Salary Delayed? Here’s How to Handle Emergencies Without Panicking

Your salary pays for everything, household expenses, medical expenses, leisure activities, and more. But what if you do not receive it on time? The bills will be due, and you will have a low cash flow.

So, what should you do to maintain your cash flow during salary delays?

Let’s find that out:

Tips to Handle Emergencies During Salary Delays

With a few simple tips, you can easily manage your finances in case you haven’t received your salary. Here’s what you should do:

Verify the Reason for Delay

First, understand why the delay happened. Was it an administrative glitch, bank issue, or something else? Look at your bank or ask coworkers.

Reach out to your employer. Document the communication, it helps if follow-up is needed.

Prioritise Essentials

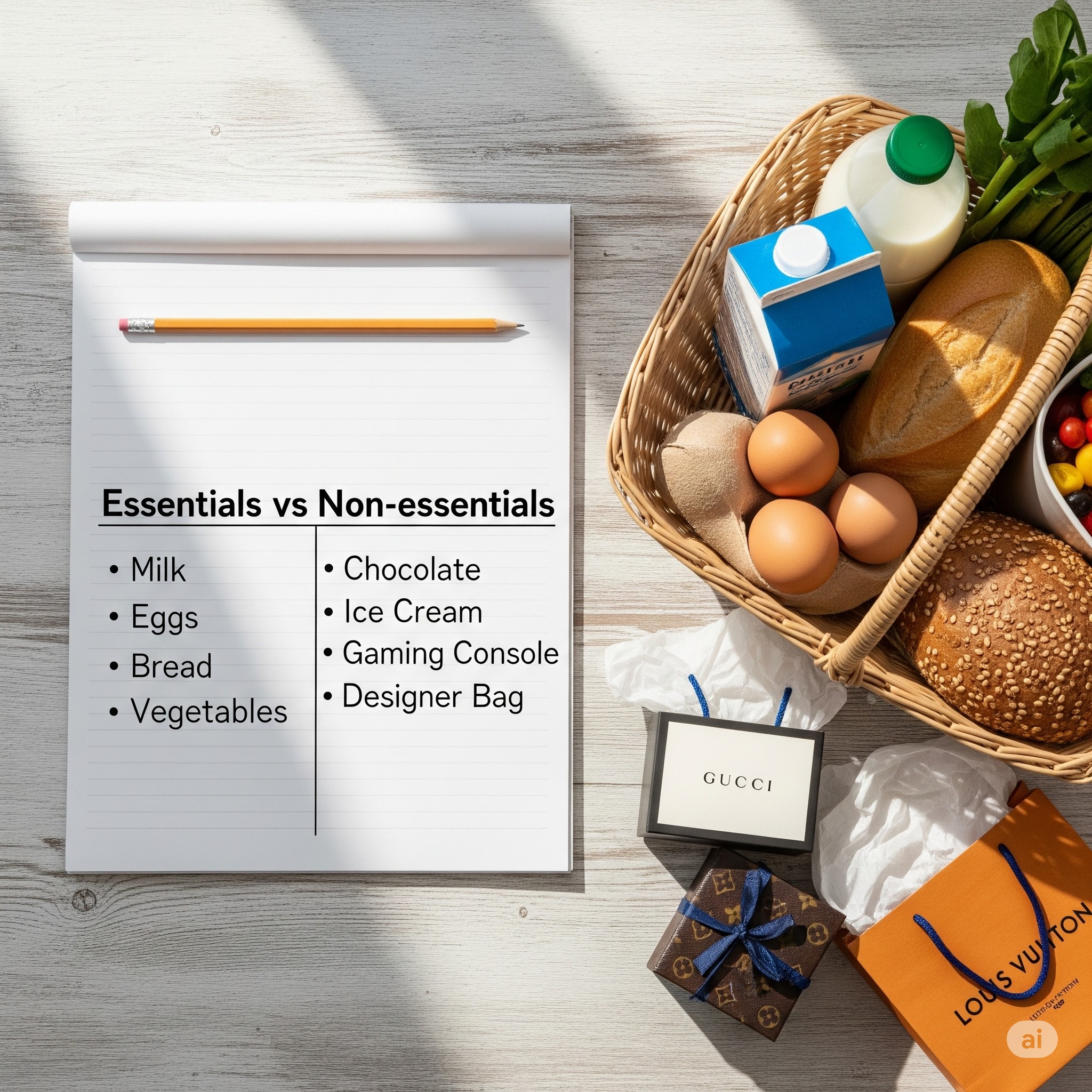

Create a budget and prioritise the essentials first. Reduce discretionary expenses to save more for emergencies. Track expenses in a spreadsheet to identify non-essential expenses and cut back on those.

Negotiate Payment Terms

If salary delay is a recurring issue, negotiate the terms with your employer. Request partial payments or set up a schedule that aligns with your financial needs. This helps you avoid uncertainty and delays in time-sensitive expenses like rent, installments, and more.

Go for Short-term Personal Loans

If there’s an urgent financial gap due to salary delays, consider a short-term personal loan to bridge the gap. You get immediate access to cash to meet any financial emergencies. Choose flexible personal loan apps that offer quick approval and disbursal of funds.

Also Read: What is an Emergency Loan? A Complete Guide for Instant Funding

Adjust Investments

When investing, you should keep a mix of flexible and non-flexible expenses to manage finances during salary delays. Stop SIPs or other flexible investments till you get your salary. Use that amount to meet emergency expenses.

Freeze Non-essentials

When there is a cash crunch, pause non-essential lifestyle expenses immediately. Stop spending on subscriptions, EMI top-ups, extra SIPs, online shopping, travel plans, and others.

Also Read: Essential Personal Finance Tips for Effective Money Management

Seek Additional Income

Even a small amount helps optimise the risk to some level:

- Consider freelance gigs, tutoring, driving, and more to start quickly.

- Sell items you no longer need

This helps you get immediate cash, so you can finance emergency expenses easily.

Communicate With Your Landlord

If you live in a rental house, communicate with your landlord about salary delays. See if they extend the due date for rent. Negotiate for partial payments if they cannot extend the rental due date.

Build for Future Resilience

Once the crisis passes, reinforce your financial defenses:

- Set aside a fixed amount each paycheck

- Keep your emergency fund growing to cover the expenses of at least 6 months

- Go for freelance, tutoring, rental income, investments, and other income streams for extra income. Diversify your income sources, so if one is delayed, other sources can keep you covered

- Track where you spend throughout the month. Categorise the expenses in essentials and non-essentials, and where you can cut back to increase savings

- When you get tax refunds, bonuses, or other extra sums, split them between savings and enjoyment

Conclusion

Salary delays are stressful, but they don’t have to break your financial stability. Stay calm, verify the cause, and focus on essentials to maintain steady cash flow. Smart steps like freezing non-essentials, negotiating terms, using short-term loans wisely, or tapping into temporary income sources help bridge the gap without panic.

Get a short-term personal loan if managing finances becomes difficult. With Hero Fincorp, you get flexible terms to get a personal loan. With the instant loan app, applying for the loan becomes easy. Plus, quick approval and disbursal ensure that you can finance your emergencies easily.

Apply for a personal loan now and keep your finances on track during salary delays.

Frequently Asked Questions

1. What is the minimum income and eligibility terms to get a personal loan?

The approval of a personal loan depends on your credit score, documents, and job stability. The minimum salary you need to get approval is 15000 per month.

2. How much time does it take for personal loan approval?

With Hero Fincorp, your personal loan will be approved within 10 minutes if you meet eligibility and apply online.

3. What to do if there are recurring delays in salary?

Communicate with your HR to find out the reasons for delay and discuss solutions. Document the communication for proof and follow-ups.