Embedded Finance: Redefining Financial Services with Hero FinCorp

- What is Embedded Finance? The Intersection of Tech and Finance

- How Embedded Finance Differs From Traditional Financial Services

- Types of Embedded Finance: Examples Reshaping Industries

- The Benefits of Embedded Finance for All Stakeholders

- How to Learn Embedded Finance: Resources and Pathways

- The Future of Embedded Finance in India

- Why Choose for Your Financial Needs in an Embedded World?

- FAQs

Have you ever received an offer for instant credit during the purchase of a high-ticket item at any e-commerce website?

If yes, then what you have been offered is embedded finance.

Embedded finance lets service providers extend financial offerings to buyers without the need for the strict regulatory requirements of a traditional financial services provider.

Read on to know more about embedded finance here, including types, features, benefits and more.

What is Embedded Finance? The Intersection of Tech and Finance

In simple terms, embedded finance is the integration of financial services into a traditionally non-financial platform. The concept applies to loans, insurance, payments, investments and more.

Core Principles of Embedded Finance

- Seamless user experience and contextual integration

- Technology-driven

- User-centric and personalisation

Also Read: The Rise of Embedded Lending—Borrowing While Shopping Online

How Embedded Finance Differs From Traditional Financial Services

Here are the key differences between the two-

| Aspect | Embedded Finance | Traditional Financial Services |

|---|---|---|

| Context | Offers financial services within a non-financial platform, | Users can access financial services through dedicated channels like banks or NBFCs. |

| Integration | Integrated via APIs, enabling payments, credit, or insurance to work seamlessly | Limited integration |

| User Experience | Frictionless and intuitive | More fragmented experience involving multiple steps, documentation, and manual verification processes. |

| Data Usage | Leverages real-time, contextual data (purchase behaviour, usage patterns) for personalised decisions. | Relies mainly on historical financial data, credit scores, and formal documentation. |

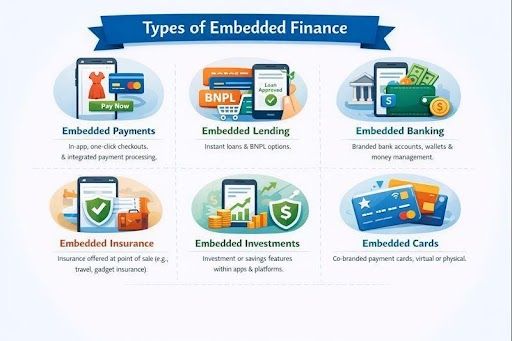

Types of Embedded Finance: Examples Reshaping Industries

Several types of embedded finance are changing how consumers and businesses interact with money. Among these are-

1. Embedded Payments: Seamless Transactions Everywhere

With embedded payments, users can complete transactions instantly within digital platforms. This eliminates the need to redirect to external banking apps or payment gateways.

The main advantage of embedded payments is the easy facilitation of cashless and in-app payments, making everyday transactions easy.

For example, using ride-hailing apps, you can pay automatically once the trip ends.

2. Embedded Credit: Instant Lending Solutions with HeroFinCorp

The concept of embedded credit brings lending directly to the point of need. This allows users to access instant financing without a separate loan application process.

With features like point of sale credit and BNPL (Buy Now, Pay Later), embedded finance platforms can offer flexible payment options when customers are ready to buy.

For instance, HeroFinCorp’s embedded credit solutions integrate into partner platforms easily to empower businesses to offer contextual lending while users benefit from fast and hassle-free credit access.

3. Embedded Insurance: Protection at the Point of Need

Embedded insurance offers coverage exactly when and where it’s required. Instead of buying separate policies, users can add insurance as part of a transaction.

For instance, travel companies offer trip or flight delay insurance during booking, while e-commerce sites offer device protection at checkout.

4. Embedded Investments: Democratising Access to Wealth Creation

Embedded investments integrate various wealth-building options into everyday digital experiences. Through micro-investing features, users can start investing small amounts directly from payment or savings apps.

The Benefits of Embedded Finance for All Stakeholders

Embedded finance benefits all stakeholders by creating seamless, convenient experiences.

For Businesses/Platforms

- Enhanced customer experience & revenue

- One-stop solutions for all needs

- Faster transactions and personalised offers.

For Financial Institutions Like HeroFinCorp

- Expanded reach beyond traditional channels

- New revenue streams

- Stronger customer acquisition

For End-Customers

- Accessible, affordable & personalised financial services

- Lower costs & better value

- Seamless access

How to Learn Embedded Finance: Resources and Pathways

Here is a guide to various resources and pathways for learning embedded finance

Online Courses and Certifications

Among the key embedded finance courses are-

- SIM (Singapore Institute of Management): Offers specialised courses on the implementation of embedded finance.

- FIS Global: Offers "Simply Fintech" educational series.

Industry Reports and Expert Insights

Staying updated through strong and credible embedded finance reports and fintech industry analysis is very important. These include reports from McKinsey, Bain & Company, BCG, and Deloitte.

Networking and Communities in Embedded Finance

Joining an active embedded finance community helps accelerate learning through peer insights and real-world exposure.

The Future of Embedded Finance in India.

The future of embedded finance in India is completely set to redefine how consumers and businesses access financial services, and Hero FinCorp is at the forefront of this change.

Guided by a strong HeroFinCorp fintech vision, the focus will remain on making finance contextual, instant, and inclusive.

Why Choose for Your Financial Needs in an Embedded World?

HeroFinCorp financial solutions offers you a distinct competitive advantage with seamless, integrated financing along with digital convenience, fast approvals, and tailored products.

As your digital finance partner with expertise in instant personal loans, HeroFinCorp is committed to making complex financial journeys simpler and smoother.

Connect with us today and know more about our instant personal loans.

FAQs

Is embedded finance the same as Banking as a Service (BaaS)?

No, Embedded Finance and Banking as a Service (BaaS) are not the same, but they are related.

What regulatory challenges does embedded finance face in India?

Ambiguous licensing and strict data privacy are some of the regulatory challenges that embedded finance faces in India.

How can a small business leverage embedded finance?

Small businesses can leverage embedded finance to streamline operations and enhance customer experience without needing to become licensed financial institutions.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.