Difference Between Short Term and Long Term Loans

Thinking of taking a loan? Good idea! But do you know which type is right for you?

When it comes to loans, two broad categories exist: long-term loans and short-term loans. Most people think they’re just repayment tenures. But the reality is far more complicated than that.

Picking the wrong loan type doesn’t just mean choosing the wrong repayment period. It also means paying higher EMIs, enjoying lower credit flexibility, and messing up your finances.

So in today’s blog, let’s break down short-term loans vs long-term loans. Read and find out which one you should go for.

What Is a Long-Term Loan?

A long-term loan is a credit option, like a home loan or loan against property, that helps to finance major expenses, like building a home, financing higher education, etc. Its repayment period is usually longer, lasting from 36 to 180 months.

What Is a Short-Term Loan?

A short-term loan is used to cover immediate expenses, such as medical bills, vacation, marriage and more. As the name suggests, it’s repayable within a short time period, typically between 12 to 36 months. One common example of a short-term loan is a personal loan.

Want to check how much personal loan you’re eligible for? Use a Personal Loan Eligibility Calculator now!

Long-Term vs Short-Term Loans: Key Differences

Long-term and short-term loans differ in more ways than just repayment tenures. Here are some of them -

| Aspect | Long-Term Loan | Short-Term Loan |

|---|---|---|

| Loan Amount | Typically between ₹20 lakhs and ₹7.5 crores | Typically between ₹50,000 to ₹5 lakhs |

| Duration | 36 to 180 months | 12 to 36 months |

| Interest Rate | Lower (starts from 11% p.a.) | Higher (starts from 19% p.a.) |

| EMI Amount | Lower (spread over longer period) | Higher (compressed repayment) |

| Approval Speed | Rigorous and time-consuming (detailed documentation, verification, collateral check if applicable) | Quick and swift (minimal paperwork, often digital approval in hours/days) |

| Ideal For | Hefty expenses (e.g., home renovation, business expansion, education, vehicle purchase, debt consolidation) | Small, urgent expenses (e.g., medical emergency, wedding, travel, short-term cash flow gap, gadget purchase) |

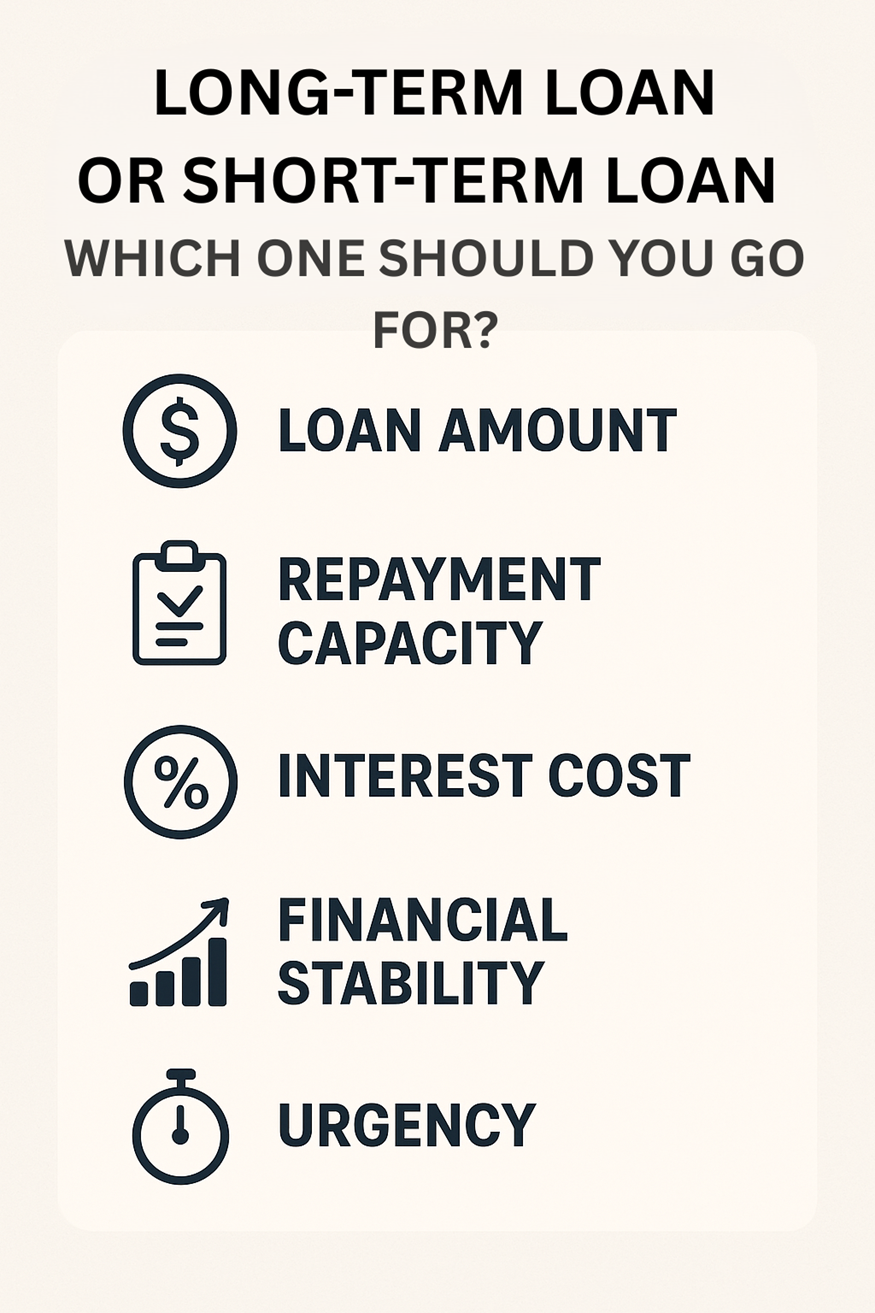

Long-Term Loan or Short-Term Loan: Which One Should You Go For?

Choosing between a long-term loan and a short-term loan can be challenging, especially if it’s your first time. So, here are all the aspects you should consider -

Loan Amount

If you need a small amount, go for a short-term personal loan. You will save money on interest. If you need a large amount, a long-term loan is a viable option.

Repayment Capacity

If you can handle high monthly EMIs, short-term personal loans can be ideal for you. However, if you want to pay off your loan conveniently, in small EMIs, choose a long-term loan.

Interest Cost

Even if the interest each month is lower, long-term loans can cost more over time. Short-term loans have high monthly interest, but you will pay them off more quickly, saving on the total interest cost.

Financial Stability

A long-term loan might be a great choice if you have a reliable income. If not, a short-term loan can assist you in getting out of debt faster.

Picked the Wrong Loan Type? Here’s What You Should Do Next

Have you already made the mistake of choosing a loan type that doesn’t justify your needs? Don’t worry, here’s what you can do -

- Talk to your lender - Most lenders offer easy refinancing facilities. So, reach out to them to make adjustments.

- Make partial pre-payments - If you’ve mistakenly opted for a long-term loan instead of a short-term loan, consider making partial pre-payments. This helps reduce principal faster and save on interest. However, check with your lender regarding any prepayment charges.

- Extend your tenure - If you’ve opted for a short-term loan when you actually needed a long-term loan, request your lender to adjust your tenure. Although you might have to pay slightly higher interest, this lowers your monthly EMIs, making them easier to manage even when cash flow is tight.

Finding the Loan that Works for You

Personal loan, car loan, home loan, payday loan—so many options, so much confusion. But the drill for choosing between a long-term and short-term loan is actually pretty simple.

The best loan depends on what you need the money for and how fast you want to pay it off. Short-term loans are good for fast cash. Long-term loans fit larger expenses better. Take a minute and really think about it before choosing.

Looking for a loan that resonates with your needs? Apply with Hero FinCorp—get flexible tenures, quick approval, and minimal hassle.

Frequently Asked Questions

1. Do short-term loans have higher interest rates?

Yes, usually. But you often pay less interest overall because the loan is paid back faster.

2. Can I switch from a short-term loan to a long-term loan later?

Yes, but it depends on your lender. They might need to change the loan agreement.

3. Which type of loan is easier to get approved for?

Short-term loans are often easier to get approved for. But your credit score and income always play a big role.