Budget, Borrow, Pay – All from Your Phone: The Future of Personal Finance

Managing your money shouldn't be a constant struggle with spreadsheets or long queues at the bank. But the EMI date can slip through your mind, or you just can't figure out where you spent your money.

So, what to do then? How should you plan your budget, manage your borrowings, and pay without spreadsheets or bank visits?

That's where personal finance apps help.

Personal finance apps offer a user-friendly way to track spending, save, borrow, and maintain control. Whether planning finances or paying bills, these apps bring clarity.

Here's how a smartphone helps manage finances and how to choose the right personal finance app.

How Smartphones Help Manage Your Personal Finances

Suddenly planned a trip with friends? Need money for a medical emergency? Planning to save more?

A personal finance app makes all of this simple. It helps you analyse your affordability and plan if you need a loan or where you need to cut expenses.

Here's how a smartphone app helps -

Complete Overview of Your Finances

Personal finance apps connect to your bank accounts and collect the summary of your income, investments, spending, and EMIs. With all the data in one place, it becomes simpler to handle budget and payments whenever and wherever you want.

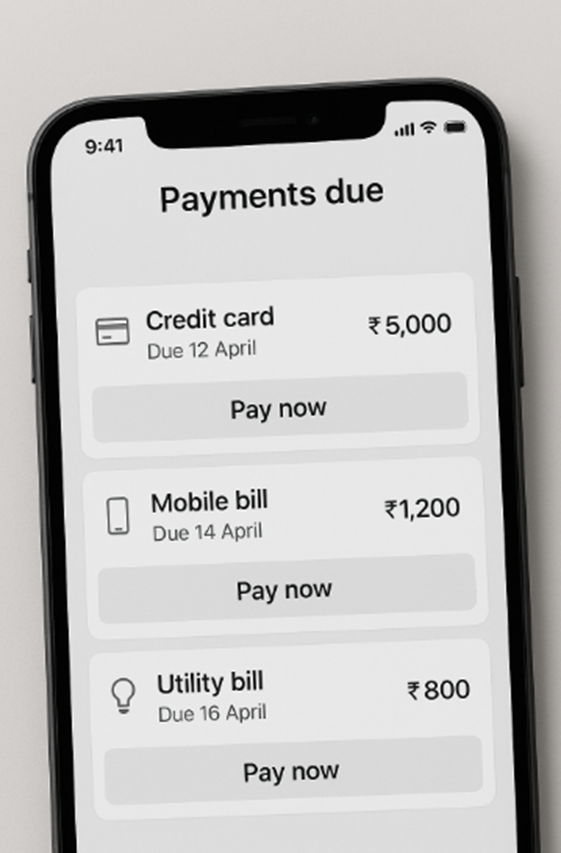

Timely Alerts

You no longer need to remember due dates for bills, SIPs, and EMIs. A personal finance app keeps you on track by sending you alerts for low balances, upcoming bills, or transactions.

Categorises Expenses

The app shows spending categories, trends, and patterns to help you see where your money goes. So you can structure your budget based on that data instead of vague assumptions.

Quick Personal Loans

Need money for emergencies? A personal loan app lets you apply and get approval in minutes. Plus, you receive funds quickly, which helps manage emergencies.

Several financial institutions allow you to customise loan terms, choose amounts, tenure, and other terms from anywhere and at any time, with zero paperwork.

But, how will you decide the term and tenure so it comfortably fits your budget? Use a personal loan EMI calculator and get an accurate EMI amount based on the term, interest rate, and tenure.

Additionally, with authentication and encryption, the app keeps data and transactions safe.

Easy Money Transfers

No need to visit an ATM or write checks to pay. You can transfer funds to family, pay loans, and meet other expenses by directly paying through your smartphone.

What to Look for in a Personal Finance App?

The personal finance app should align with your goals, whether you are budgeting, borrowing, or paying. Here's what to look for when choosing one -

Budgeting and Expense Tracking

For easy personal finance management, you need to track your expenses and budget accordingly. Look for an app that helps you -

- Set custom budgets for different expense categories

- Track and categorise expenses

- Sync with bank accounts and cards

- Offers detailed charts and graphs to help you understand your spending

Goal Setting and Savings

The app should let you set saving goals such as emergencies, vacations, or major purchases. Here are the must-haves -

- Automated options to transfer small amounts to savings

- Progress trackers for a visual overview of savings

Debt Management

If you have debt to pay off, look for -

- Debt payoff calculators to create a repayment plan

- Reminders for due dates

- Insights on interest rate and how to reduce it

Also Read: Tips to Effectively Manage Your Personal Loan EMI

Bill Payment and Reminders

To ensure timely bill payments and avoid payment, here are the features to check -

- Bill tracking and payment reminders

- Automated bill payments

Security and Privacy

To keep your sensitive financial information secure, here are the features to look for -

- Encryption to protect data

- Multi-factor authentication

- Biometric login options such as Face ID or fingerprint

- Regular security updates and compliance

Keep Your Finances On Track with A Personal Finance App

A personal finance app takes the complexity out of money management. You won't need to search for data across banking and investment apps. Just one app for everything finance.

Choose the right app, and you will always have the numbers at your fingertips. Track your spending patterns, check your investments, and pay without hassle.

And when life brings unexpected expenses, you won't have to panic. Instead of stressing over paperwork or rushing to a branch, you can borrow funds instantly, right from your phone.

With paperless personal loans from trusted NBFCs like Hero FinCorp, money is one less thing to worry about. That means more time and energy to focus on your family, your goals, and the moments that truly matter.

Frequently Asked Questions

1. Can I manage multiple bank accounts with one app?

Yes, you can sync and monitor several accounts at once. This gives you a complete financial view.

2. How quickly can I get a loan through a personal loan app?

At Hero FinCorp, your loan is approved in minutes. Plus, you also get quick disbursal of money to handle emergencies.

3. How do personal finance apps help with bill payments?

Personal finance apps track due dates and send reminders. Plus, you can automate recurring payments to avoid delays or misses.