Can I Take a Personal Loan and Home Loan Together?

- Home Loan and Personal Loan: Exploring the Basics

- Taking a Home Loan and a Personal Loan Together

- Personal Loan and Home Loan Eligibility: What Matters

- Personal Loan and Home Loan: Benefits and Risks

- How to get a Personal Loan and a Home Loan? Quick Tips for Approval

- Plan Wisely and Get Both Loans

- Frequently Asked Questions

Your home loan is approved, the paperwork is signed, and you are ready to move into your dream home. Just when everything appears to be going smoothly, more costs come up—interior, furnishing, and refurbishing.

The majority of borrowers at this point tend to resort to a personal loan as a means of financing. This, of course, brings up the question that is paramount: can a personal loan and home loan be taken out together?

The guide here provides insights into whether you can both apply for the loans at once, how it impacts your eligibility, and what lenders take into account before approving your application.

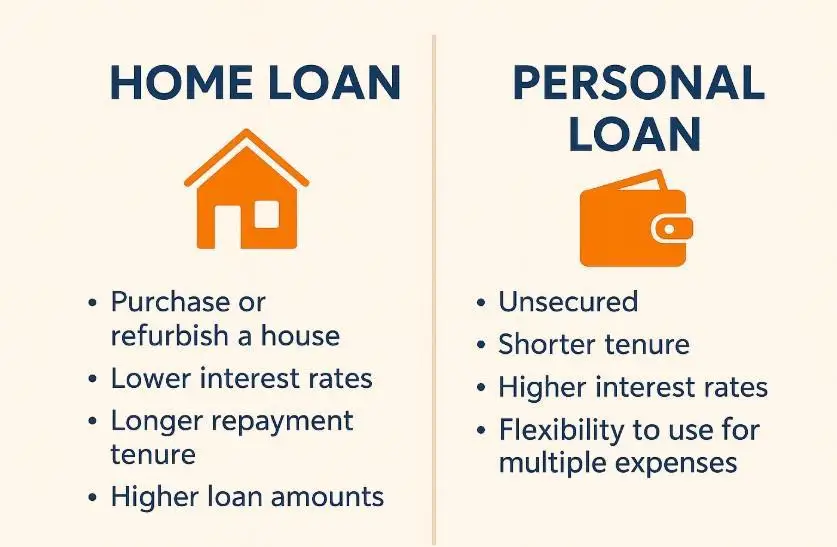

Home Loan and Personal Loan: Exploring the Basics

Here’s what each loan provides:

Home Loan:

- Purchase, construct or refurbish a house

- Lower interest rates, as property acts as collateral

- Longer repayment tenure up to 30 years

- Higher loan amounts based on property value.

Personal Loan

- No collateral required

- Shorter tenure of 1-5 years

- Higher interest rates

- Ideal for furniture, interiors, weddings, emergencies or travel

Remember, home loans are long-term repayment commitments that you need to plan for, as they are secured loans against your property and require financial discipline over several years.

Need quick funds? Download our Instant Loan App and apply in just minutes!

Taking a Home Loan and a Personal Loan Together

There has been an increase in home loans in FY2024, with both public and private banks reporting increases of 11% and 7%, respectively. Personal loans also saw a 26% increase in the same period. However, an individual may apply for both loans at the same time, when

- There is a need for immediate cash during a home purchase

- Managing two separate financial goals

- You need additional funds, but you don't want to use your savings

But can you take a personal loan and home loan together?

Yes. In India, you can, and there are no RBI regulations that prohibit this.

Rohan and Meera applied for loans last month.

Rohan applied for a home loan and a personal loan.

Meera applied for just a home loan. You think Meera’s single-loan application would be approved first, right?

Surprisingly, it was Rohan who got approved faster.

Why?

Because Rohan had everything lenders prefer: a high credit score, a low debt-to-income ratio, and the correct documentation.

This proves you can take a home loan and a personal loan together; what matters is your financial health.

Read More: What Are The Pros And Cons Of Taking Multiple Loans

Personal Loan and Home Loan Eligibility: What Matters

Applying for two loans at once requires planning.

However, before applying for both loans together, it’s essential to calculate the EMIs for your personal loan and home loan. You can determine whether you can comfortably repay both EMIs without affecting your regular budget.

Here’s what lenders will look at:

1. Maintain your Credit Score

A score of 700+ is ideal to handle both loans. Multiple credit enquiries can lower your score, so apply carefully.

2. Verify the Debt-to-Income (DTI) Ratio

The total EMI amount paid should ideally be less than 40–50% of your net income. A higher DTI leads to lower chances of getting approved.

3. Stable Monthly Income

Steady jobs, clean bank statements, and timely salary bolster your profile and help you get loan approvals faster.

4. Loan Tenure

Balancing a shorter personal loan tenure with a longer home loan tenure helps reduce monthly EMI pressure. Approvals become faster if you have pre-approved loan offers.

Personal Loan and Home Loan: Benefits and Risks

Combining personal and home loans can be helpful, but understanding the impact of a personal loan on a home loan is key to borrowing smart.

Here are the risks and benefits of the two loans together:

| Benefits | Risks |

|---|---|

| Get immediate funds for expenses | Higher combined EMI burden |

| Flexibility in the use of personal loans | Increased overall interest cost |

| Helps maintain liquidity without using savings | Missed EMIs impact your credit score |

| Can build a stronger repayment history if managed well | Financial stress if income is unstable |

Read More: What is Personal Loan Application Process | Step-by-Step Guide to Approval and Verification

How to get a Personal Loan and a Home Loan? Quick Tips for Approval

Follow these steps to improve approval chances:

1. Assess Your Financial Health

- Check your income, EMIs, and other monthly commitments.

- Make sure you have a good credit scorewhen you apply.

- Watch out for pre-approved Home and Personal Loan offers. They usually come with quick processing and minimal documentation.

2. Submit Required Documents

- Check your eligibility requirements for personal loansand home loans.

- Submit all necessary documents, including ID proof, address proof, salary slips, bank statements, ITR, employment proof, and property documents.

3. Plan Loans and Manage EMIs

- Home loans take longer to be approved, while personal loans are approved almost instantly. Plan which one you need first.

- Set up UPI AutoPay, align due dates, and maintain a buffer for repayments.

Plan Wisely and Get Both Loans

Taking a home loan and a personal loan together is possible, as long as your financial profile supports it.

If you need a quick and no-fuss personal loan on top of your home loan, HeroFincorp makes the whole process smooth and simple. With user-friendly applications, fewer requirements for documentation, and rapid approvals, you can receive the money you require without any delay.

Download our loan app now to explore flexible personal loan options and manage your financial needs with confidence and convenience!

Frequently Asked Questions

1. Can I take a personal loan and a home loan together in India?

Yes. Banks and NBFCs approve it based on your financial health.

2. Does having a personal loan reduce my home loan eligibility?

A personal loan reduces your disposable income, which directly lowers your home loan eligibility.

3. What is the impact of personal loan EMIs on home loan interest rates?

Personal loan EMIs can affect your credit risk profile, and you get a higher home loan interest rate if you fall in the high-risk category.

4. Does a joint application increase personal loan and home loan eligibility?

Adding a co-applicant with stable income improves your eligibility for both home and personal loans, as the combined income reduces lenders' risk.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.