Scam-safe borrowing: a checklist to verify RBI-regulated lenders

A teacher from Haryana applied for a personal loan in Jan 2026 for her son's wedding. He was enticed by a quick loan of ₹10 lakhs, which was offered despite a low credit score and the lack of verification documents. As soon as he applied online, his bank account was drained within minutes, and he never got the loan he applied for.

Currently, borrowing has never been easier. With just a few phone clicks, one can borrow a loan, receive EMIs, and track payments. However, with ease comes more scams.

Spammers are advertising themselves as quick loan providers offering instant approvals with minimal paperwork, simply to trap borrowers in fake apps or illegal agreements.

For someone who is arranging family security and financial stability, it is a sheer necessity that you borrow only from an RBI-regulated lender. Let us review an efficient checklist that will keep you scam-proof and safe while borrowing.

About Scam-Safe Borrowing: Why RBI Regulation Matters

The Reserve Bank of India is the central governing body that monitors banks and NBFCs. Any authentic lender must be registered under RBI norms. Borrowing money from an RBI non-registered company can put you into fraud, information misuse, and unethical recovery procedures.

RBI has reported a 27% surge in banking fraud cases in 2025-26, with 18,461 cases amounting to ₹21,367 crore. Loan amounts range between ₹10 lakh and ₹1 crore, which makes it imperative to understand common fraud tactics to protect financial health.

Scam-safe borrowing is as easy as checking the authenticity of the lender before signing up. It's all about ensuring that the lender is authorised by the RBI.

Personal Loan Scams Types

There are a few tricks that scammers have up their sleeves. These are the most common types -

- Suspicious Loan Apps – Instant loan apps that provide quick cash but are not RBI-approved. They misuse your details.

- Advance Fee Scams – Lenders who ask for money in advance of loan approval. Genuine lenders do not.

- Phishing Emails or SMS – Emails or SMS with a link to spurious loan sites that loot your bank accounts or data.

- Identity Theft – Fraudsters posing as NBFCs to collect your Aadhaar, PAN, or bank details.

- Predatory Recovery Agents – Fake lenders using threats or harassment to extract money.

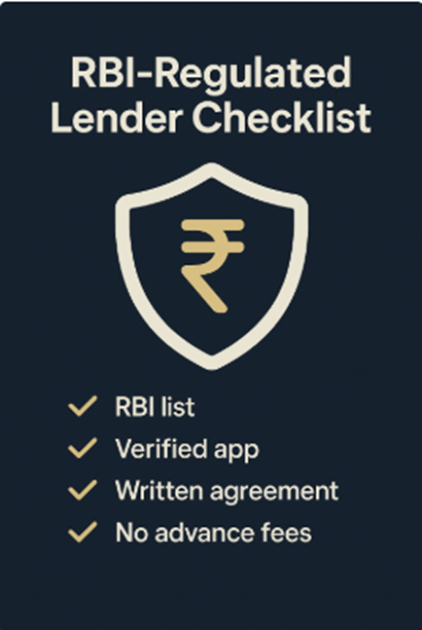

The Perfect Checklist to Verify RBI-Regulated Lenders

If you want to apply for a personal loan, using a genuine personal loan app, here's your step-by-step guide -

Step 1 - Check RBI's Official List

RBI publishes a list of authorised NBFCs and banks. Cross-verify the lender's name.

Step 2 - Company Website and Contact

An authorised lender will have a proper website with clear addresses, customer care numbers, and proper compliance disclosures.

Step 3 - Loan Agreement

RBI-regulated loan apps always offer an agreement that quotes interest rate, repayment terms, and charges in writing.

Step 4 - No Advance Fees

If an app asks you to pay up front, it is a red flag. RBI-regulated lenders charge after disbursal of the loan.

Step 5 - App Verification

When borrowing through a loan app, check whether it's available on the Google Play Store or App Store with proper RBI or NBFC details.

Step 6 - Customer Reviews

Look up authentic reviews, go through testimonials, and real customer experiences before trusting a quick loan app.

Red Flags of Scam Lenders

Watch out for these indicators -

- Offering personal loans without asking about your credit score

- Really high interest rates are built into the fine print

- Requests for unnecessary personal data, like social media login credentials

- Pressure sales to sign blindly without documents

- Recovery agents are contacting you without proper authorisation

How to Protect Yourself from Personal Loan Scams in India

Here are some best practices you can follow -

- Always Take Loans from RBI-controlled NBFCs or Banks - Verified instant loan apps will protect your information and rights.

- Check Documents – Read the loan agreements and the blueprint thoroughly before you submit your documents.

- Never Share OTPs – RBI-approved lenders will never ask you to share sensitive OTPs through calls or SMS.

- Use Eligibility Tools – Use the online loan eligibility calculator of an RBI-registered financial institution to check your eligibility securely.

Borrow Smart, Borrow Safe

Applying for a personal loan should bring you peace of mind and not sleepless nights. By embracing a scam-proof borrowing checklist, you will learn to separate genuine RBI-regulated lenders from spammers. Always double-check to avoid fraud.

Need funds in a hurry? Choose an RBI-verified lender like Hero FinCorp for a personal loan to remain safe from scams. Our 100% digital, paperless process ensures quick, stress-free access to money when life throws surprises.

Frequently Asked Questions

1. Should I trust all loan apps available on the Play Store?

No. The majority of the spurious apps succeed in evading the Play Store safety checklist. Always check if the app is associated with an RBI-approved lender before making the application.

2. Must all lenders register with the RBI?

Yes. NBFCs and banks require RBI sanction to lend in India legally. Illicit lending is a red flag.

3. What do I do if I was victimised by a loan scam?

Immediately report the fraud to your bank, cybercrime portal, and police station. Block the fraudster's access to your account.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.