What is Personal Loan Application Process | Step-by-Step Guide to Approval and Verification

For any borrower, submitting a personal loan application marks the end of a process. But in reality, you’re merely passing on the baton to the lender. It’s the cue for a series of behind-the-scenes journeys. You have eligibility checks, KYC verification, loan approval workflows, and finally, disbursal. There’s a whole flurry of activity.

To make things clear and less mysterious, here’s a friendly walkthrough of the entire personal loan process. We also dive into how Hero FinCorp keeps it fast, digital, and stress-free.

What does the Loan Application Process Mean?

The loan application process is just several steps you are compelled to go through to apply for a loan from a lender. This typically involves giving your personal information, demonstrating your ability to repay the loan, and selecting the form and size of the loan most suitable for you. From application to receiving your loan distribution, here's what happens.

Understanding the Personal Loan Application Process with the Online Journey on Our Website

Getting a personal loan from Hero FinCorp is easy. Here's how:

- Website Visit: Visit the website of Hero FinCorp.

- 'Apply Now' Click: Proceed to the personal loan page and click on "Apply Now."

- Input Mobile Number and Validate OTP: Input your mobile number and authenticate it by validating the received OTP.

- Select Loan Amount: Select the loan amount you desire.

- Confirm KYC Details: Provide your KYC details to verify your income eligibility.

- Submit Your Application: Click "Submit" to complete the application process.

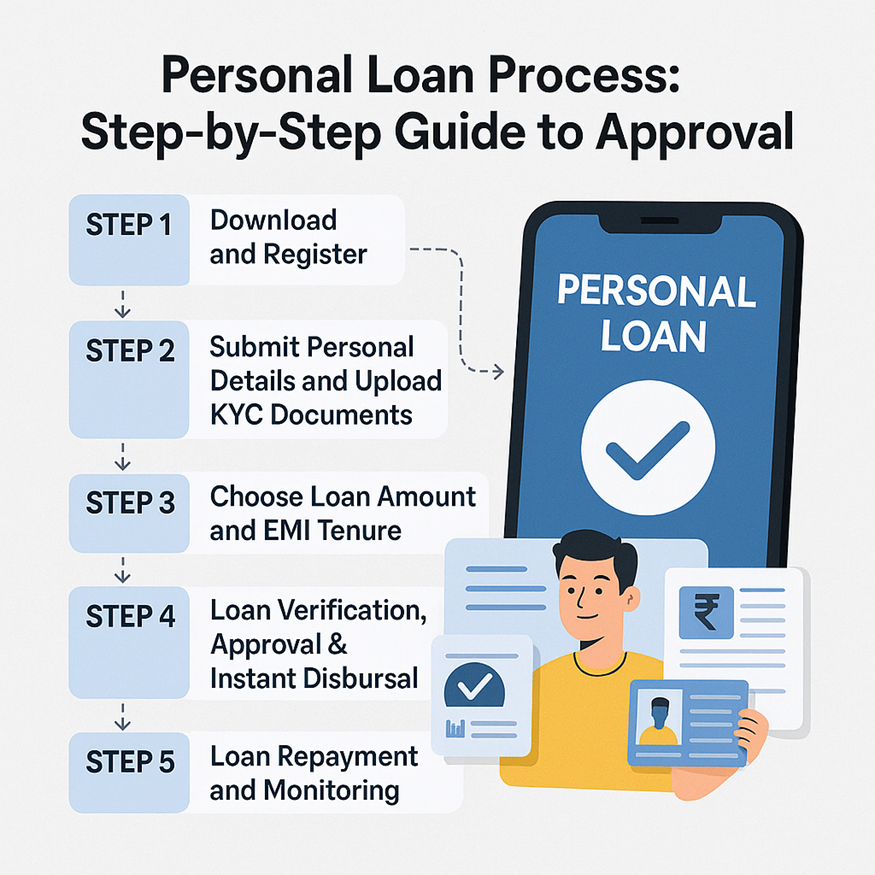

Understanding the Personal Loan Application Process with the Hero FinCorp Loan App

Nowadays, applying for a personal loan is faster and simpler than ever. With new-age loan apps like Hero FinCorp, you can apply online and get approval within 10 minutes. Here’s a step-by-step guide.

Step 1: Download the Hero FinCorp App & Register

Start by downloading the Hero FinCorp instant personal loan app from Google Play Store or the Apple Store app. After installation, register using your mobile number (linked to your Aadhaar card). You will receive an OTP for verification.

Key Actions:

- Register via mobile number

- Verify your number via OTP

Step 2: Enter Your Details & Submit KYC Documents

After registration, enter your personal, financial, and occupational details. You will also need to provide your KYC details. You should have:

- Identity Proof (Aadhar card, PAN card, or Driving License)

- Address Proof (Utility bills, rental agreements)

- Income Proof (Salary slips - salaried; business continuity proof - self-employed; bank statements for the last 6 months)

KYC Verification Process

This is the process where your details are verified in real-time through the app, ensuring a paperless and seamless experience. The app also verifies digitised KYC information, which may include video KYC to validate your identity.

Step 3: Choose Loan Amount & EMI Term

Now that your details are entered, use the personal loan EMI Calculator within the app to select the loan amount and tenure that best suit your financial needs. The app calculates the EMI amount based on different interest rates and terms, so you can choose the most suitable option.

Key Actions:

- Use the EMI Calculator to estimate your monthly payments

- Adjust the loan amount and tenure based on your affordability

Step 4: Loan Approval & Disbursal

Once your application and details are verified, Hero FinCorp moves to loan approval. Our process is designed for instant approval and quick disbursal.

Key Actions:

- After approval, the loan amount is disbursed directly to your bank account

- You will receive an SMS/Email confirming the loan disbursement

Approval and Rejection Process

- Loan Approval: If approved, you will receive an offer letter containing the loan amount, interest rate, EMI schedule, and loan terms.

- Loan Rejection: If rejected, common reasons include low credit score, insufficient income, or discrepancies in submitted documents. You may be allowed to reapply after addressing the issues.

Step 5: Begin Loan Repayment

After the loan amount is disbursed, you can start repaying your loan based on the EMI schedule. You can opt for auto-debit or use online banking to ensure timely repayments. The loan EMI can be customised to suit your monthly income and repayment capacity.

Key Actions:

- Set up auto-debit for hassle-free EMI payments

- Track your repayment schedule using the Hero FinCorp app

Eligibility Criteria for Personal Loan Approval

Before applying for a Personal Loan, make sure you meet the basic eligibility requirements. These help ensure smoother processing and faster approval.

- Age: Applicant must be between 21 to 58 years.

- Minimum Income: Rs15,000 per month.

- Credit Score: A good credit score of 750 or more can make loan approval faster.

- Work Experience: Minimum 6 months (salaried) or 2 years (self-employed).

Benefits and Features of the Loan Application Process

Hero FinCorp’s Personal Loan application process is designed to provide quick, flexible, and stress-free financial support for your money requirements.

Ample Loan Amount: Borrow from Rs 50,000 to 5 Lakh, depending on your eligibility and requirements.

Instant Availability: Get instant approval when you apply via the Hero FinCorp website or loan app.

Attractive Interest Rate: Enjoy competitive rates starting at just 1.58%* per month.

Flexible Repayment Tenure: Repay your loan comfortably over 12 to 36 months.

Multiple Usage Options: You can use the loan for various purposes like higher education, home renovation, medical emergencies, or travel expenses.

Collateral-Free: There is no need for security or guarantors—your assets remain untouched

How Hero FinCorp Compares with Other Lenders

Traditional lenders like banks often require physical visits, involve longer processing times, and have stricter eligibility norms. However, they may offer competitive interest rates, especially to existing customers with strong credit profiles.

In contrast, NBFCs and online lenders such as Hero FinCorp provide a faster and more convenient borrowing experience. With minimal documentation, paperless procedures, and the ability to apply directly through the app, they offer instant approvals—making them a preferred choice for many.

Also Read: What Is Personal Loan Verification Process

Conclusion

Understanding the Personal Loan application process helps you make informed borrowing decisions. With Hero FinCorp’s quick, digital-first approach, you can apply online or offline and enjoy instant approval, minimal documentation, and flexible repayment options. Whether it’s for education, medical needs, or travel, Hero FinCorp makes personal financing easy, fast, and accessible—right when you need it most.

Frequently Asked Questions

1. What is the Loan Approval Process?

The Personal Loan approval process requires submitting an application, verification of documents, assessing creditworthiness, and receiving approval or rejection.

2. How Does the Online Personal Loan Process Work?

Download the loan app, register, submit KYC and income documents, select loan amount and tenure, get instant approval, and receive funds directly in your bank account.

3. What are the Steps for Applying Offline?

Visit your nearest Hero FinCorp branch or authorised DSA, submit your application with documents, get instant approval if eligible, and receive funds after document verification.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.