How India’s Credit Bureaus Are Adapting to AI & Real-Time Reporting

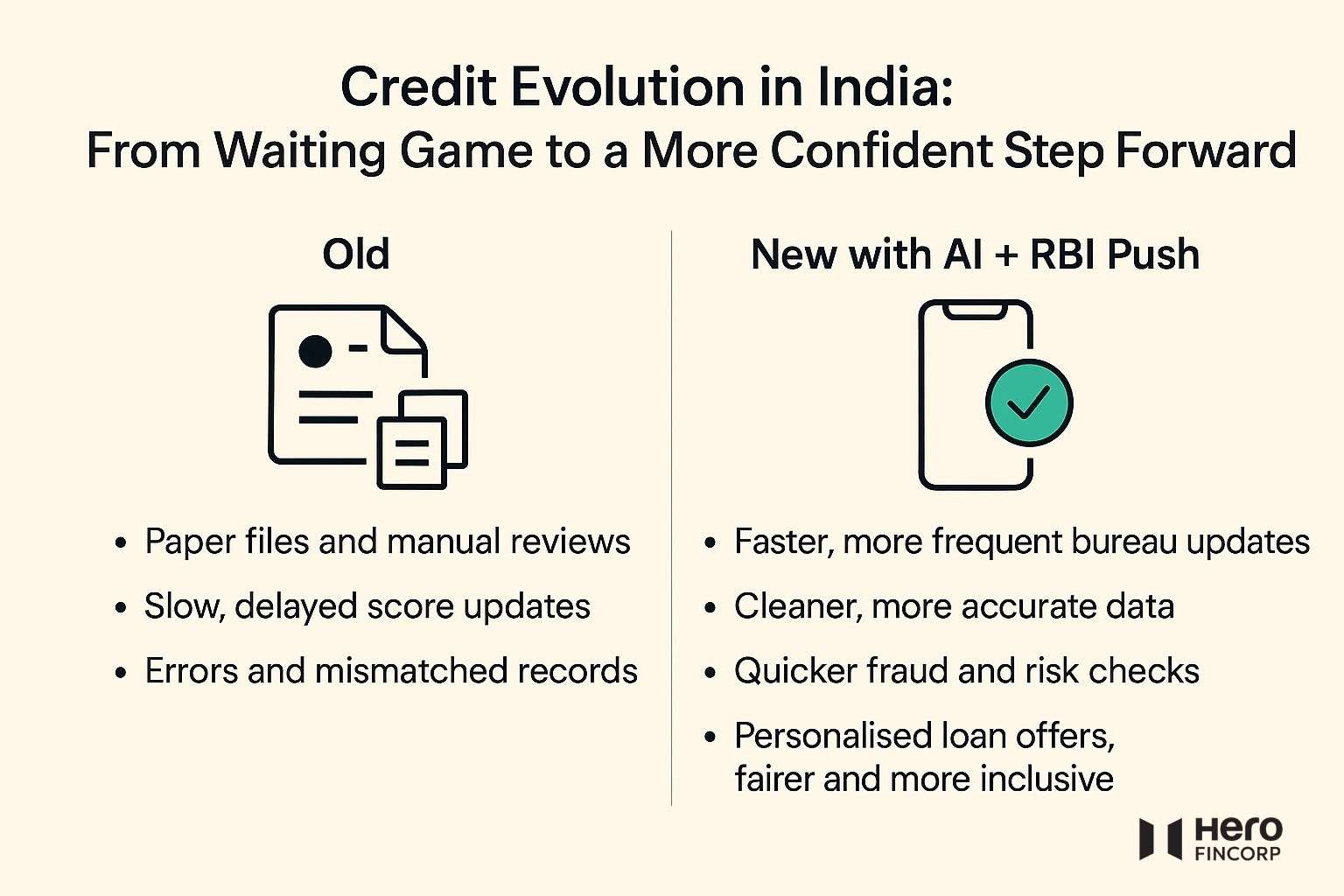

For years, your credit report lagged behind your financial life. Paid off a card? Closed a loan? You'd still wait weeks before it reflected, slowing approvals and making borrowing stressful when you needed money the most.

The Reserve Bank of India (RBI) recognised this friction. Effective January 1, 2026, it enforced stricter mandates requiring lenders to report credit information to Credit Information Companies (CICs) every 15 days, or even more frequently, to ensure near real-time accuracy.

It is a welcome move, but only the beginning. The real shift is the integration of ai credit systems, where AI in Credit Scoring allows every payment, closure, or delay to reflect almost instantly. This transition toward Adapting to AI Real-Time Reporting will reshape how credit works for all of us.

Why Credit Bureaus Matter in Borrowing

Whenever you borrow, your credit report takes centre stage. Whether it is a quick Rs 50,000 personal loan or a home loan, it shows lenders if you are loan-ready. In India, four licensed CICs—TransUnion CIBIL, Equifax, Experian, and CRIF High Mark—maintain these records.

Here is what they do:

- Track Repayments: Every EMI or credit card bill is logged.

- Build Your Credit Score: This three-digit number (300–900) is the primary filter. According to CIBIL data, a score above 750 is generally considered the "prime" threshold for lower interest rates.

- Shape Loan Terms: A strong score speeds up approvals and helps reduce your Total Cost of Borrowing.

How AI Is Changing the Credit Game involves moving beyond static snapshots to dynamic, real-time risk assessments. As RBI Deputy Governor M. Rajeshwar Rao stated at the CIBIL Conference in July 2025:

"Real-time or near-real-time credit reporting will improve underwriting precision, enable timely reflection of borrower actions, and deliver a superior consumer experience.".

Building a Real-Time, Error-Free Credit System

How India's credit bureaus are adapting to AI includes fixing the errors that frustrate borrowers. To close the gaps, the regulator is steering the system toward:

- A Unique Borrower ID: To wipe out duplicate files and mismatched details that derail applications.

- Data Quality Index (DQI): Published by credit bureaus to hold regulated NBFCs and banks accountable for the accuracy of the data they submit.

- Unified Lending Interface (ULI): Digital platform designed by the RBI to standardise data sharing across the ecosystem, reducing turnaround time (TAT) for loans from days to minutes.

Read Also: What is Credit Control? Meaning, Methods and Its Process

How AI Is Changing the Credit Game

Real-time reporting answers the "when," but AI in Credit Scoring is rewriting the "how." Here is how it impacts you:

1. Making Alternative Signals Count

Nearly 37% of Indian adults remain "credit invisible." ai credit tools change this by recognising alternative data like on-time utility bills, mobile recharges, and GST returns. This enables regulated NBFCs to offer credit to those without a traditional history.

2. Fighting Fraud in Milliseconds

AI in reporting allows systems to scan millions of transactions. A sudden spike in spending or mismatched IDs triggers an instant alert, preventing identity theft before a loan is even disbursed.

3. Sharper Risk Checks That Adapt

Old models were rigid. Today, AI in Credit Scoring tracks how your income and spending evolve. You are judged on your current financial resilience rather than a single mistake from three years ago.

4. Personalised Credit via AI Real-Time Reporting

Intelligent systems now suggest the right loan size and repayment plan. For a salaried professional, this could mean EMIs aligned with bonus cycles, ensuring the debt remains manageable.

Conclusion

India's credit story is changing. What once felt like a waiting game is now a confident leap ahead. As a regulated NBFC, Hero FinCorp leverages these technological shifts to provide transparent, accessible, and faster credit solutions tailored to your profile.

Ready to move forward with clarity? Apply online with Hero FinCorp today and discover how effortless borrowing can be!

Frequently Asked Questions

Can I get a loan if I've never borrowed before?

Yes. With AI in Credit Scoring, everyday digital footprints like bills and recharges now count toward your eligibility.

How often will my credit score update now?

Per the RBI mandate, lenders must report data every 15 days, ensuring your score reflects payments twice a month.

What is the Grameen Credit Score?

It is a Union Budget 2025–26 initiative designed to provide rural borrowers and SHGs with fairer credit access using non-traditional financial habits.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.