Registering a UPI Complaint Online: A Complete Guide

- How to Generate a UPI Complaint

- Register a Complaint Through the UPI App

- Reach Out to the Bank

- Raise a Complaint With NPCI

- Raise a Complaint With Reserve Bank of India’s Ombudsman

- Essential Information to Collect for Your Complaint

- Monitoring Your UPI Complaint Status

- Timelines and Expected Resolutions for UPI Complaints

- Best Practices to Prevent UPI Issues

- Stay Careful to Ensure Smooth UPI Transactions

- Frequently Asked Question

- Is there a direct government portal to register a UPI complaint?

- Can you complain about a fraudulent UPI transaction to the police online?

- What happens after you register a UPI complaint online?

- Are there any charges for registering a UPI complaint?

- How can I ensure my UPI complaint is processed quickly?

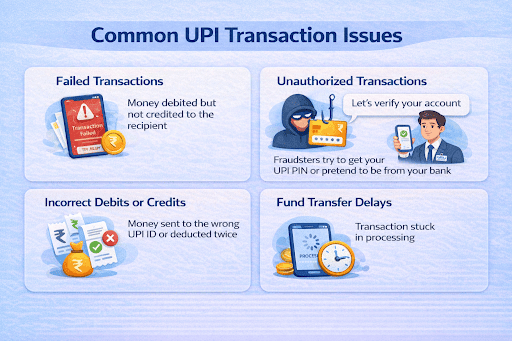

85% of digital transactions in India are powered by UPI. As the number of users increases, phishing and transactional errors are likely to increase. You need to be careful while making a payment. But what if you encounter an issue?

You can always register a UPI complaint to resolve the issue.

Let’s find out how you can register a UPI complaint and the best practices to avoid UPI issues.

How to Generate a UPI Complaint

You can register a UPI complaint through the UPI App, bank, or NPCI. Here’s how you can register a UPI complaint with each of them:

Register a Complaint Through the UPI App

- Open the UPI app and locate the transaction history

- Look for the problematic transaction

- Click on “raise issues.”

- Fill in the required details and submit

Also Read: How to Create Your UPI ID

Reach Out to the Bank

If you do not get a resolution through the app, you can reach out to the bank.

Call the customer support number or visit the branch to file a complaint.

To reach out to the bank online, here's what to do:

- Open the bank's mobile app

- Visit the support or grievance section

- Click on the UPI-related complaint option

- Enter the required details and submit

Do not forget to note the complaint reference number, whether submitting the complaint online or through a branch visit.

Raise a Complaint With NPCI

- Visit the redressal mechanism page

- On the page, select the type of issue and fill in the necessary details, including complaint type, transaction details, and email ID

- Click on submit, and your complaint will be registered

Raise a Complaint With Reserve Bank of India’s Ombudsman

If you do not get a resolution within 30 days, you can raise an issue under the Reserve Bank – Integrated Ombudsman Scheme.

Essential Information to Collect for Your Complaint

For effective resolution, you need to provide certain details when registering a UPI complaint. Here's what you need to collect:

| Information to collect | Description |

|---|---|

| Bank details | Bank name, account number, account holder's name |

| Error proof | Take a screenshot of unusual screens and error messages |

| Contact Details | Name, email address, UPI ID, and phone number |

| Transaction details | UPI ID, transaction ID, time and date of transaction, and amount |

| Issue description | Detailed explanation of the UPI issue you faced |

Also Read - What Is a UPI Reference Number & How to Track It Online?

Monitoring Your UPI Complaint Status

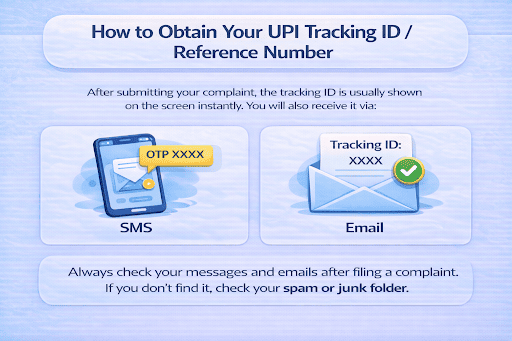

After filing your complaint, you can check the complaint status using the reference number. Here’s how you can do it:

- Visit the ‘help’ section of the UPI app to check transaction status on the app.

- To check the status through NPCI, visit the complaint status page, fill in the CRN number and other details, and click on “Get Status.”

Timelines and Expected Resolutions for UPI Complaints

Here’s when you can expect resolutions for UPI complaints:

Amount Debited, but Transaction Failed

As per RBI, you should receive your money back within T+1 days when the beneficiary account is not credited during fund transfers. For payments to merchants, you should get a refund within T + 5 days.

Incorrect or Duplicate Transactions

Once you report these transactions, it can take between 5 and 7 working days as they need to communicate with other banks or merchants involved.

Unauthorised Transactions

The investigation for these transactions can take as long as 90 days. Depending on the time you report and the circumstances, your liability becomes zero or limited for unauthorised transactions.

Also Read - How to Check UPI Transaction Status?

Best Practices to Prevent UPI Issues

By being careful, you can prevent common UPI issues. Here’s what you should do:

- Do not share your PIN or password with anyone. Never click on suspicious messages or links claiming to be from banks or service providers

- Double-check beneficiary details before you pay. This includes checking the UPI ID, beneficiary's name, and bank details

- Use strong passwords to lock your phone. Do not use predictable patterns as passwords

- Regularly check your transaction history to spot unusual transactions. Contact your bank and NPCI quickly if you notice any suspicious activity

- Do not use public wi-fi when making a payment. Use a strong internet connection to make payments

- Make sure that you use official apps or websites to make payments. Keep the UPI app updated to get the latest security features

Also Read - UPI Not Working? Here’s How to Fix It Fast

Stay Careful to Ensure Smooth UPI Transactions

UPI apps, banks, and NPCI offer a dispute resolution mechanism, so you always get the right solution for UPI issues. Keep the necessary details handy with you to ensure fast resolution in case of an issue.

In case of wrong debits, unauthorised transactions, or payment not credited, especially when you need funds for an emergency, Hero Fincorp offers you the support you need. With quick and easy access to a personal loan, you can manage emergencies without stress.

Explore how a personal loan offers a financial cushion in case of emergency fund requirements.

Also Read: Best UPI Apps in India for 2025 – Features, Limits & Charges

Frequently Asked Question

Is there a direct government portal to register a UPI complaint?

Yes. NPCI offers a dispute redressal mechanism page where you can register a UPI complaint.

Can you complain about a fraudulent UPI transaction to the police online?

Yes. In case of fraudulent UPI transactions, you can file a complaint online at the National Cybercrime portal.

What happens after you register a UPI complaint online?

After filing a complaint, you will receive a reference number. The platform or bank will run an investigation and work towards resolving the complaint.

Are there any charges for registering a UPI complaint?

There are no charges to register a UPI complaint.

How can I ensure my UPI complaint is processed quickly?

To ensure that the UPI complaint is processed quickly, keep essential documents handy and report the issues quickly.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.