Instant Personal Loans on WhatsApp—The Rise of Conversational Credit

WhatsApp is an application that needs no introduction. It is one of the most popular messaging platforms in India and worldwide.

As of today, it's being used for more than just personal communication; you can shop via the app, get customer support, and receive important notifications.

But here’s something new: you can now get an instant personal loan on WhatsApp. Sounds surprising? Let’s explore.

What Is Conversational Credit, and Why Is WhatsApp Becoming a Loan Channel?

Conversational credit, simply put, is a way of accessing instant personal loans simply by reaching out to a lender via WhatsApp.

You can inquire about a loan, share your details via chat, and get offers in real time in the same chat window. In short, no more standing in queues at the bank or filling out forms on websites.

Now, why WhatsApp, of all the messaging platforms? Simple, because of its reach in the country. India has over 853.8 million active users as of 2025, and we are already paying bills, booking tickets, and shopping via the loan app. Using it as a potential channel for loans was the obvious next step.

How Do Conversational Loans Work?

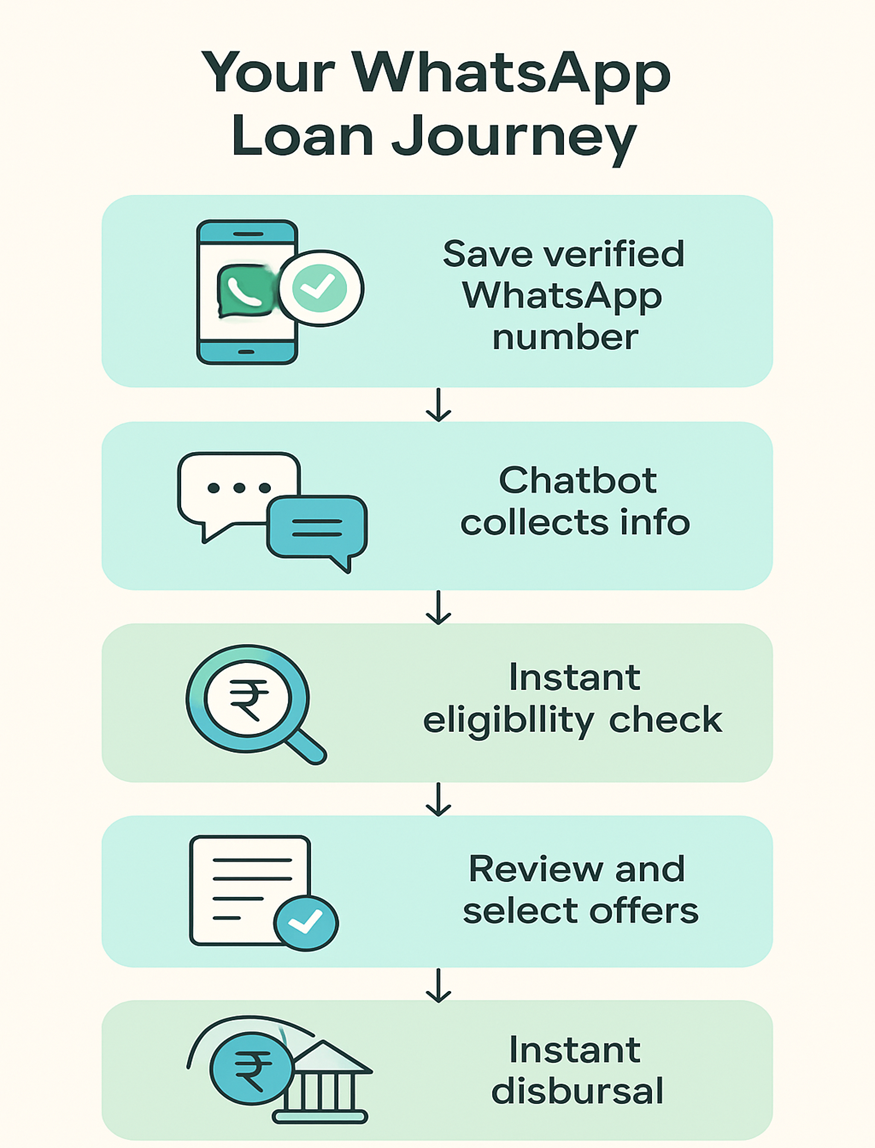

The journey of getting an instant personal loan via WhatsApp generally (the process can vary slightly from lender to lender) goes like this.

• Step 1: Lenders often have an official WhatsApp number for this specific purpose. Save it and start the process by messaging "Hi". Note: Make sure the number has the verified tick next.

• Step 2: The chatbot will then walk you through the process, where you will be asked to enter basic details like your Name, your PAN number, employment details, and so on.

• Step 3: The system runs a quick check to verify your eligibility for a loan, and you will be presented with loan offers within a few seconds.

• Step 4: You can review the offer and then pick the one you need. You may be directed to a secure link to complete your eKYC.

• Step 5: Once you confirm that everything is in order, approval and disbursement should occur within minutes.

If you are still sceptical, considering this is a fairly new process, and the fact that WhatsApp scams are now everyday occurrences, you can always opt for a trusted instant loan app available on Android and iOS.

The Benefits of Conversational Loans

The above process should put into place the benefits of this new format of availing loans:

• You are on an app you are familiar with.

• There is zero paperwork involved.

• Eligibility checks are instant.

• You have quick access to small loans for emergencies.

That said, just cause the process is convenient doesn't mean you should borrow casually. Take only when you truly need one and only borrow what you need and not what you are eligible for.

Conclusion

Conversational credit combines familiarity and convenience, making it easier than ever to access funds through WhatsApp. But while the process is simple, borrowing should never be taken lightly—it’s a responsibility, not a shortcut.

For your larger goals or emergencies that require larger amounts, head over to Hero Fincorp. With clear terms, paperless processing, and quick approvals, we make borrowing simple and secure. Apply for a personal loan today!

Frequently Asked Questions

Are conversational loans secure against fraud?

Yes, conversational loans are secure. Make sure that you verify that the number you have saved is from official sources and has the verified tick next to it.

Are digital documents acceptable for WhatsApp loan applications?

Some lenders will accept digital copies of your documents via WhatsApp, while others will redirect you to a secure link to complete your eKYC.

Do we get reminders or support for the loan via WhatsApp?

Yes, lenders will send you EMI reminders, payment links, and provide any support required via the same chat window.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented Here is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.