e-Aadhaar Card: Understanding, Downloading, and Verification by HeroFinCorp

- What is the e-Aadhaar Card? Your Digital Identity Explained

- Key Features of the e-Aadhaar Card

- Benefits of e-Aadhaar Over Physical Aadhaar Card

- How to Download e e-Aadhaar Card Online: A Step-by-Step Guide

- Downloading Your e-Aadhaar Using Aadhaar Number/Enrollment ID/Virtual ID

- Understanding the Aadhaar Password

- e Aadhaar Card Verification: Ensuring Authenticity

- The Value of e-Aadhaar for HeroFinCorp's Financial Services

- Streamlining KYC Processes for Loans and Other Services

- Making Financial Transactions More Accessible and Secure

- What if You Don't Have an Aadhaar Card?

- HeroFinCorp's Commitment to Digital Convenience and Security

- Frequently Asked Questions

Have you ever been in a situation where you couldn’t locate the hard copy of your Aadhaar card when you urgently needed it?

The e-Aadhaar card is useful in this situation. It is the password-protected digital version of your physical Aadhaar card, the official identity card that the Unique Identification Authority of India (UIDAI) issues.

With rapid digitization in the past few years, the idea of e-Aadhaar has made things quite convenient. Let's understand more about the concept of the e-Aadhaar card here.

What is the e-Aadhaar Card? Your Digital Identity Explained

Put simply, an e-Aadhaar is your Aadhaar card available in a digital format. Similar to a physical Aadhar card, it has all the essential information like biometric and demographic data, including your name, DOB, etc.

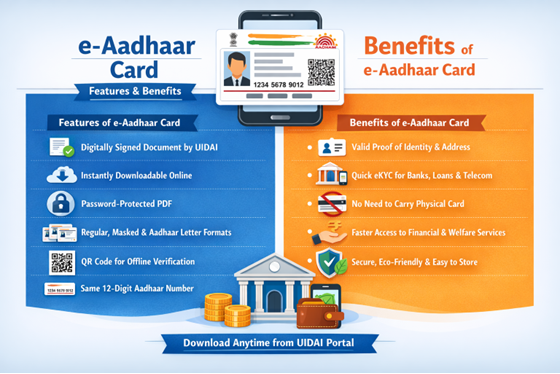

Key Features of the e-Aadhaar Card

It is an electronic copy of the Aadhaar card

Given to all Indian citizens by the Government of India

It is a 12-digit alphanumeric identity

Works similarly to the original Aadhaar card

Benefits of e-Aadhaar Over Physical Aadhaar Card

Below are some of the Aadhar advantages that can be very useful.

- 24/7 accessibility: The e-Aadhaar is available digitally, and you can access it anytime, anywhere

- Password protected: e-Aadhar has a password protection feature to prevent any kind of misuse

- Universal identity: The digital format of Aadhaar is a valid proof for identity and address for most processes across India

- Subsidy benefits: Aadhar is essential for accessing various government subsidies

Also Read: Aadhaar Card Loan: How to Apply Online Instantly in a Few Simple Steps

How to Download e e-Aadhaar Card Online: A Step-by-Step Guide

Downloading your e-Aadhaar online is a quick and convenient process. To begin the e-Aadhaar card download online, you need to visit the official UIDAI website and select the “Download Aadhaar” option.

Requirements for Downloading e-Aadhaar

Make sure you fulfill the following prerequisites in order to finish your e-Aadhaar download.

- Get your Aadhaar number or Enrollment ID (EID) ready.

- In order to obtain the OTP for verification, you must also have access to the cellphone number linked to your Aadhaar account.

- A stable internet connection

- A device capable of opening PDF files

Downloading Your e-Aadhaar Using Aadhaar Number/Enrollment ID/Virtual ID

Follow the instructions below to download an e-Aadhaar card using your Virtual ID (VID), Enrollment ID (EID), or Aadhaar number (UID):

- Go to the UIDAI website.

- Click My Aadhaar, then select Download Aadhaar from the drop-down menu.

- After inputting your UID, VID, or EID, select the masked Aadhar option.

- Once the security code has been entered, click "Send OTP."

- Once the obtained OTP has been entered, click "Download Aadhaar."

Understanding the Aadhaar Password

The e-Aadhaar card is password-protected to improve user security. The first four letters of your name, followed by the year of your birth, are the password to access the file. For instance, the password will be "MIRA1988" if your name is MIRA and your birth year is 1988.

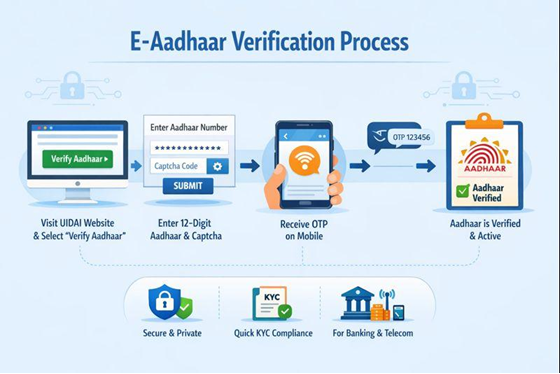

e Aadhaar Card Verification: Ensuring Authenticity

e-Aadhaar verification ensures authenticity by matching submitted details with the UIDAI database.

How to Verify the Aadhaar on the UIDAI Website

Use an e-Aadhaar number with OTP

You can also use biometrics (fingerprint/iris/face) for authentication

Verification through QR Code and mAadhaar App

QR code e-Aadhaar verification entails scanning the QR code on the printed e-Aadhaar using the myAadhaar app (or UIDAI QR Scanner) on your smartphone.

The Value of e-Aadhaar for HeroFinCorp's Financial Services

Lenders like HeroFinCorp now verify customer identities differently thanks to the eKYC process with e-Aadhaar. Borrowers can swiftly complete digital e-Aadhar verification in place of time-consuming paperwork and in-person verification.

Streamlining KYC Processes for Loans and Other Services

e-aadhar significantly speeds up the KYC processes for loan applications, reduces documentation errors, and improves approval turnaround times.

HeroFinCorp can provide a smooth onboarding process while guaranteeing complete regulatory compliance thanks to its instant identity and address verification features. Customers will benefit from quicker and less complicated loan access.

Also Read: Impact of Aadhar Card on Personal Loan

Making Financial Transactions More Accessible and Secure

The Aadhaar system enables safe financial transactions through its secure authentication system, which uses encrypted Aadhaar data. This system protects sensitive information while it reduces the possibility of fraudulent activities.

What if You Don't Have an Aadhaar Card?

Any person who lives in India can obtain an e-Aadhaar card through the application process. The documents required to apply for e Aadhar card include a valid proof of identity (POI), address (POA), and relationship (POR) documents for enrollment.

HeroFinCorp's Commitment to Digital Convenience and Security

HeroFinCorp’s commitment to digital convenience and user security is primarily rooted in delivering fast, simple, and secure financial experiences. Through well-designed and intuitive digital platforms, users can apply for instant personal loans and track repayments anytime, anywhere.

Contact us today to know more about us personal loan solutions.

Frequently Asked Questions

Is the Aadhaar legally valid?

The Aadhaar system establishes a complete identification system that provides both identity verification and residential address proof through its digital version, which contains UIDAI's digital signature.

Can I use a masked Aadhaar for verification?

The masked Aadhaar functions as a legal identification document that you can use for verification purposes.

How often can I download my e-Aadhaar?

The UIDAI website and mAadhaar app allow users to download their e-Aadhaar documents without any restrictions on the total number of downloads.