Top Factors that Impact Personal Loan Interest Rate

A recent survey shows that 67% of Indians have taken a personal loan for their financial requirements. However, many people are still unaware of the factors affecting personal loan interest rates.

Getting a personal loan is easy today, but understanding why your interest rate is higher (or lower) than someone else’s isn’t always obvious. From your credit score and job type to the Reserve Bank’s repo rate, several factors quietly shape the rate you get.

Let's lay them out in simple terms, so you can borrow more intelligently and perhaps even save yourself a few thousand rupees in interest along the way.

What is a Personal Loan Interest Rate?

A personal loan interest rate is simply the percentage a bank or NBFC charges annually on your loan amount. It directly affects your monthly EMIs, total repayment, and overall financial planning.

For instance, if you borrow ₹5 lakh for five years, even a small rate variation of 1%-2% can significantly impact your annual budget.

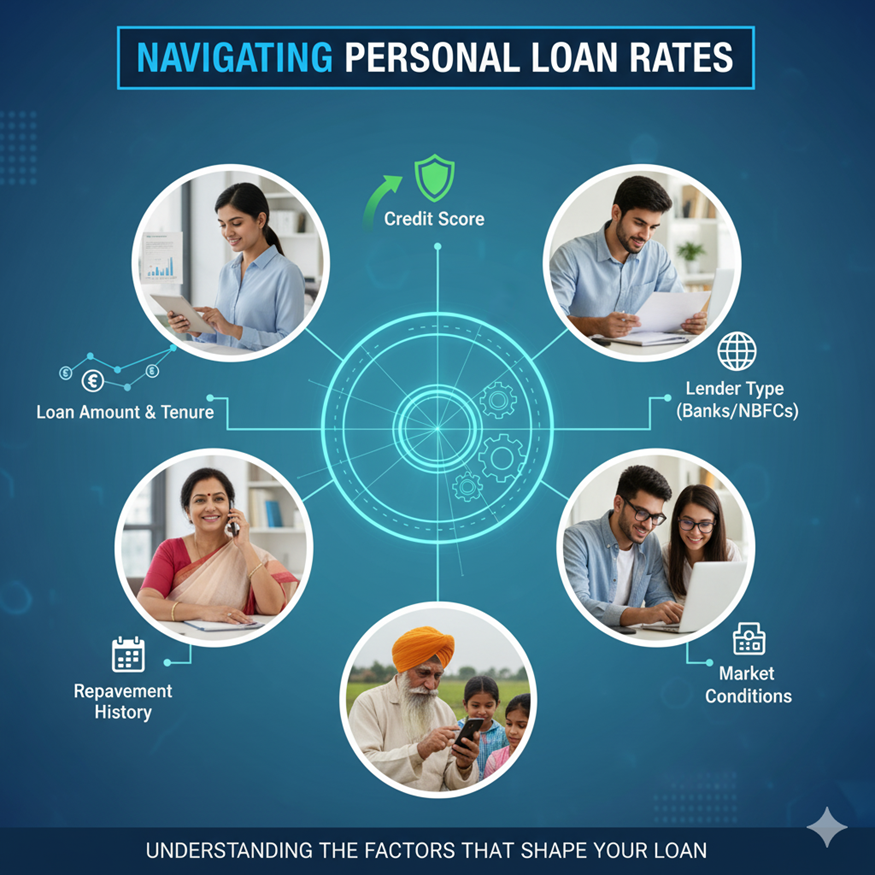

Top Factors Affecting Personal Loan Interest Rate in India

Two people could borrow the same amount from the same lender, and still end up with different EMIs. Why? Because lenders look at your financial picture from multiple angles before deciding your rate.

Let's explore the factors affecting personal loan interest rates in India:

Credit Score and Credit History

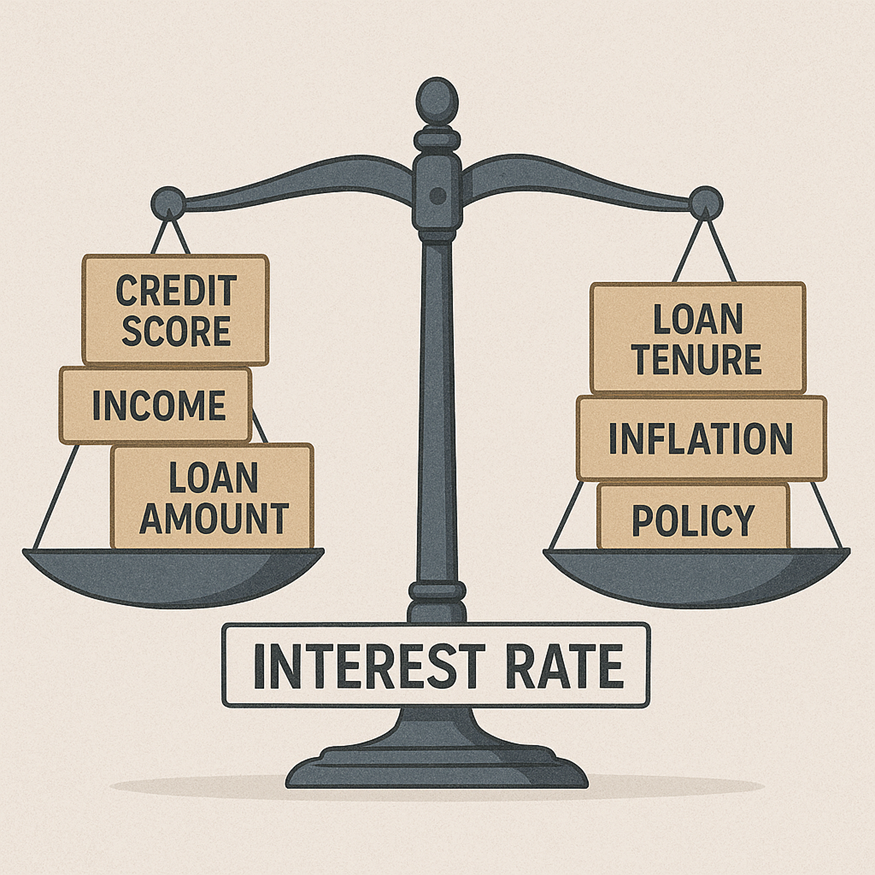

Your credit score plays a crucial role in determining your personal loan interest rate. It is a three-digit score that indicates your creditworthiness, and is usually evaluated as follows by CIBIL or Experian:

- Excellent (750+): You will most probably avail the lowest rates.

- Good (700-749): You can avail competitive rates.

- Fair (600-699): You will be offered higher rates.

- Poor (Below 600): You will find it difficult to avail a loan, and the rates will be extremely high.

Income Stability and Employment Type

Stable, regular income, particularly from a well-known employer or government employer, typically commands you improved rates. So if you are self-employed or have a business, you may get a higher interest rate even if your earnings are solid.

Debt-to-Income Ratio (DTI)

Your DTI compares your total monthly debt payments to your monthly income. It is a key measure of how “stretched” your finances are. Let’s say your income is ₹1 lakh, and your EMIs total ₹50,000. That’s a 50% DTI, which is quite high. The higher your DTI, the greater the perceived risk, and the higher your interest rate may go.

Loan Amount and Tenure

How much you borrow and for how long can also tilt your rate.

A longer tenure or a larger loan amount is usually charged slightly higher rates because it exposes the lender to greater risks over a longer period.

Relationship with the Lender

Your existing relationship with a bank or NBFC can work in your favour.

If you have a salary account with a bank in good standing, you might get a better rate compared to someone without any history with the bank.

Market Conditions & RBI Policies

Market situations and the monetary policies of India also have an impact on personal loan interest rates.

RBI varies the repo rate to manage inflation and liquidity. These variations impact your EMI, even if your credit score or employment situation remains unchanged.

Also Read: Reverse Repo Rate: Meaning and How It Works?

How to Improve Your Personal Loan Interest Rate

Though you can't avoid all of the factors that affect your personal loan interest rate, there's still a great deal within your control. Here's how to increase your odds of securing a lower interest rate:

Boost Your Credit Score and Credit Report Management

Your credit score is based on your financial conduct. Therefore, to maintain a high score, be sure to:

- Keep your credit utilisation rate under 30%.

- Never make late payments, even by a couple of days.

- Don't take more than one loan or card at the same time.

- Clear the small debts before you take a new loan.

- Regularly check your credit report. Lodge a dispute if you see an inaccuracy to get it rectified.

Reduce Existing Debts and Manage DTI Effectively

If your DTI ratio is high, lenders will view you as over-extended. Take care to settle any high-interest loans, like credit card debt or small personal loans, before going for a personal loan. This makes repayment easy and strengthens your case for a better deal.

Choose an Appropriate Loan Amount and Tenure

Lower amounts or shorter terms typically receive lower interest rates, as the risk for the lender is minimal. Use an EMI calculator to determine the most favourable interest rate and term of repayment to suit your requirements.

Try Hero FinCorp's personal loan eligibility calculator to calculate your EMI in minutes.

Leverage Existing Banking Relationships

Your existing relationship with a bank or NBFC can be an advantage, especially if you’ve maintained your account responsibly. Lenders are likely to reward reliable customers with faster approvals or special discounts on interest rates.

Impact of Interest Rate Changes on Personal Loan Repayments

Even a tiny shift in your interest rate can have a significant impact on how much you pay. That's because the interest is compounding.

You take a ₹5 lakh loan for 3 years. With an interest rate of 18%, your EMI will be ₹18,076 a month. But if the rate goes up to 22%, that EMI climbs to ₹19,000. Go higher to 30%, and you’re looking at ₹21,700 a month. That’s ₹3,400 more every month, or ₹1.2 lakh extra in total.

Here’s a comparison to visualise how this plays out.

| Loan Amount (₹) | Tenure | Interest Rate (p.a.) | Approx. EMI (₹) | Exact EMI (Calculated) (₹) | Total Repayment (₹) |

|---|---|---|---|---|---|

| 5,00,000 | 3 years | 18% | 18,076 | 18,076 | 6,58,908 |

| 5,00,000 | 3 years | 21% | 18,750 | 18,838 | 6,75,000 |

| 5,00,000 | 3 years | 24% | 19,403 | 19,616 | 6,98,508 |

| 5,00,000 | 3 years | 27% | 20,074 | 20,413 | 7,22,664 |

| 5,00,000 | 3 years | 30% | 21,717 | 21,226 | 7,81,812 |

Now consider those numbers spread over a longer term, five years, and the gap only increases. That's why paying attention to an even marginal rate movement is important.

Get The Best Personal Loan Interest Rate with Hero FinCorp

Finding the right personal loan shouldn’t feel like a maze of hidden costs and confusing fine print. At Hero FinCorp, transparency isn’t just a feature but the foundation of our entire process.

We offer reasonable personal loan interest rates begin at 18% p.a., and there is full transparency regarding fees and repayment terms. It's a completely digital process, so you can check eligibility, upload documents, and monitor the loan status, all from your device.

Apply for a personal loan now and receive the best personal loan interest rates!

Frequently Asked Questions

1. What is the range of personal loan interest rates in India?

Yes, especially if you have switched companies regularly. Most lenders prefer borrowers with steady income and longer job tenures, as this reduces risk.

2. Can changing my job affect my personal loan interest rate?

Yes, especially if you have switched companies regularly. Most lenders prefer borrowers with steady income and longer job tenures, as this reduces risk.

3. Does the loan tenure increase or decrease the interest rate?

It depends on the lender. With lenders such as Hero FinCorp, you can obtain an interest rate of just 18% regardless of the length of your loan tenure.

4. Is it beneficial to consolidate loans to get a better interest rate?

Yes. If you already have several high-interest loans like a loan taken against a credit card or others, you may consolidate all of them into one. This will reduce the interest rate and allow you to pay the amount borrowed effectively.