Understanding the UPI Cooling Period

- What Is the UPI Cooling Period?

- Why is a UPI Cooling Period Necessary?

- Cooling Period for New UPI PIN Registration

- Cooling Period for Large Transactions or New Beneficiaries

- How to Check Your UPI Cooling Period Status?

- Overcoming UPI Cooling Period Challenges

- Stay Prepared And Manage Your UPI Access With Confidence

- Frequently Asked Questions

You open your UPI app to send money, and everything looks normal at first. The balance shows correctly, the amount feels routine, and the PIN works without issue. Still, the payment refuses to move. You try again, wondering if you missed something small, because that is usually how these things go.

The confusion settles in slowly. Nothing appears broken, yet nothing works either. That pause creates doubt, especially when the payment feels urgent. Many people run into this situation after changing phones or updating UPI details.

The reason often lies in a short waiting window built into the system. Once you understand what that pause means, the situation becomes far less stressful.

What Is the UPI Cooling Period?

The UPI cooling period is a temporary safety window that begins after specific actions in your UPI setup. Banks activate this window when someone registers UPI for the first time, resets a PIN, or begins using a new phone.

During this phase, the system limits certain transactions while it confirms account ownership. Smaller payments may work, while higher amounts remain restricted. Once verification completes, full access is automatically restored without any additional steps.

HeroFinCorp explains this process clearly so users understand that the delay protects their money rather than blocking usage without reason.

Also Read: What is UPI and How Does UPI Work?

Why is a UPI Cooling Period Necessary?

Digital payments offer speed, but speed also increases risk. The importance of the UPI cooling period becomes clear when you look at how fraud typically begins.

Unauthorised access usually happens immediately after a phone change or SIM replacement. Criminals rely on quick transfers before anyone notices unusual activity. The cooling window interrupts that pattern and prevents instant loss.

This protection works in several practical ways.

- It blocks high-value transfers during early access

- It protects accounts after device or SIM changes

- It reduces misuse when adding unfamiliar contacts

- It allows banks to monitor transaction behaviour

These checks run silently in the background while keeping everyday users secure.

Cooling Period for New UPI PIN Registration

Setting a UPI PIN is considered a sensitive action because it grants direct access to funds. The UPI cooling period after PIN set begins immediately after completion of this step.

During the new UPI PIN cooling period, apps limit transaction amounts for a short-term duration. The system uses this time to confirm that the correct person completed the setup using the registered mobile number.

Once verification is complete, the system automatically removes restrictions and allows normal usage without additional approvals.

Also Read: How to Set up a UPI PIN Without a Debit Card?

Cooling Period for Large Transactions or New Beneficiaries

The system also applies controls when users add a new payee or attempt higher-value payments. The UPI transaction cooling period reduces risk during moments that typically attract fraud.

When someone adds a new beneficiary, the platform restricts large transfers for the first 30 days. A similar limit applies when users initiate unusually high payments with no prior history.

| Scenario | What usually happens |

|---|---|

| Adding a new beneficiary | Transfer limits apply initially |

| Attempting a high amount payment | Temporary cap activates |

| New device activity | Safety checks begin |

| Irregular payment pattern | Restrictions appear briefly |

The new beneficiary cooling period and high-value UPI cooling period together ensure money moves only after trust develops through verified activity.

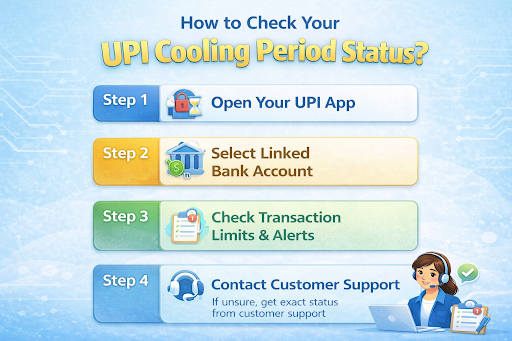

How to Check Your UPI Cooling Period Status?

Understanding your account status helps avoid unnecessary worry. Most UPI apps display cooling-related information directly within account settings.

Start by opening your UPI app and selecting the linked bank account. Review transaction limits shown on the screen and check alerts related to recent setup activity. System messages usually mention whether restrictions apply and when full access will resume.

If clarity remains missing, customer support can confirm the exact status instantly. HeroFinCorp encourages users to rely on official updates rather than repeated payment attempts.

Overcoming UPI Cooling Period Challenges

Payment restrictions often create stress when money needs to move urgently. Many users search for ways to bypass UPI cooling period limits, but safer options are more effective.

Net banking transfers remain available during this phase and help manage immediate needs. Cash payments can serve as temporary support when digital transfers pause. Waiting for the verification window to complete usually resolves the issue smoothly.

For urgent UPI transfer situations, early preparation makes a difference. Adding beneficiaries in advance and avoiding last-minute setup reduces disruption.

Stay Prepared And Manage Your UPI Access With Confidence

When you understand how UPI safety works, everyday payments feel easier to handle. You know what to expect, and that clarity removes unnecessary stress during regular transactions.

At the same time, financial stability often depends on having quick access to funds when plans change. With HeroFinCorp, you can apply through the personal loan app, complete the process digitally, and receive money quickly. This support helps you stay in control without interrupting your daily routine.

Frequently Asked Questions

What happens if I try to transact during the UPI cooling period?

The app blocks or limits the payment until the verification window completes.

Is the UPI cooling period applicable to all UPI apps?

Banks follow standard security rules across platforms, though display formats differ.

Can I request a waiver for the UPI cooling period in an emergency?

Banks do not remove this restriction manually because it follows fixed safety protocols.

How long does the UPI cooling period typically last in India?

The duration depends on bank policies and setup activity, usually lasting a few hours to one day.

Does resetting my UPI PIN trigger a new cooling period?

Yes, changing the PIN activates a fresh safety window to protect account access.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.