How To Change EMI Date of a Personal Loan?

- What Is an EMI Date and Why Does It Matter?

- Why Would You Need to Change Your Personal Loan EMI Date?

- How to Change Personal Loan EMI Date – Step-by-Step Process

- Eligibility and Important Considerations When Changing EMI Date

- How Changing the EMI Date Affects Your Loan Tenure and Interest

- Tips to Manage Your EMIs Effectively After Changing the EMI Date

- Make Your EMI Date Work for You

- Frequently Asked Questions

Ever found yourself wishing your EMI date came just a little later? Maybe your salary day shifted, or you're juggling multiple EMIs that all fall around the same time.

You're not alone. Many borrowers face this mismatch every month. The good news? You can easily change your personal loan EMI date to better align with your income and daily expenses.

Let's see how this process works and when it makes sense to ask for a change.

What Is an EMI Date and Why Does It Matter?

Your EMI date is the day each month when your repayment is automatically deducted from your bank account. Lenders usually fix this date at the time of disbursal, based on your preference or the loan agreement.

If the date is too early, you might risk a low account balance. If it's too late, it could overlap with other expenses. Picking the right EMI date helps you:

- Keep your cash flow steady and prevent penalties

- Stay regular with repayments and build lender trust

- Safeguard your credit score from missed payments

- Plan your monthly budget with more confidence

Planning a new personal loan? Use Hero FinCorp's EMI Calculator to find an amount that suits your comfort zone and align the EMI date with your income cycle.

Why Would You Need to Change Your Personal Loan EMI Date?

Life doesn't always run on the same schedule, and neither do our finances. Here are a few valid reasons to change the EMI date and make repayments easier:

- Salary Date Change: When your employer modifies your payday or you switch jobs.

- New Bank Account: If you've changed your salary or repayment account.

- Multiple EMIs: To spread out different loan payments across the month.

- Avoiding ECS Failures: If EMIs often bounce due to timing gaps.

- Co-Borrower Convenience: If you share a joint loan and want a date that suits both borrowers.

- Seasonal Income Pattern: For self-employed professionals or freelancers who don't get paid on fixed dates.

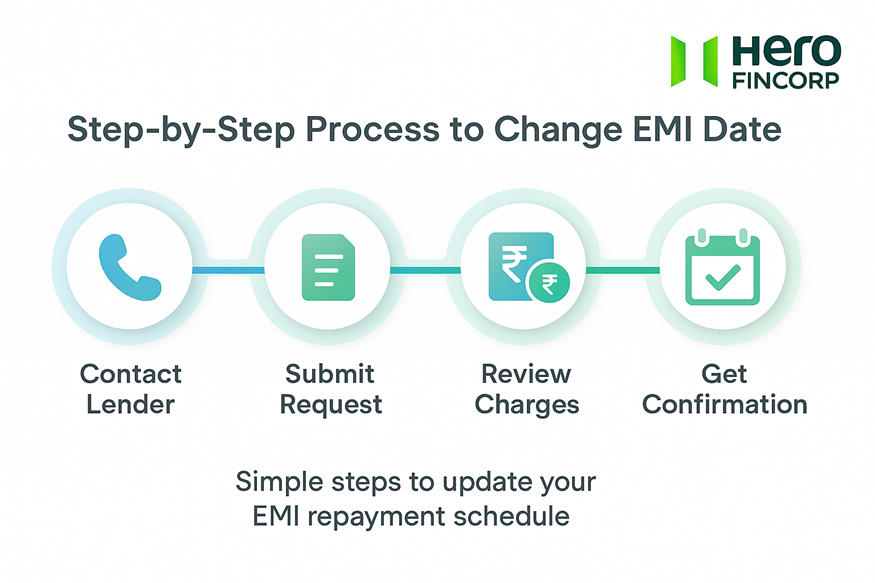

How to Change Personal Loan EMI Date – Step-by-Step Process

Changing your EMI date is easier than it sounds.

Here's what to do:

Step 1: Contact Your Bank or NBFC

Start by contacting your lender's customer care team. You can do this by:

- Calling the service helpline

- Sending an email or raising a request through the app

- Visiting the nearest branch

Provide your loan account number, registered contact details, and reason for the change (for example, "salary credit now happens on the 10th instead of the 5th").

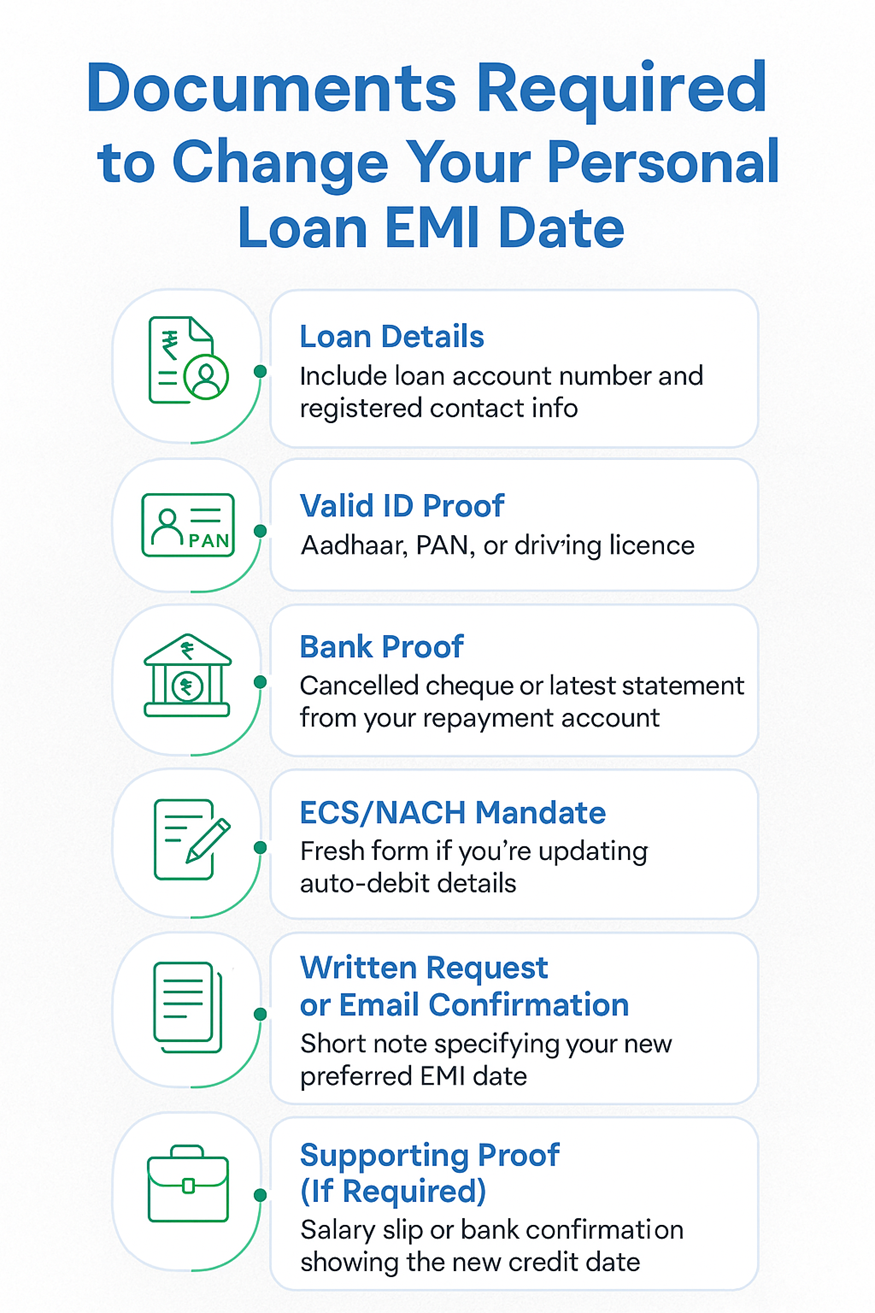

Step 2: Submit an Official EMI Date Change Request

Once you have spoken to your lender, you will need to submit an official request. You can do this either online or by filling out a service form at a branch. Make sure to mention:

- Your loan account number

- Current EMI date

- Preferred new EMI date

- Updated bank details, if you've changed your repayment account

Some lenders may also ask for a short EMI date change request letter or confirmation email.

Step 3: Understand Charges (If Any)

Some lenders may charge a small processing fee to update your repayment plan. Before confirming, check:

- The exact fee amount plus GST

- Whether a new ECS/NACH mandate is needed

- Any potential change in your next EMI cycle

Ask about the charges beforehand so everything is clear before the update.

Step 4: Await Confirmation and New Schedule

When your request is complete, your lender will notify you through email or SMS. It will include:

- The new EMI date

- The first cycle when the change will take effect

- An updated repayment schedule

The update usually reflects within 7–15 working days, based on your loan type and payment mode. Until then, keep a sufficient balance in your account to avoid missed deductions.

Eligibility and Important Considerations When Changing EMI Date

Before you ask your lender to change your EMI date, take a quick look at a few basics to ensure your request goes through smoothly.

- You've paid at least three EMIs on time.

- There are no pending dues or overdue payments on your account.

- The new date falls within your lender's approved debit window.

- Your repayment mode (eMandate or NACH) is active and verified.

- Most lenders allow an EMI date change only once during the loan tenure.

- If the new date increases the gap between two payments, a small interest for those extra days may apply.

- You might need to sign or revalidate your ECS/NACH mandate to confirm the change.

Need quick funds? Download our Instant Loan App now and apply in just a few taps!

How Changing the EMI Date Affects Your Loan Tenure and Interest

Changing your EMI date usually doesn't alter your loan amount or tenure. But depending on when the new date falls, there may be a slight adjustment to the interest for the extra days between instalments.

For instance, if you shift your EMI from the 5th to the 12th, your lender may charge interest for those extra seven days, just once during that transition month. After that, your payment cycle continues as usual.

Tips to Manage Your EMIs Effectively After Changing the EMI Date

Once your new EMI date is active, a little planning can help you stay on track and avoid any repayment stress.

Here are some simple personal loan EMI management tips to follow:

- Set up UPI AutoPay or standing instructions to ensure EMIs are paid on time.

- Keep one extra EMI amount in your account as a safety buffer.

- Check email or SMS updates to confirm every deduction.

- Spread multiple EMIs across the month to balance cash flow.

- Review your EMIs regularly to see if they fit your budget and future plans.

A little attention each month makes repayment stress-free and keeps your credit score in good shape.

Make Your EMI Date Work for You

A small change to your EMI date can make a big difference to how you manage money each month. It helps you plan better, stay on track with payments, and feel more in control of your finances.

If you're planning a new personal loan or looking to realign your EMIs, Hero FinCorp makes it simple. We help you check your eligibility instantly so you can plan repayments that fit your income cycle and comfort level.

So why wait? Explore our offerings and apply for a personal loan to enjoy flexible EMIs, quick disbursal, and a hassle-free borrowing experience tailored to your needs today!

Frequently Asked Questions

1. Can I change my EMI date multiple times?

No. Most lenders allow an EMI date change only once during the loan tenure.

2. Will changing my EMI date affect my credit score?

No, your credit score stays safe as long as you pay your EMIs on time.

3. Is there a fee for changing the EMI date?

Yes, some lenders charge a small administrative fee, typically ₹200–₹500.