What is Emergency Fund and How it works?

Until an unforeseen expense arises, most households can comfortably manage their daily spending. Unexpected medical emergencies, essential home repairs, or last-minute travel can disrupt schedules and cause immediate financial strain.

When no funds are allocated to address these circumstances, they become considerably more difficult. That is why many people keep a dedicated amount reserved for urgent needs. An emergency fund helps you stay financially steady when something unplanned affects your routine.

In this post, we explain what an emergency fund is, how much you may need, and simple steps to build one that supports you during difficult moments. Read on!

What Is an Emergency Fund?

An emergency fund refers to money you set aside to cover unplanned expenses. It is used when an unexpected expense requires immediate attention and your regular income is insufficient to cover the cost. In India, this often includes sudden medical bills, job loss, or urgent home repairs.

The fund’s purpose is to provide you with support in such situations without taking on debt or compromising your long-term savings. Maintaining this sum on hand safeguards your monthly budget and enables you to handle crises with ease.

Emergency loans can provide rapid access to money with less paperwork if your emergency reserve has run out and you still require assistance. These should, however, serve as an alternative to emergency savings rather than their replacement.

Need funds urgently? Download our Instant Loan App and complete your application in minutes!

How Much Should Your Emergency Fund Be?

Your monthly necessities determine the amount of your emergency fund. Reviewing your rent, electricity, food, and travel expenses will help you determine this. This provides a well-defined starting point for your savings goal.

Family size also changes your total requirement. A bigger family needs stronger financial protection. Job security also affects this, as unstable roles require higher savings. City costs also affect living expenses.

Most people save three to six months of expenses. This range gives steady support during sudden changes. You can choose a higher target if your job feels risky or seasonal.

For example, consider someone who spends ₹50,000 per month on basic needs. They first look at how steady their income feels. If it is stable and saves three months of expenses, or ₹1,50,000, it usually feels sufficient.

If their income changes during the year or they want extra safety, they may choose four months instead. That brings their target to ₹2,00,000 and provides a little more comfort in case of sudden expenses or short-term income delays.

Thinking of applying for a loan? Check your eligibility in minutes with our easy-to-use loan eligibility calculator!

Recommended Emergency Fund Amount

The table below gives a clear idea of the recommended emergency fund amount for different life situations:

| Scenario | Recommended Amount | Explanation |

| Single professional | Three months of expenses | Offers strong protection during a sudden income loss. |

| Married couple | Four months of expenses | Helps manage shared responsibilities effectively. |

| Family with children | Five months of expenses | Covers education and household requirements. |

| Unstable or contract job | Six months of expenses | Supports long-term uncertainty confidently. |

Also Read: 10 Quick and Proven Ways to Get Emergency Money Fast

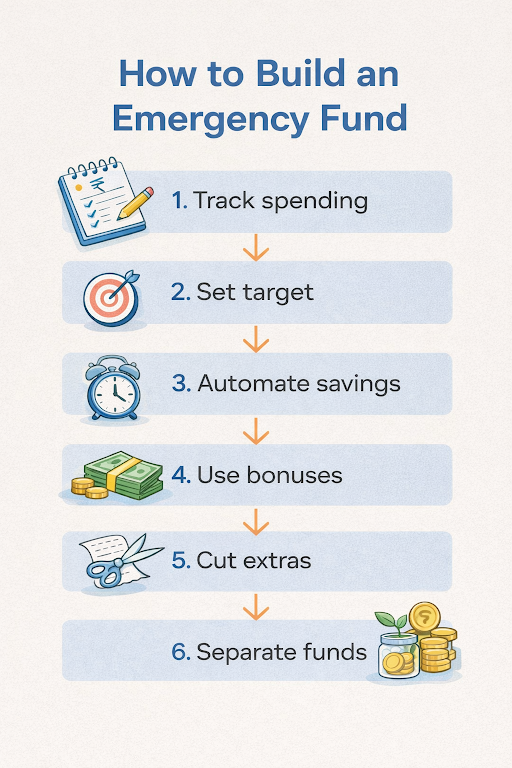

How to Build an Emergency Fund Step-by-Step?

Many Indians juggle rising costs, irregular income, and long-term commitments. You can grow the fund slowly with consistent effort and smart planning.

The steps below explain how to build an emergency fund without pressure.

Step 1. Review your monthly spending

Track expenses carefully each month to understand possible savings. This helps you remove unwanted costs. A clear view makes money planning easier.

Step 2. Set a realistic saving target

Choose a monthly sum that you are comfortable with. Modest contributions maintain long-term effectiveness. Large, sporadic deposits are less important than consistency.

Step 3. Automate your savings every month

Automatic transfers create discipline for regular contributions. This prevents skipped saving months. Automation supports busy schedules without extra effort.

Step 4. Use bonuses or festival income wisely

Direct some bonus money towards your emergency fund. Extra income accelerates progress quickly. This builds a stronger safety net.

Step 5. Cut short-term nonessential spending

Reduce occasional leisure costs temporarily. These small sacrifices help you save faster. You reach goals with better stability.

Step 6. Keep the fund separate from regular savings

Separate accounts prevent accidental spending. This clarity strengthens long-term commitment. You maintain discipline during tough periods.

When and How to Use Your Emergency Fund

Your emergency fund is meant for situations that need prior attention. These often include urgent medical needs, essential repairs, or months when income is temporarily affected. It offers support when decisions must be made quickly.

It is important to keep the fund for genuine emergencies rather than planned purchases. Once you use a portion of it, replenishing it helps restore your safety net for future needs.

| Do’s | Don’ts |

| Use it for unexpected and essential expenses | Spend it on planned or routine expenses |

| Keep the money accessible | Lock the fund in long-term or risky assets |

| Refill the fund after withdrawal | Ignore rising costs when reviewing the amount |

Common Mistakes to Avoid with Your Emergency Fund

Many people unknowingly make small mistakes with their emergency funds that seem harmless but can cause serious stress later. These errors occur in daily spending, especially when finances are already tight.

- Saving Too Little: A very small fund may not cover real emergencies, especially in cities with higher living costs. A clear target makes planning easier.

- Using it for Non-Emergencies: Buying gadgets or funding holidays from this fund weakens the purpose of having a safety cushion. Planned expenses need their own budget.

- Do Not Rebuild the Fund After Using It: Emergencies can recur. Restoring the amount keeps the fund effective for future unexpected needs.

- Keeping Money in Illiquid or Risky Investments: Placing emergency funds in long-term deposits, stocks, or other locked-in products makes it difficult to access funds quickly.

A quick review of these habits keeps your fund meaningful and always ready for unexpected situations.

Building Financial Calm for the Unexpected

Although an emergency fund cannot prevent unforeseen circumstances, it can help you address them calmly. It lessens anxiety when dealing with urgent repairs, health problems, or work-related issues. Being ready turns into a long-term financial advantage.

When your emergency fund falls short, you still deserve safe options. Hero FinCorp lets you explore personal loan offers based on your profile, so you understand what fits your situation before making a decision.

So why wait? Explore our personal loan options and make informed decisions with confidence!

Frequently Asked Questions

How fast can I access my emergency fund in India?

You can usually access it instantly through your savings account. Liquid funds may take a few extra hours depending on processing times.

Can I use my emergency fund for EMIs during financial stress?

Yes, if you face a temporary income loss and want to avoid missed payments. Refill the fund gradually once your income stabilises again.

Are liquid funds better than savings accounts?

Liquid funds generally offer higher returns than a basic savings account. However, withdrawals may take a few hours to process.

How often should I revise my emergency fund size?

Review your fund annually to keep pace with rising expenses. You should also recheck after job changes, marriage, or family changes.

Emergency fund vs sinking fund — what’s the difference?

A sinking fund covers planned expenses such as school fees or annual travel. An emergency fund covers sudden expenses such as medical bills or job loss.

Is a small emergency fund still helpful?

Yes, even a small fund provides short-term confidence during emergencies. The goal is to grow it steadily over time without pressure.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.