What Is Collateral? Meaning, Types, and How It Affects Your Loan

- Understanding Collateral: Definition and Core Concept

- The Importance of Collateral in Lending

- Types of Collateral Accepted

- Collateral Transaction Meaning in Banking and Finance

- Secured vs. Unsecured Loans: The Role of Collateral at Hero FinCorp

- How Collateral Impacts Your Hero FinCorp Loan Terms

- What Happens if You Default on a Collateralised Loan?

- Choosing Hero FinCorp: Your Partner for Secured Lending

- Frequently Asked Question

Imagine you want to expand your small business by purchasing a new delivery truck, but you don't have the full amount in cash.

You approach a lender like Hero Fin Corp for a loan. To give the lender confidence that the money will be repaid, you offer your existing warehouse as a "guarantee". If things go south and you can't pay back the loan, the lender has the right to take the warehouse to recover the loss.

In the world of finance, that warehouse is your collateral. It is the safety net that turns a "maybe" into a "yes" for many borrowers.

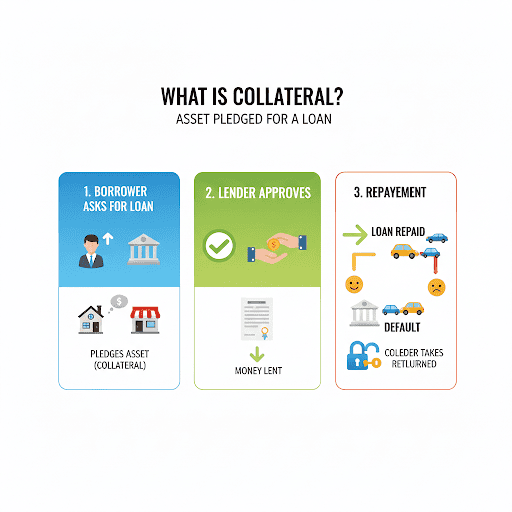

Understanding Collateral: Definition and Core Concept

At its heart, it is an asset or property that a borrower offers to a lender as security for a loan.

From Hero Fincorp's perspective, it acts as a secondary source of repayment. While we always hope for a smooth repayment journey, collateral protects the lender if the borrower is unable to meet their financial obligations. It effectively shifts some of the risk from the lender to the asset.

The Importance of Collateral in Lending

The collateral loan is deeply tied to risk management. For financial institutions, requiring collateral serves a dual purpose of risk mitigation and borrower benefits.

To understand risk mitigation and borrower benefits, consider a business owner, Rahul, who needs ₹10 Lakhs.

- Risk Mitigation (Lender): Rahul offers his warehouse as collateral. If he fails to pay, the lender can sell the warehouse to recover the ₹10 lakh. This safety net reduces the lender's risk of losing money.

- Borrower Benefits (Rahul): Because the lender feels secure, they reward Rahul with a 9% interest rate instead of the 16% charged for unsecured loans. He also gets 7 years to pay it back instead of 3, making his monthly EMIs much more affordable.

In short, collateral gives the lender security and gives the borrower savings.

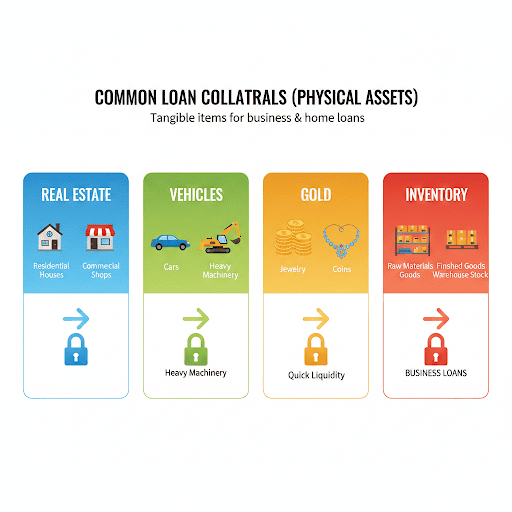

Types of Collateral Accepted

Not every asset can be used to secure a loan. Hero FinCorp generally looks for assets that have a stable market value and can be legally transferred. Types of collateral usually fall into two broad buckets: physical or tangible and financial or intangible.

Also Read: Loan Against Property

Tangible Assets as Collateral

These are physical items you can touch and see. They are common in business and home loans:

Financial Instruments as Collateral

Sometimes, your "paper wealth" is your best asset. You can pledge financial investments without having to sell them:

- Fixed Deposits (FDs): A safe and highly liquid form of security.

- Shares and Mutual Funds: Pledging your equity portfolio allows you to get funds while still potentially benefiting from market growth.

- Insurance Policies: Certain life insurance policies with a surrender value can be used as security.

Collateral Transaction Meaning in Banking and Finance

In banking, a collateral transaction refers to the legal process of creating a "charge" over an asset. It isn't just a verbal agreement; it involves specific legal mechanisms:

- Pledge: Common for movable assets like gold or shares, where the lender may physically or virtually hold the asset.

- Hypothecation: Common for vehicles or stock. You keep using the asset (like driving your car), but the lender has a legal right to it until the loan is paid off.

- Mortgage: Used specifically for immovable property like land or buildings.

Once the loan is fully paid, the lender initiates a "release of charge", returning full legal ownership of the asset to you.

Secured vs. Unsecured Loans: The Role of Collateral at Hero FinCorp

Understanding collateral loans (secured) versus unsecured loans is vital for choosing the right financial product.

| Collateral Needed | Yes (Property, Gold, etc.) | No |

|---|---|---|

| Interest Rates | Generally Lower | Generally Higher |

| Loan Amount | Higher (based on asset value) | Lower (based on income) |

| Approval Basis | Asset value + Credit Score | Primarily Credit Score & Income |

| Risk to Borrower | High (Asset can be lost) | Low (No specific asset at risk) |

Also Read: Secured Loans Vs. Unsecured Loans: A Comparison

How Collateral Impacts Your Hero FinCorp Loan Terms

Offering collateral doesn't just get you an approval; it improves the "quality" of your loan.

- Lower Interest Rates: Since the risk is lower for Hero FinCorp, we pass that benefit to you through more competitive rates.

- Higher Loan Amount: You can often unlock larger sums of money—sometimes up to 70-80% of the asset's value.

- Flexibility: It can help borrowers who might have a slightly lower credit score but own a high-value asset, making loan eligibility more inclusive.

What Happens if You Default on a Collateralised Loan?

Defaulting is a serious situation. If a borrower stops making payments, the lender follows a structured legal process:

- Notice Period: The lender will send multiple reminders and legal notices to help the borrower settle the arrears.

- Foreclosure/Seizure: If the default continues, the lender invokes their right to take possession of the collateral.

- Auction: The asset is sold to recover the principal and interest. Any remaining balance after the sale is usually returned to the borrower, though a default will severely damage your credit score.

Also Read: How Does a Personal Loan Impact My Credit Score?

Choosing Hero FinCorp: Your Partner for Secured Lending

Whether you are looking for a secured personal loan or a business-orientated collateral loan, Hero FinCorp provides a transparent and efficient process. We offer expert valuation, quick processing, and a commitment to helping you use your assets to build your future.

Ready to grow? Apply for a collateral-backed loan today!

Frequently Asked Question

What is the difference between a pledge and hypothecation?

In a pledge, the lender typically takes possession (like gold in a vault). In hypothecation, the borrower keeps possession and use of the asset (like a car), but the lender holds the legal "charge".

Can I use jointly owned property as collateral?

Yes, but all co-owners must agree to the pledge and usually sign as co-applicants.

How does Hero FinCorp determine the value of my collateral?

We use professional third-party valuers to determine the current "fair market value" of the asset.

Are there any loans that do not require collateral?

Yes, we offer unsecured personal and business loans, which are based on your income and credit history.

Can the collateral be released before the loan is fully repaid?

Generally, no. However, you can sometimes "swap" collateral if the new asset has a similar or higher value, subject to approval.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.