What Does Being a Loan Guarantor Mean?

- What Is a Loan Guarantor?

- Why Is a Loan Guarantor Required?

- Types of Loan Guarantors In India

- What Are the Benefits and Risks of Being a Loan Guarantor?

- What Is The Difference Between A Loan Guarantor And A Co-Signer?

- Understanding Your Obligations in a Guarantor-Backed Loan

- Take Wise Decisions Before Becoming A Guarantor

- Frequently Asked Questions

Loans are approved based on risk. When a lender feels uncertain about a borrower’s repayment capacity, they often look for additional assurance. This is where another individual may be asked to step in, not as a borrower, but as a backup.

These "backups" are what are referred to in the industry as loan guarantors. If you are considering becoming one, you must know all the responsibilities and risks that come with the role. This post will do just that.

What Is a Loan Guarantor?

A loan guarantor is someone who acts as a co-applicant for the primary loan applicant. Their role, as per the loan agreement, is to repay the loan if the primary applicant fails to do so. They do not receive the loan amount.

Why Is a Loan Guarantor Required?

A loan guarantor is not mandatory for all loans, but there are specific cases when lenders ask for one. These include when the applicant has:

- A low or limited credit history.

- Irregular income.

- Existing large loans or a poor credit utilisation ratio.

The above scenarios cover instances where a borrower is high risk or has a weak credit profile. That said, loan guarantors can also be used to secure better loan terms or interest rates, as they further lower the risk associated with a loan.

Types of Loan Guarantors In India

Loan guarantors can take on several forms in India. Each type serves a different purpose depending on the loan structure.

- Personal Loan Guarantors: A personal loan guarantor is any individual with a stable income and a good credit record.

- Corporate Guarantor: These are usually companies that support a loan application.

- Collateral Guarantor: This refers to when the applicant promises physical assets that the lender can take if the loan is not repaid. In this case, the assets are viewed as the guarantor.

What Are the Benefits and Risks of Being a Loan Guarantor?

Loan guarantors do not benefit from opting to be one. It's only the borrower who benefits from having one, and these are in the form of:

- A higher possibility of the loan being approved

- Access to higher loan amounts

- Better interest rates

Being a guarantor does have its risks, though. Which are:

- Being legally obligated to repay the outstanding dues if the borrower defaults.

- A possible negative impact on the credit score.

- It reduces access to credit when they need to borrow funds.

What Is The Difference Between A Loan Guarantor And A Co-Signer?

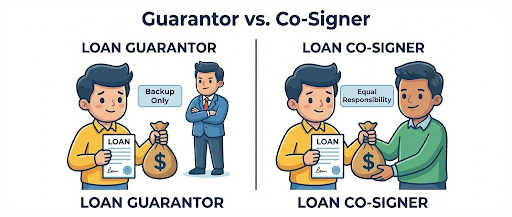

It's crucial to understand the distinction between a co-signer and a loan guarantor. The table below outlines these differences clearly.

| Loan Guarantor | Loan Co-Signer | |

| Receives the loan amount | No | Yes |

| Responsibility to repay the loan | Only when the borrower defaults. | The same as the borrower. |

| Impact on Credit Score | When the loan is defaulted on | Immediate |

Understanding Your Obligations in a Guarantor-Backed Loan

If you plan to borrow money with a guarantor, do your best to clear your dues on time. Any delays will hurt your credit score and your guarantor's as well.

If you can’t make a payment, let your guarantor know in advance. This way, they can assist in making sure the dues are paid on time.

Take Wise Decisions Before Becoming A Guarantor

Being a guarantor on a loan isn’t just a simple favour for someone you care about; it’s a serious commitment. You get free of it only after the loan is repaid in full. That is why clarity matters more than intent when making this decision.

For those considering guarantor-backed loans, Hero FinCorp provides transparent documentation and a fully digital application process. This ensures all parties involved know exactly where they stand before moving forward. The application can be filed either via an instant loan web app or by dedicated mobile apps for Android and iOS.

Frequently Asked Questions

Can a guarantor be let off the hook from their obligations?

No, a guarantor must stick to their commitments until the loan is completely paid off.

Does being a guarantor impact my credit score if the borrower is punctual with payments?

As long as the borrower keeps up with their payments, there will be no impact on the guarantor's credit score.

What if the borrower defaults and the guarantor is unable to pay?

In such a scenario, the lender may initiate recovery actions based on the legal options available to them.

What documents are required to become a loan guarantor with Hero Fincorp?

With Hero Fincorp, you will need to produce an identity proof, income documents, and address proof as a guarantor.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.