Best UPI Apps for Cashback in 2026: Top Options to Save Money on Every Payment

There was a time when credit cards ruled the cashback and reward point game. Today, however, it's the UPI apps that have stolen that mantle. With the majority of payments from those at a tea stall to fine-dining restaurants or retail stores being made with them, it makes sense to use them wisely to save a little using their cashback offers.

So which of these apps offer the best cashback offers in 2026? Read on to find out.

How Does UPI Cashback Work?

To understand how to get the most out of the cashback offers, you must first understand the various models at play. Cashbacks on UPI don’t happen automatically with every payment. Various apps use different reward models to entice spending, such as:

Scratch Cards & Gamification

Google Play is the best example of this model. Here, you gain a scratch card on almost every transaction, and each of them gives you a different reward. These are not always cashbacks (but getting one makes you feel lucky), but can also be in the form of brand vouchers or credits that you can redeem at specific outlets.

Wallet Credits

Phone Pe, MobiWiki, and Paytm are some of the apps that use this model of cashbacks. Here, you earn points or wallet credits that can only be used or redeemed for purchases from within their individual ecosystems.

Direct-to-Bank Transfers

Direct-to-Bank Transfers is the new kid on the block, and the cashback here is a flat percentage of your UPI spend and is transfered it straight into your bank account. Pioneered by Super. money (a product of FlipKart), this “real money” approach is gaining traction because the cashback is instant and is not stuck within any ecosystem.

Also Read:What Is the Difference Between BHIM and UPI?

Top 6 UPI Apps for Maximum Cashback in 2026

So, which apps should you be using for maximum cashback in 2026? Here is the list.

1. Super. money

Super.money is emerging as a high-reward UPI player in 2026. Based on user feedback, it offers cashback at a flat percentage (upto 5%) on transactions and can be integrated with RuPay credit cards to further improve your rewards.

Top features

- Flat cashback on UPI payments

- Direct bank-credited rewards

- RuPay credit card link for extra benefits

Pros

- Cashback is real money

- Simple earning logic

Cons

- Small rewards on low ticket spends

2. PhonePe

PhonePe continues to be one of the most widely used cashback UPI apps even today. It offers structured rewards on bill payments, mobile recharges, and merchant QR code spends.

Top features

- Cashback and coins on eligible spends

- Offers on utilities and travel

- Broad merchant acceptance

Pros

- Regular rewards

- Strong offline support

Cons

- Offers are region-specific

3. Paytm

Paytm is one of the older players here, and it blends cashback within its larger payment ecosystem. While you still can't add money to its wallet, your cashback gets credited into it.

Top features

- Cashback on bills and recharges

- Paytm Points are redeemable in various categories

- Product ecosystem benefits

Pros

- Offers multiple ways to earn cashback

- Good app for bill payments

Cons

- Cashback restricted to the Paytm ecosystem

4. Google Pay (GPay)

Google Pay, or Gpay, is still one of the best apps out there for everyday UPI payments that offers cashbacks and various other rewards in the form of scratch cards. There are also campaign-based offers from time to time that let you gain access to even better rewards.

Top features

- Daily scratch cards on eligible spends

- Great offers for partner brands

- Easy bank-to-bank cashback credit

Pros

- Familiar and secure UI

- Scratch cards can be high-value.

Cons

- No guaranteed cashback on every transaction

5. Amazon Pay

Amazon Pay integrates UPI cashback with Amazon shopping and bill payments. Users can earn an Amazon Pay balance on eligible transactions and online shopping. If you are an online shopaholic, this is the app for you.

Top features

- Cashback credited as Amazon Pay balance

- Extra offers during sales and promo periods

Pros

- Useful for Amazon shoppers.

- Bills + shopping rewards.

Cons

- Rewards tied to the Amazon ecosystem.

6. CRED

Cred’s UPI rewards are aimed at users with strong credit profiles. Premium users often unlock exclusive deals, vouchers, and high-value rewards.

Top features

- High-value brand rewards

- Cashback for credit card bill payments

Pros

- Loads of premium rewards for power users

- Great UI

Cons

- Doesn't offer much for basic transactions

Also Read:What is UPI Circle and How Does it Work?

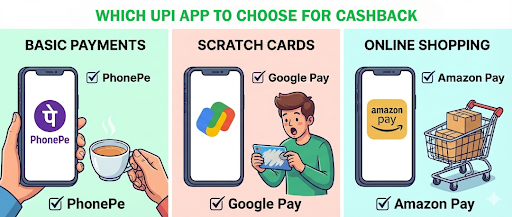

So, Which App Should You Choose?

If you:

| Purpose | UPI App to Pick for Cashback |

|---|---|

| Need an app for basic everyday payments | PhonePe |

| Like the thrill of discovery via scratch cards | Google Pay |

| Want cashback on your utility and other bill payments. | PayTM. |

| Your cashback is straight back into your bank account. | Super.Money |

| Do a lot of online shopping | Amazon Pay |

| Want premium rewards and offers | Cred |

Save Wisely With the Right Cash Back App for You

No one app will give you more cashback than the other. If you want to really save money, it's best to use multiple apps based on where they work best to maximise your cashback. Offers keep changing, so keep checking all the apps periodically and rework your payment strategy to continue saving money.

And, if you ever need access to funds beyond your daily UPI limits or cashback cycles, Hero FinCorp has your back. We offer a fully digital and transparent loan application process without any paperwork. Apply today!

Frequently Asked Questions

Which UPI app gives the highest cashback for beginners?

If you are new to UPI payments, PhonePe, and Google Pay are usually the easiest apps to use to earn cashback from.

Are cashback rewards taxable in India?

Cashback from UPI apps is not taxable unless they exceed ₹50,000 in a financial year.

Why did I stop receiving GPay scratch cards?

Gpay doesn't have offers running all the time. There may be gaps here and there. This is normal.

Is it safe to link my bank account to multiple UPI apps?

Yes, it is safe to link your bank account to multiple apps simultaneously.

What is the monthly limit for UPI cashback?

Monthly limits depend on the specific apps.