What is Financial Planning - Meaning, Types, and Purpose

What is Financial Planning?

Financial planning is the complete process of evaluating your current financial factors, like income, expenses, and assets you hold, and creating a strategic plan for future goals. If you think financial planning is just about saving, then you’re wrong. It is a combination of budgeting, debt management, investing, and risk protection.

If you have a proper plan in hand, you can achieve financial security and build long-term wealth.

Importance of Financial Planning

Many people around us earn well but still struggle financially because they lack a clear plan. This is why understanding the importance of financial planning is essential for everyone.

- Financial planning gives you clarity towards your goal by setting a clear timeline and fixing a target amount. This clarity gives you a roadmap to achieve your goals efficiently.

- By tracking actual cash flow and removing impulsive purchases, a financial plan improves the standard of living. This allows you to spend money on things that improve your quality of life.

- Wealth creation and compounding happen when you follow a disciplined investment rather than saving. By starting early and choosing the right asset, you’ll get more benefit out of personal financial planning.

- An individual can live a stress- free life by sticking to the right financial planning. Also, it gives you peace of mind, even if you face an unexpected expense.

- It helps you to save for emergency preparedness, which is three to four months of expenses in the form of cash in a savings account or in an FD for easy withdrawal.

To attain financial security, one must understand the importance of financial planning.

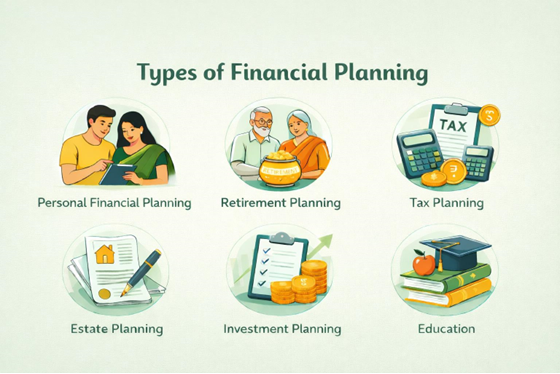

Types of Financial Planning

There are many different types of financial planning, and it is important for you to choose the one that aligns with your financial goals.

- Personal Financial Planning: It is an effective strategy to manage your money by budgeting, saving, and investing. Without affecting your future security, this type of planning helps you reach goals wisely (buying a car or paying school fees).

- Retirement Planning: This plan helps you save and invest money now to meet the expenses of your future. Even if you stop working, you’ll be able to meet your regular expenses by following this plan.

- Tax Planning: This type of planning is specifically prepared to pay ‘less tax’. It helps you to select available tax-saving options and the right investments to have a proper cash flow. On the other hand, to keep the maximum amount of what you earn. For example, if you have a home loan, you can save up to ₹1.5 lakh per financial year as per Section 80C.

- Estate Planning: Estate planning is a pre-planned process of distributing assets to heirs in your absence. It contains legal papers such as wills, powers of attorney, and trusts related to particular assets to avoid conflicts between different heirs.

- Investment Planning: You need to invest your savings into different assets like stocks, mutual funds, or gold so that your money grows faster than inflation over time.

- Education Planning: This plan focuses on accumulating enough funds to cover the whole costs of a child’s education, from schooling to graduation.

How to Start Personal Financial Planning in India?

Rahul started his personal financial planning with these five steps -

Step 1: Understanding Income And Expenses

Basically, Rahul earns ₹30,000 as in-hand salary. He listed his fixed expenses like rent, food, travel, and utilities. Finally, to know the savings amount, he subtracted all expenses from his income.

Step 2: Setting a Real/Practical Goal

With a ₹30,000 salary, Rahul needs to set practical goals like saving an emergency fund, small vacations, skill courses, or long-term retirement. Fixing clear timelines and required amounts helped Rahul to stay financially balanced.

Step 3: Building an Emergency Fund and Insurance

Rahul should first priorities saving an emergency fund, which is three to five months of his expenses in the form of liquid cash or in a savings account. Rahul must also buy basic health insurance to protect his limited income.

Also Read: Medical Expenses Without Financial Stress: Smart Ways to Cope

Step 4: Consistent Investment

Rahul started investing a minimum amount of ₹2,000 - ₹3,000 monthly in investment vehicles like mutual funds, EPR, and PPF. He stayed consistent, even though it is a small amount.

Step 5: Review and Update

Rahul reviewed his personal financial plan regularly, or in case of any life change. This helps him to stay on track, correct changes in the early stage, and achieve financial security at an earlier age.

By following these 5 personal financial planning steps, Rahul can achieve financial freedom in his earlier 50’s.

Also Read: Financing Your First Luxury Bike with a Personal Loan

Common Financial Planning Mistakes to Avoid

People in India lose thousands and lakhs of rupees by making just simple mistakes. To avoid those losses, you need to spend time understanding the common financial planning mistakes.

- Not setting clear financial goals: Most of us will save and invest without clear short-term and long-term goals. While doing so, your money lacks direction, and progress becomes less.

- Skipping an emergency fund: This is one of the biggest mistakes that makes you borrow or withdraw all your investments. So keeping 3-4 months of expenses is highly recommended.

- Delay in Investment: If you invest too late, it leads to poor compounding of money. So investing in the early stage is more important than investing a huge amount later.

- Overspending: If you don’t have control over your expenses, then it is too hard to achieve financial security, even if you earn in lakhs. Build a proper monthly budget and stick to it.

- Lack of Tracking: Absence of financial planning leads to clueless spending and stress. To overcome this issue, using a budgeting app is very helpful.

Also Read: Essential Personal Finance Tips for Effective Money Management

Tools & Resources for Effective Financial Planning

Financial planning tools play a very important role in tracking the financial planning process and budgeting.

- Budgeting Apps: Mint, YNAB, Walnut, etc.

- Investment calculators: Groww, SBI mutual fund, Investor.gov.

- Expenses Trackers: Valley Budgeting, GoodBudget.

- Financial Advisor Websites: Hero FinCorp, Investyadnya

Start Taking Control of Your Future

Managing unexpected expenses can be stressful, especially while earning a minimum amount. By getting a low-interest EMI at the right time, one can avoid a financial crisis.

When planning your finances, having the right support during unexpected expenses matters just as much as saving and investing. If you need funds to bridge a gap, manage a big goal, or handle an emergency without disrupting your plan, a personal loan can help.

Hero FinCorp offers quick approvals, flexible tenures, and transparent terms, so your financial journey stays on track.

Apply for a Hero FinCorp personal loan today and take confident control of your money.

Frequently Asked Questions

1. What is the difference between financial planning and budgeting?

Budgeting is just daily income and expenses. Financial planning is a broader term that includes long-term goals, investments, and insurance to meet financial security.

2. What are the common financial planning mistakes to avoid?

Common financial planning mistakes include starting too late, skipping an emergency fund, and not reviewing or adjusting when changes occur or changes in income.

3. How much money do I need to start financial planning?

You can start financial planning with a minimum amount of a thousand by budgeting, saving small amounts, and planning your goal consistently.

4. Can I do financial planning on my own, or should I hire a financial planner?

You can do financial planning by yourself if your finance simple or low income. If your income, goals, or investments are huge, then you can go with a financial planner to avoid costly mistakes.

5. Is financial planning only for high-income individuals?

Absolutely not, financial planning is not only meant for high-income individuals. It is necessary for each and every person, regardless of the amount of income they generate.