they are taking on too much debt compared to what they are making.

- Investors how stable a business is and how well it's managing its cash flow.

- Lenders whether the business can repay what they intend to borrow.

DSCR is calculated as Net Operating Income / Total Debt Service

Where:

Net Operating Income (NOI) is the business's net income after paying for the day-to-day costs needed to run it but before paying out all its debt obligations. In India, lenders specifically use EBIT or EBITA instead of NOI for a more accurate picture.

Here's how they differ:

Metric | What It Means | How It’s Calculated |

NOI | Income after daily operating costs | Total Income – Operating Expenses |

EBIT | Profit before interest and taxes | NOI – Non-operating Expenses |

EBITDA | Cash profit before interest, taxes, and non-cash costs | EBIT + Depreciation + Amortization |

Total Debt Service (TDS) is, simply put, the total amount a business must pay toward its debts each year.

This includes:

The principal of the business owes across all its outstanding loans.

The total interest due on these loans.

Some lenders also include lease payments (if applicable) and amounts set aside for future debt repayments or expenses, known as sinking fund contributions, as part of TDS.

How Is It Calculated?

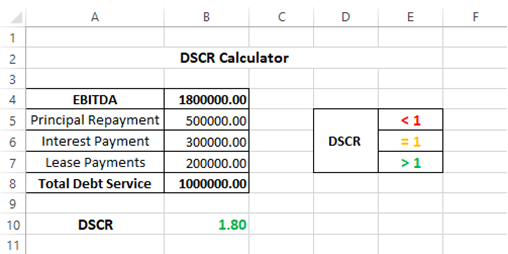

Let's use a fictitious business (X) with the following figures to see how you can calculate its DSCR directly and via Microsoft Excel.

Assume:

- Their EBITDA is -₹18,00,000.

- The Loan principal outstanding is - ₹5,00,000

- The Interest on the outstanding principal is ₹300,000.

- Their total lease payments are - ₹2,00,000

With these figures, X's TDS works out to:

5,00,000 + ₹300,000 + ₹200,000 = ₹1,000,000

When we apply this to the DSCR Formula, which is Net Operating Income (EBITA) divided by Total Debt Service, we obtain:

X's DSCR is equal to ₹18,00,000 divided by ₹10,00,000, or 1.8.

How to Calculate DSCR In Microsoft Excel?

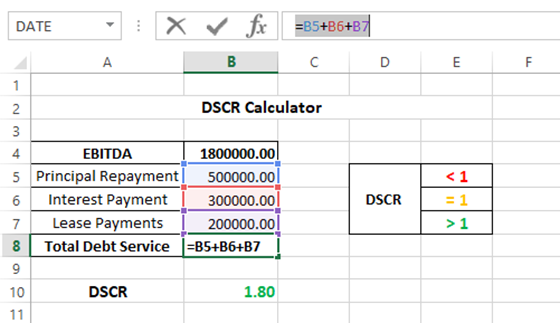

You can replicate the same in Excel by entering the values in Excel as shown in the screenshot below:

For the calculations, enter the formula to calculate the total debit services as "=B5+B6+B7"

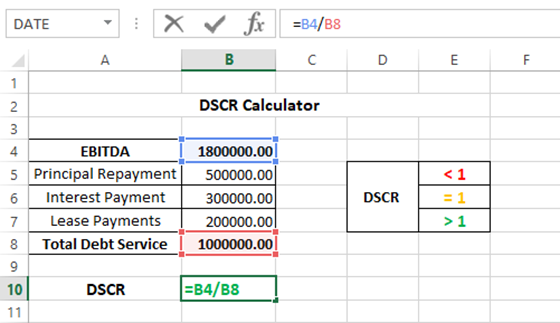

And for the DSCR as "=B4/B8"

Planning to take a loan and unsure how to calculate your EMIs? Use our personal loan EMI calculator for quick and accurate estimates.

What Is Considered an Ideal Debt Service Coverage Ratio By Lenders?

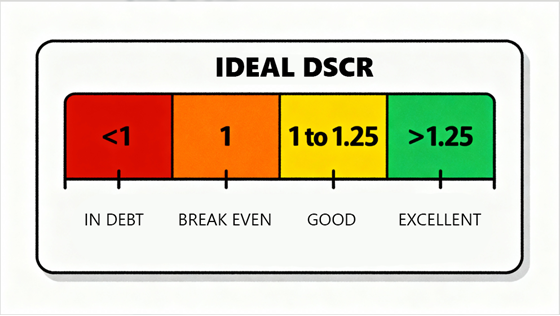

Your ideal Debt Service Coverage Ratio, especially if applying for a loan, is between 1.25 and 1.5. Here is what various DCSR figures tell you.

- DSCR is <1: It means that the business is not making enough money to pay its debts. At this stage, no lender will sanction a loan.

- DSCR is 1: This means that your business is just breaking even, or in simpler terms, making just enough money to pay debts. Again, not an ideal scenario from a lender's POV.

- DSCR between 1 and 1.25: Here, the business is just about making profits after covering its debt. Lenders may approve a loan here, but most likely with higher interest rates.

- DSCR > 1.25: Any figure above 1.25 signifies that business is going well enough to pay off any additional debts. Almost all lenders will easily approve a loan here.

How to Improve Your Debt Service Coverage Ratio?

Assume Business X has a DSCR of 1 instead of 1.8. We can do this by reducing their EBITDA to ₹10,00,000 (it was ₹18,00,000 in the above example).

The TDS stays at ₹10,00,000. Now, X can improve their DSCR in the following ways:

- Increase Revenue: If X adds a new revenue stream that brings in an additional ₹2,50,000 annually, the EBITDA rises to ₹12,50,000 and the DSCR goes up to 1.25.

- Refinance its Debt: X can refinance its existing debt at a lower interest rate. As a result, if the interest component under the TDS drops by even ₹1,00,000 annually, the DSCR now stands at ₹10,00,000/₹9,00,000 = 1.11.

- Restructure Loans: X will reduce the annual principal payment component if it restructures its loans and lengthens their term. The TDS value now drops to ₹800,000 and consequently, the DSCR improves to 1.25.

Each move can make a significant improvement on X's DSCR. If X can manage multiple simultaneous, it will go a long way in improving the figure to a range where they have access to favorable loan options.

Use Your DSCR to Secure Better Financing

A DSCR is a critical metric that paints the same picture for all stakeholders (business owners, investors, and lenders) involved: Can this business handle debt? A ratio above 1.25 improves your chances of getting a loan at highly favorable rates. Anything lower means that the business needs to re-evaluate its finances before it can seek out a loan.

If you’re seeking a business loan and have a strong DSCR, HeroFincorp’s instant loan app lets you apply digitally and get quick, hassle-free approvals. So why wait? Explore our solutions and apply today!

Frequently Asked Questions

1. What is the best DSCR for a small firm in India?

A DSCR of 1.25 to 1.5 is seen as favorable for small firms in India.

2. Can a business obtain a loan if its DSCR is less than 1?

A corporation with a DSCR of less than one is very unlikely to be granted a loan.

3. How often should DSCR be calculated?

If you are growing rapidly, recalculate your DSCR quarterly. Otherwise, once a year is frequent enough.

4. Does DSCR apply to both secured and unsecured loans?

Yes, lenders take DSCR into account for both secured and unsecured business loans in India.

5. Does GST affect DSCR?

Yes, GST can affect your DSCR score, but by a very small margin, as your cash flows must include what is left after paying your GST.

6. Do personal loans affect business DSCR?

Personal loans can impact your DSCR in the case of an unsecured loan, where the owner is the guarantor.