India’s Digital Rupee—What Borrowers Need to Know in 2025

Imagine this: your salary lands in your account, and seconds later, you’ve paid your bills. Or you’re out shopping, and a quick scan from your phone settles the payment instantly.

That convenience is what India’s Digital Rupee offers. And it does more than improve daily transactions. If you're planning a personal loan, the digital rupee streamlines the application and review process, too.

Wondering how to make the most of the Digital Rupee? Here’s all you need to know, and how it could reshape your loan experience this year.

What Exactly Is the Digital Rupee?

Before you think it: No, it’s not a cryptocurrency.

The Digital Rupee is more like the online twin of your paper money. It was launched by the Reserve Bank of India (RBI) to reduce the environmental impact of printing cash. The digital rupee is also great for people who don’t always have access to traditional banking.

Written as e₹ or eINR, it is created and managed by the RBI. That means it's official, safe, and fully regulated. It's stored in a digital wallet through your bank for making payments and even receiving salaries.

Today, it’s already being used widely in cities like Mumbai, Delhi, and Bengaluru.

Why the Digital Rupee Matters In Your Personal Loan?

While the digital rupee has a lot of uses in everyday life, here's why it's becoming a hot topic for lenders.

Clearer Spending Records

Digital Rupee uses blockchain distributed-ledger technology, making it very traceable and secure.

What insights e₹ gives personal loan applications -

• Regular e₹ payments highlight financial discipline

• Expense tracking happens in real time, reducing paperwork

• Cleaner records can mean quicker pre-approvals and better deals

Real-Time Income Verification

If you receive your salary or business income in Digital Rupees, lenders can verify it instantly.

How this helps your profile -

• Immediate proof of income stability

• No need to dig through bank statements and PDFs

• Faster loan disbursal with fewer delays

Better Credit Profiling

If you haven't taken many loans before, traditional approvals are tricky. Having a Digital Rupee trail reflects your habits and becomes part of your financial profile.

When the digital rupee works best in personal loan applications -

• You have a low or no credit score

• You're self-employed with irregular income

• You prefer digital over card-based payments

Smarter EMI Payment

If your e₹ wallet is linked to your loan account, EMIs are easier to set to auto-pay. You’ll get real-time alerts and smart reminders to never miss a due date.

Why this is an advantage for both you and your lenders -

• On-time repayment history

• Lower risk of late fees

• Better creditworthiness over time

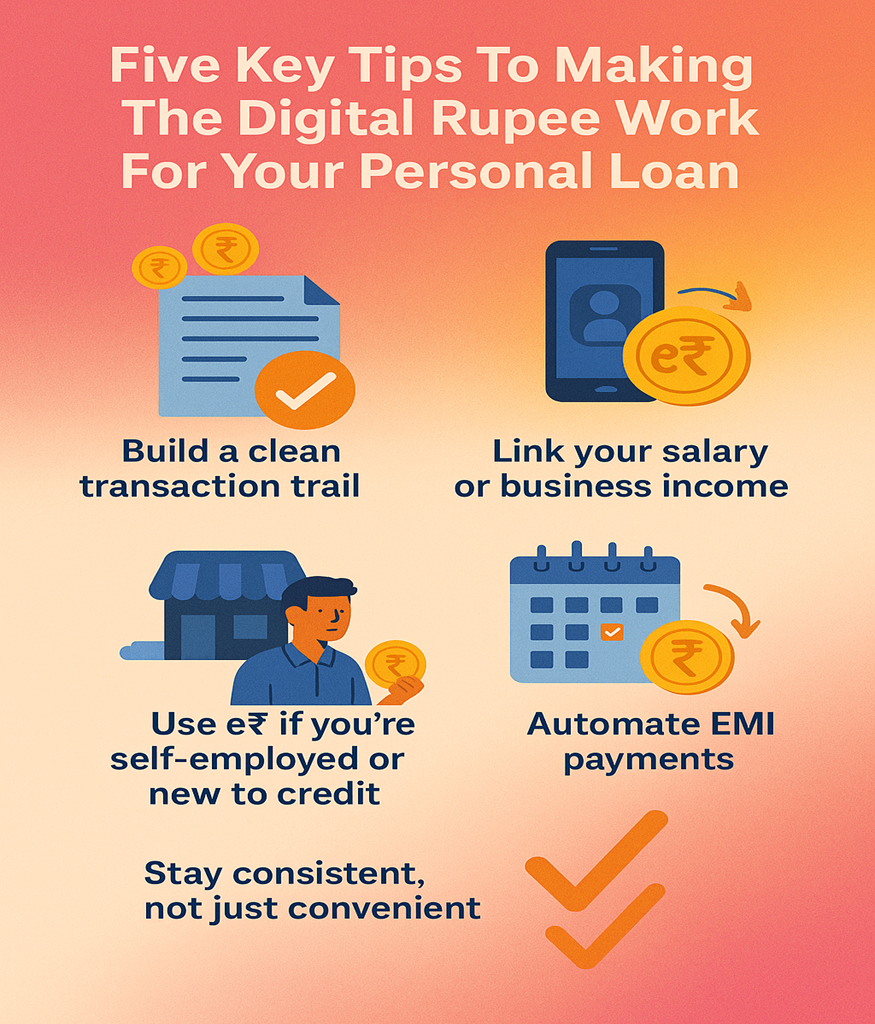

Five Key Tips to Making the Digital Rupee Work for Your Personal Loan

Given how clean your financial transactions get, making the digital rupee the norm is a must. Here are a few ways to use e₹ in a way that makes it an advantage -

• Build a clean transaction trail - Use your e₹ wallet for regular expenses, bill payments, and EMIs. This creates a transparent record that lenders can rely on.

• Link your salary or business income - Getting income in digital rupees speeds up verification and makes your profile more trustworthy for faster loan disbursals.

• Automate EMI payments - Set up auto-debits through your e₹ wallet to avoid missed payments, late fees, and to strengthen your repayment history.

• Use e₹ if you’re self-employed or new to credit - For borrowers with irregular income or limited credit history, a steady e₹ usage pattern can act as a substitute financial profile.

• Stay consistent, not just convenient - Don’t treat e₹ as a one-off experiment. Consistent usage signals financial discipline and helps you unlock better loan terms in the future.

It’s Not Just Currency, It’s Clarity

The Digital Rupee isn’t just money gone digital. It’s a chance to leave behind paper trails for a sharper, transparent financial identity. With the control, speed, and clarity that comes with e₹, it becomes easy to turn loan applications into a seamless experience.

Of course, a smarter currency works best with a smarter lender. Hero FinCorp makes the process quick, reliable, and stress-free. It offers instant disbursal, minimal documentation, and real-time tracking. Apply for a personal loan today!

Frequently Asked Questions

1. Is the Digital Rupee mandatory for getting loans now?

No, it's not mandatory, but having a trackable e₹ trail can improve your loan approval chances.

2. Does e₹ usage help if I have a low credit score?

Yes. A steady digital transaction history can support your case.

3. Will I need a separate app for e₹ payments?

Most major banks offer e-wallets compatible with e₹ within their mobile apps.

4. Can I repay Hero FinCorp loans using Digital Rupee?

Yes, digital payments are accepted. Just ensure your wallet is linked to your bank.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.