What Is an NBFC Personal Loan and How Is It Different from a Bank Loan?

- Personal Loan by NBFCs

- Types of NBFCs Regulated by RBI

- Why Regulation Matters for a Borrower for Personal Loan

- Key Features of a Reliable Regulated NBFC for Personal Loan

- Benefits of Choosing a Regulated NBFC for Personal Loan

- Regulated vs. Unregulated NBFCs

- How Hero FinCorp Stands Out

- Tips for Borrowers to Verify NBFC Reliability

- Conclusion

- Frequently Asked Questions

Have you ever wondered how people and businesses get loans without going through a traditional bank? This is where NBFCs, or Non-Banking Financial Companies, come in. Unlike regular banks, these companies provide loans, offer credit, and even invest in securities. They operate without a traditional banking license. NBFCs make it easier for borrowers to access Personal Loans and other financing solutions, helping them meet urgent needs on time. But how they manage such fast and flexible lending while complying with RBI regulations is worth exploring.

Personal Loan by NBFCs

A regulated NBFC (Non-Banking Financial Company) like Hero FinCorp offers personal loans under the supervision of the Reserve Bank of India (RBI). These lenders follow strict RBI guidelines, ensuring transparent and secure lending. We provide personal loans at competitive interest rates starting from 19% per annum, with minimal documentation and quick approval. This makes NBFC personal loans a flexible and reliable option for managing urgent financial needs.

Also Read: what is nbfc company

Types of NBFCs Regulated by RBI

NBFCs are classified by the RBI based on their primary business activities:

- Deposit-taking NBFCs (NBFC-D): Accept fixed deposits from the public and provide lending and investment services.

- Non-deposit NBFCs (NBFC-ND): Cannot accept public deposits. They fund operations through borrowings and capital contributions.

- Asset Finance Companies (AFCs): Specialise in financing physical assets like vehicles, machinery, and equipment.

- Loan Companies: Offer personal and business loans without accepting deposits, focusing on credit for individuals and SMEs.

- Infrastructure Finance Companies (IFCs): Provide long-term financing for infrastructure projects.

- Microfinance Institutions (NBFC-MFI): Provide small loans to low-income households and underserved communities.

- Residuary Non-Banking Companies (RNBCs): Accept deposits under specific schemes and provide targeted lending.

These categories help NBFCs deliver specialised financial solutions across consumer, retail, SME, and infrastructure finance segments.

Also Read: what is nbfc

Why Regulation Matters for a Borrower for Personal Loan

RBI regulations matter because they ensure fairness, security, and transparency in lending. For borrowers, this means:

- Transparent Fees: Interest rates, charges, and loan terms are clearly disclosed from the outset. There are no hidden costs in NBFC Personal Loans.

- Data and Fund Security: Personal information and funds are protected by legal standards.

- Fair Practices: Lenders adhere to ethical guidelines and refrain from engaging in predatory lending practices.

- Dispute Resolution: NBFCs have grievance mechanisms approved by the RBI.

Regulatory oversight reduces the risk of fraud, ensures ethical lending practices, and protects borrowers’ rights. Choosing a compliant NBFC provides peace of mind and predictability in borrowing.

Also Read: What is a Personal Loan? Meaning, Benefits & Uses

Key Features of a Reliable Regulated NBFC for Personal Loan

When choosing an NBFC, it’s essential to know what makes it trustworthy. The following features highlight why an NBFC is considered reliable and safe for borrowers.

Transparent Loan Processes

They provide clear eligibility criteria and loan terms. Borrowers know precisely how much they need to repay, with no hidden fees.

Digital and Paperless Applications

Applications are safe and encrypted online. Verification and approvals are faster, saving time and effort.

Prompt Disbursal and Clear Communication

Once approved, funds are transferred quickly. Borrowers receive real-time updates about their loan status.

Customer Support and Grievance Handling

They have a dedicated support team via phone, email, or chat. Grievances are addressed in accordance with RBI-mandated guidelines.

Compliance with RBI Guidelines

All loans follow KYC norms, credit assessment rules, and lending limits. This ensures borrowers are legally protected and the company operates responsibly.

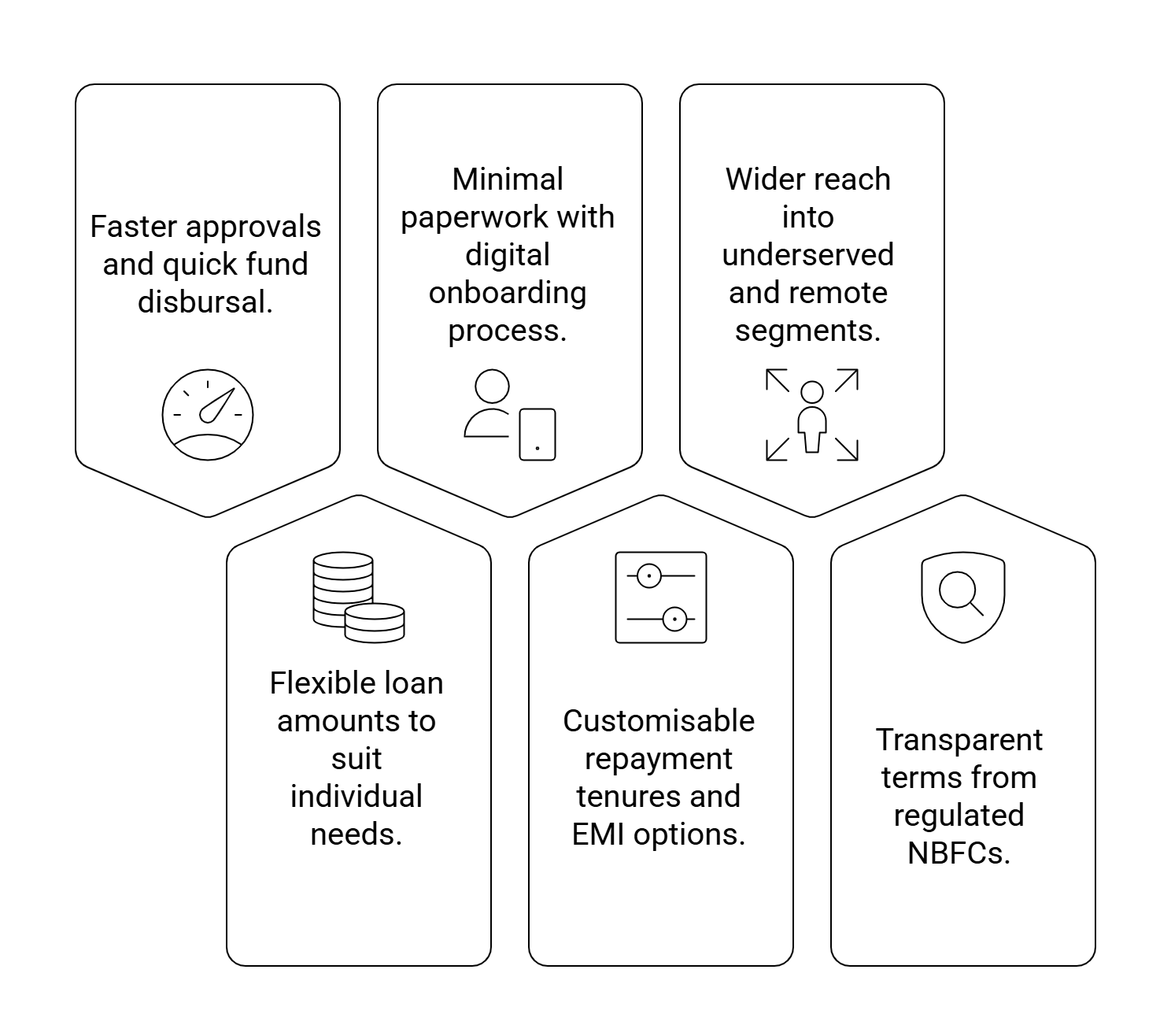

Benefits of Choosing a Regulated NBFC for Personal Loan

Opting for an NBFC comes with several advantages that make borrowing safer, faster, and more convenient.

Regulated vs. Unregulated NBFCs

| Feature | Regulated NBFC | Unregulated NBFC |

|---|---|---|

| Legal Compliance | Fully registered with RBI and follows all rules | Often operates without RBI registration; legal compliance not guaranteed |

| Transparency | Clear interest rates, fees, and loan terms | May have hidden charges or unclear terms |

| Customer Protection | Borrowers are protected by RBI-mandated grievance redressal and KYC norms | Limited or no protection; disputes harder to resolve |

| Interest Rates | Competitive and set as per regulatory guidelines | Can be arbitrary, sometimes higher than market rates |

| Operational Oversight | Subject to audits, reporting, and risk management checks | No formal oversight; higher risk of fraud or malpractice |

| Loan Products | Offers verified and legal products like NBFC personal loans, SME loans | Products may be unverified or non-compliant |

| Trust and Reliability | High credibility due to compliance, transparency, and regulation | Uncertain reliability; may involve risk to borrower funds |

| Dispute Resolution | RBI-regulated grievance mechanisms ensure fair resolution | No formal recourse; disputes often unresolved |

How Hero FinCorp Stands Out

Hero FinCorp is an RBI-registered entity with years of experience in lending. They offer a range of loans for personal, SME, and other financial needs with clear terms. Their digital-first approach ensures safety and convenience, with fast approvals and real-time updates. Grievance and support mechanisms adhere to regulatory standards, ensuring that borrowers' concerns are addressed in a responsible manner. Reliability comes from regulation and sound operational practices, not marketing claims. Borrowers can trust that their money and information are secure.

Tips for Borrowers to Verify NBFC Reliability

Before taking out a loan, it’s essential to ensure that your lender is trustworthy. Here are some practical tips to check the reliability of an authorised NBFC.

- Check the NBFC’s RBI registration number.

- Confirm the company is listed on the RBI’s official NBFC directory.

- Ensure all loan terms, fees, and interest rates are clearly disclosed.

- Read credible reviews or testimonials from other customers.

- Avoid lenders who make unrealistic promises or skip documentation.

- Prioritise regulated NBFCs for safety and peace of mind.

Conclusion

RBI-recognised NBFCs are considered reliable because they adhere to RBI regulations, ensure transparency, and protect borrowers. Choosing a regulated lender reduces risk and makes the borrowing process smooth and predictable. With clear terms and legal safety standards, you can access funds confidently when you need them.

Frequently Asked Questions

1. Is it safe to borrow from Hero FinCorp?

Hero FinCorp is a reliable lender offering instant personal loans with competitive interest rates. It offers flexible repayment options and a fully digital process, providing a secure way to access loans.

2. What is the processing time of Hero FinCorp loans?

Hero FinCorp processes personal loans quickly, often approving and disbursing funds within 24 to 48 hours of accepting the loan offer. The 100% digital application process makes the experience seamless.

3. How is a bank different from an NBFC?

While both offer personal loans, banks are more strictly regulated and require more paperwork. An NBFC like Hero FinCorp provides quicker approval, flexible terms, and a more straightforward instant personal loan application process—ideal for urgent needs.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.