How to Link Your PAN Card with Your Bank Account for Faster Tax Refunds

You file your income tax return and expect your refund to follow soon after. Then you wait. Days pass, sometimes longer than expected. In many cases, the issue is surprisingly simple. Your PAN (Permanent Account Number) acts as your financial identity in India, quietly connecting your tax and banking records.

With around 800 million PANs issued nationwide, the system now relies fully on digital verification. As refunds shifted from paper cheques to Direct Benefit Transfer, knowing how to link a PAN card to a bank account became essential.

Today, a proper bank account PAN card link isn’t optional if you want your refund credited smoothly. Without a verified PAN card linked to a bank account, payments can get delayed.

Why Linking PAN to Your Bank Account is Mandatory

Linking your PAN with your bank account is no longer just a formality. It is a regulatory requirement that helps keep your banking and tax records aligned and hassle-free.

- To avoid higher tax deductions- If PAN is not linked, banks must deduct TDS/TCS at a higher rate of up to 20% on interest income and certain withdrawals, instead of the standard 10%. under Section 206AA.

- To prevent PAN from becoming inoperative- An inoperative PAN is treated as “not furnished,” which can trigger tax penalties and restrict financial transactions.

- To complete high-value transactions smoothly- PAN linkage is compulsory for cash deposits above ₹50,000, buying demand drafts, and opening new bank accounts.

- To receive tax refunds without delay- The Income Tax Department credits refunds electronically only to bank accounts linked and validated with PAN.

- To meet regulatory compliance- Linking PAN helps banks and regulators track transactions, reduce tax evasion, and maintain transparency across the financial system

Step-by-Step Guide: Linking PAN via Internet Banking

If you already use net banking, linking your PAN usually takes less time than expected. Once you learn how to link a bank account with a PAN card online, the process appears simple and easy to handle.

Step 1: Log in to your bank's official internet banking website with your login credentials. Check the website URL for a couple of seconds before you continue.

Step 2: Navigate to Service Requests, Profile Settings, or KYC Update sections, and pick the option for PAN registration.

Step 3: Enter your PAN number, date of birth exactly as it is on the PAN card, and your registered email ID. It is very important to be accurate here.

Step 4: Complete the verification step using an OTP or transaction password, depending on your bank’s process.

Step 5: After submission, the bank verifies the request in the background. In most cases, the PAN card link to the bank account is confirmed within two to seven working days.

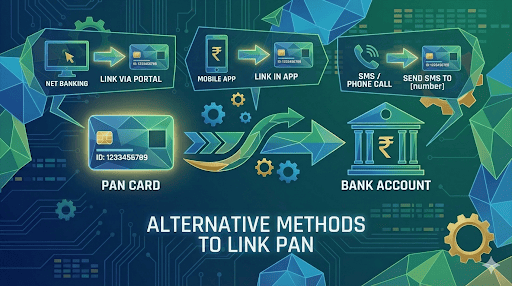

Alternative Methods to Link Your PAN

If internet banking isn’t your first choice, you still have dependable ways to complete the process. Banks and government platforms offer multiple options so you can link your PAN card to a bank account using the method that feels most comfortable.

Linking via the Bank Branch (Offline)

If you find digital banking a bit intimidating, you may always use the option of visiting your bank branch. Make sure to bring your original PAN card as well as a self-attested copy of it. Once verified, the bank completes the bank account PAN card link manually.

Linking via Mobile Banking App

Many banks now allow PAN linking directly through their mobile apps. The process is quick and paperless, which helps if you already manage your finances on your phone.

The Income Tax e-Filing Portal

Once your bank associates the PAN, you also need to validate your bank account on the Income Tax e-Filing portal. If you miss this step, refunds might not reach you even if your PAN card has been successfully linked to a bank account.

Important Rules and Restrictions (CBDT & RBI Guidelines)

PAN linkage has been mandatory for most bank accounts since February 2017. The objective is straightforward: improve transparency and reduce fraud. If your bank account PAN card link is missing, banks may restrict debit transactions, block transfers, or place partial limits until KYC requirements are met.

Basic Savings Bank Deposit Accounts follow slightly relaxed norms, but they are not always exempt. PAN-linked accounts come in handy, in particular, when you apply for credit products like a business loan or a personal loan, where verification checks are usually stricter.

When you link your PAN card to your bank account, it helps you avoid last-minute disruptions and keeps your banking experience smooth.

Also Read: How to Check Active Loan on PAN Card - Step-by-Step Guide

Finish the Link, Simplify Your Finances

It only takes a few minutes to link your PAN card with your bank account. It also helps to prevent refund delays and avoid unnecessary banking restrictions. It also keeps you prepared for future financial needs.

Once your PAN is linked, accessing credit becomes easier. If you’re planning a large expense or need funds quickly, a verified account can help speed up approvals. Hero FinCorp offers a fully digital, paperless loan application process. Apply today!

Frequently Asked Questions

1. Can you link one PAN to multiple bank accounts?

Yes, one PAN can be associated with several accounts, provided that all these accounts are owned by the same person.

2. How do you check if your PAN is already linked?

You can check this through your net banking, mobile banking app or by visiting your bank branch.

3. What happens if the name on your PAN doesn’t match your bank account?

A mismatch may lead to rejection. You’ll need to update either your PAN details or bank records.

4. Is it safe to enter PAN details on your bank’s website?

Yes, as long as you use the official website or mobile app with secure login features.

5. Can you receive a tax refund in a Current Account?

Yes. Refunds can be credited to validated current accounts once the PAN card is linked.