Personal Loan Credit Lines on UPI: Who Qualifies, How Interest Works & Credit Score Impact in 2025

Running out of cash before the month ends is a common problem many of us face. Whether it’s an unexpected medical bill, a school fee reminder or just everyday expenses piling up, financial shortfalls can happen to anyone. We traditionally dip into our savings, borrow from friends or swipe a credit card to cover these costs. But what if the UPI app you already trust could give you a small buffer of credit you can tap anytime, anywhere?

This is exactly what Credit Lines on UPI (CLOU) promise—a seamless way to access short term funds without the hassle of paperwork or delays. If you’re wondering about eligibility, interest rates and how this affects your credit score, you’re in the right place. Let’s see how credit lines on UPI work and what you need to know in 2025.

If you need a larger amount for expenses like medical expenses, home renovations or a medical emergency, you can apply for personal loan with Hero FinCorp.

Personal loans are unsecured loans for various needs including medical expenses, home renovations and urgent medical emergencies. For urgent requirements, instant loans and emergency loans are available, providing quick access to funds. The personal loan offered by Hero FinCorp has a minimum and maximum amount and the loan and interest rate depends on your eligibility criteria. You can apply for personal loan online by filling a loan application form and submitting the required personal loan documents. Once your loan is approved, funds will be disbursed to your bank account instantly. Please note that processing fees and loan processing charges may apply and all terms and charges are mentioned in the loan documents. Personal loans do not offer tax benefits. To check the maximum loan amount you are eligible for, use a personal loan eligibility calculator and review the personal loan eligibility criteria. If you have an existing loan or existing personal loan, you can apply for a top up or transfer it to another lender for better terms. Bank personal loans have specific foreclosure policies you should review. If your personal loan application is rejected, it may be because you don’t meet the eligibility criteria or documentation requirements.

What is Credit Line on UPI?

A Credit Line on UPI works like a ready-to-use overdraft facility within your UPI app. Instead of applying for a new loan every time you need extra funds, your lender sets aside a pre-approved credit limit for you. Whenever your bank account balance is insufficient, you can instantly use this credit line to pay.

Here are some key features that make CLOU stand out:

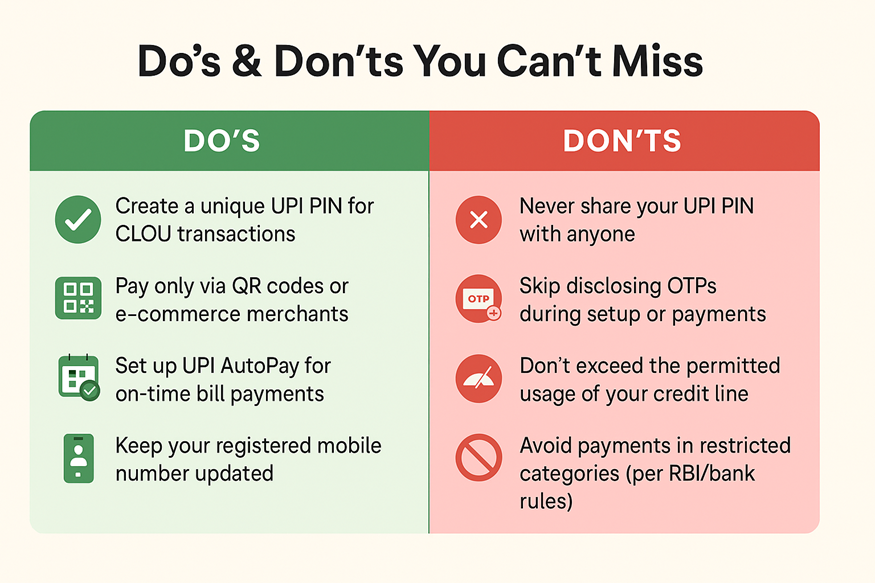

• You can activate your credit line in minutes using your registered mobile number.

• Every transaction is protected by a dedicated UPI PIN specifically for credit lines.

• You can pay seamlessly anywhere UPI is accepted—from online shopping portals to local cafes.

• A personalized limit is offered based on your income and financial profile.

• You only tap the amount you need and interest is charged only on the utilized portion.

• You can clear your dues in one go or choose from flexible repayment options by spreading payments across EMIs.

UPI already powers over 20 billion payments every month, making it India’s digital payment lifeline. Adding credit lines to this ecosystem is changing how Indians manage short term financial needs. By 2030, it is expected that credit lines on UPI could cross $1 trillion in transaction value, reshaping on-the-go borrowing.

In essence, CLOU offers credit that moves at the speed of UPI—no cards to carry, no extra accounts to manage and no added stress.

Also Read: what is nbfc company

If you have bigger expenses in mind, you can also apply for a personal loan with Hero FinCorp, which offers loan amounts up to ₹5 lakhs along with flexible repayment options.

Quick Tip: From August 2025, you’ll be able to withdraw funds or use credit lines secured by your fixed deposits, gold, shares or property via UPI (subject to lender approval). This feature will further enhance the flexibility of credit lines on UPI.

Eligibility Criteria: Who Qualifies for Credit Line on UPI?

UPI connects millions of Indians daily and Credit Lines on UPI aims to make credit more accessible than ever before. Unlike credit cards which often cater to a smaller, more select segment, CLOU is designed with inclusivity in mind. However, lenders still do a quick eligibility check before activating your credit line.

Here are the main factors lenders check:

• Credit Score and Repayment History: A credit score between 650 and 700 or above improves your chances of approval. Timely payment of previous EMIs and credit card bills shows your creditworthiness.

• Income and Job Stability: Lenders look for steady income whether from salaried employment or business earnings. Proof of income can be through payslips, bank statements or GST filings.

• Existing Debts: If you have high outstanding loan amount, your credit limit may be reduced. Lenders check your current debt-to-income ratio to assess your repayment capacity.

• KYC Compliance: Your PAN, Aadhaar and bank account details must be linked and verified as per NPCI and RBI guidelines.

• Relationship with the Lender: If you already have a bank personal loan or other financial products with the lender, your application may be processed faster. Existing customers may also qualify for loyalty loans which reward responsible borrowers.

If you are new to credit and don’t have a formal credit history, you may still qualify for a smaller credit limit. Lenders can use alternative data such as your UPI transaction history and other digital footprints to assess your creditworthiness.

The best part is that using Credit Lines on UPI responsibly over time can help you build and strengthen your credit score and open doors to better financial opportunities.

Also Read: How to Improve Credit Score in 30 Days?

How Interest Works on Credit Line on UPI

One of the most common questions about CLOU is will you pay more than necessary. The good news is that with credit lines on UPI, interest is charged only on the amount you use and not the full credit limit.

For example, if you have a maximum loan amount of ₹50,000 but use only ₹10,000 at a personal loan interest rate of 19% per annum and you repay within 30 days, the interest you pay would be approximately ₹156. This makes it a cost effective option for short term financial needs.

Here are some key points to note:

• Some lenders may charge a small one-time personal loan processing fee when your credit line is activated.

• Many credit lines offer an interest free window of 30 to 45 days if you clear your dues within this period.

• After the interest free tenure, interest accrues daily on the outstanding principal.

• Missing monthly instalments or delaying repayments can lead to late fees and negatively impact your credit score.* UPI AutoPay is a convenient way to ensure timely repayments and avoid penalties.

Interest rates on credit lines vary across banks and NBFCs so please review the Key Facts Statement (KFS) provided by your lender. This document will have all the charges including personal loan processing fee, interest rates and repayment tenure.

Credit Score Impact of Credit Line on UPI

Cost is not the only factor to consider when using a credit line on UPI. How you manage this credit facility has a direct impact on your credit score. Reserve Bank of India now requires lenders to update credit bureau records every 15 days so your financial behavior is reflected more quickly than before.

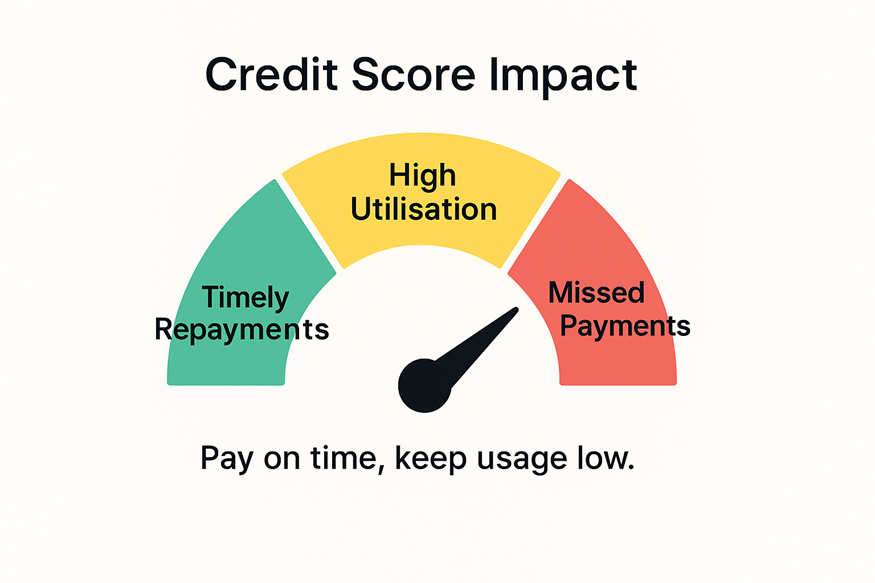

Here’s how your credit score can be impacted:

• Timely Repayments Boost Your Score: Paying your monthly instalments on or before the due date helps in building a positive repayment history. Even small regular payments count towards improving your creditworthiness.

• Delayed Payments Hurt Your Score: Missed EMIs or overdue outstanding loan amounts can drop your credit score within weeks making it harder to get future loans.

• Credit Utilization Matters: Consistently maxing out your credit limit signals financial stress to lenders. To maintain a healthy credit score borrow only what you need and repay quickly.

By managing your credit line responsibly you can show strong repayment capacity and improve your financial freedom.

Conclusion: Borrow Smart, Borrow Flexible

Credit Lines on UPI are designed for convenience and financial agility not for encouraging overspending. They are a safety net when unexpected expenses arise like medical emergencies, school fees or home renovation costs. With quick activation, flexible repayment options and transparent personal loan interest rates CLOU helps you keep your cash flow steady without the complexity of loan procedures.

For bigger financial needs consider applying for a personal loan online with trusted lenders like Hero FinCorp. Personal loans have predictable EMIs, affordable interest rates and longer repayment tenure making them ideal for big expenses or debt consolidation through personal loan balance transfer options.

With minimal documentation, instant approval processes and ability to apply for a personal loan in just a few clicks getting funds has never been easier. Use personal loan eligibility calculators and EMI calculators to plan your finances before submitting your personal loan application.

Download the Hero FinCorp app today and experience a seamless digital lending journey that puts your financial needs first.

Also Read: UPI Now Pay Later: Meaning, Benefits, Eligibility & How to Apply

Frequently Asked Questions

1. Is UPI credit line same as credit card?

No. While both offer credit, UPI credit line is linked to your bank account and UPI app. It’s faster, simpler and often cheaper than credit cards.

2. Can I withdraw cash from UPI credit line?

No. UPI credit line is for digital transactions only. You can pay merchants by scanning QR codes or make online purchases but ATM cash withdrawals are not allowed.

3. For bigger expenses should I go for personal loan?

Yes. Personal loans offer fixed monthly instalments, competitive interest rates for good credit score and structured repayment tenures. Use personal loan EMI calculator to calculate your monthly instalments and interest cost before you apply.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.