What Is CRISIL Rating: A Simple Guide for Investors and Borrowers

- Understanding CRISIL: The Full Meaning & Overview

- Beyond Ratings: CRISIL's Diverse Services and Functions

- The Indispensable Role of CRISIL Ratings for Businesses

- Empowering Investor Confidence and Market Trust

- Decoding CRISIL Mutual Fund Ratings and Rankings

- Key Parameters of CRISIL Mutual Fund Ranking Methodology

- Interpreting CRISIL Star Ratings for Savvy Mutual Fund Investing

- The Strategic Advantage of Relying on CRISIL for Your Financial Decisions

- HeroFincorp and CRISIL: Commitment to Informed Financial Solutions

- Hero FinCorp and CRISIL: Commitment to Informed Financial Solutions

- Frequently Asked Questions

- What is the primary difference between a credit rating and a mutual fund ranking by CRISIL?

- Does CRISIL rate companies in all sectors of the Indian economy?

- Are CRISIL ratings mandatory for all listed companies in India?

- How often are CRISIL ratings and mutual fund rankings updated?

- Can a CRISIL rating change over time, and what triggers such changes?

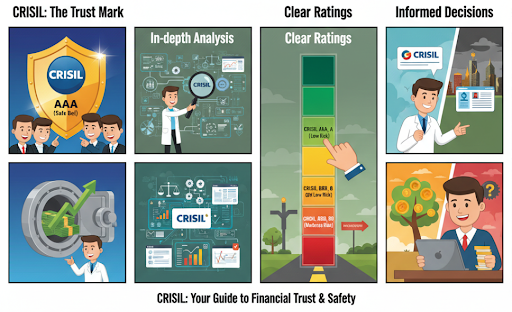

Think of CRISIL as the "ISI mark" or "Gold Hallmarking" for the world of finance.

If you were to lend ₹1 Lakh to a friend, you’d first think about their track record. Do they have a steady job? Have they paid you back before?

In the massive world of Indian finance, it’s impossible for an individual to check the background of every bank, company, or mutual fund.CRISIL ratings solve this by doing the heavy lifting for you, providing a clear score that tells you if an investment is a "Safe Bet" or a "Risky Gamble."

Understanding CRISIL: The Full Meaning & Overview

To understand whatCRISILis, we look back to 1987.CRISIL (Credit Rating Information Services of India Limited) was the country’s very first credit rating agency. Today, it is backed by S&P Global, one of the largest financial analysts in the world.

The CRISIL meaning is rooted in trust. It acts as an independent middleman that investigates the financial health of businesses. When a company wants to borrow money from the public or a bank, CRISIL looks at their account books, their management style, and their market position to assign them a rating. This helps keep the Indian financial ecosystem transparent and honest.

Beyond Ratings: CRISIL's Diverse Services and Functions

While most people recognise the name from star ratings on investment apps, CRISIL does much more than just score funds. Here is a breakdown of what they do:

- Credit Ratings: They assign codes like 'AAA' (the safest) to 'D' (default/risky) for companies issuing bonds or taking loans.

- Deep-Dive Research: They analyse over 80 different industries in India, helping businesses understand market trends.

- Risk Analytics: They provide complex data tools to help institutions like HeroFincorp manage their financial risks effectively.

- Consulting & Policy: They often work with the government to help plan large-scale infrastructure projects.

The Indispensable Role of CRISIL Ratings for Businesses

For a business, a high CRISIL ranking is a financial tool that saves them money.

- Makes Loans Cheaper: Just like a person with a high CIBIL score gets better credit card offers, a company with a high CRISIL rating can borrow money at much lower interest rates.

- Helps Pull in Investors: Large investors, like pension funds or insurance companies, often only invest in businesses that have a high CRISIL rating.

- Facilitates Trust Building: It acts as a public stamp of approval, proving that the company is managed professionally and is unlikely to go bankrupt.

Empowering Investor Confidence and Market Trust

When a company’s CRISIL ranking is strong, it creates a "halo effect." It reassures the general public that their money is being handled by a stable entity. This trust is what keeps the stock and bond markets moving smoothly, even during economic shifts.

Decoding CRISIL Mutual Fund Ratings and Rankings

If you are looking at mutual funds, you’ll encounter the CRISIL mutual fund rating. This is slightly different from a corporate credit rating. Instead of just checking if a company can pay its debts, the CRISIL Mutual Fund Ranking (CMFR) looks at how a fund performs compared to all other funds in the same category.

The focus here is on "Risk-Adjusted Returns." This means CRISIL doesn't just praise a fund for making high profits; they check if those profits were made by taking dangerous risks that could backfire later.

Key Parameters of CRISIL Mutual Fund Ranking Methodology

CRISIL doesn't just look at returns; they dive deep into the "how" and "why" of a fund's performance. It uses a multi-layered filter to decide a CRISIL MF ranking: Mean Return & Volatility. They look at the average profit and how much the fund’s value "swings" up and down.

Here are the main pillars they use for their assessment:

| Parameter | What it Measures | Why It Matters to You |

|---|---|---|

| Mean Return & Volatility | Average daily returns and how much the fund's value "swings" up and down. | Helps you avoid "rollercoaster" funds that are too unpredictable. |

| Portfolio Concentration | Whether the fund has too much money invested in just 1-2 companies or sectors. | Ensures your money is well-diversified and not overly reliant on one company. |

| Liquidity | How quickly the fund can sell its assets to pay you back in cash. | Ensures you can get your money out easily, even during a market panic. |

| Asset Quality | The credit strength of the companies to which the fund has lent money. | Essential for debt funds to ensure the borrowers won't default. |

| Tracking Error | For Index Funds, how accurately they mirror the Nifty or Sensex. | Confirms the fund manager is doing their job with precision. |

Interpreting CRISIL Star Ratings for Savvy Mutual Fund Investing

CRISIL uses a simple 1-to-5 star system to make it easy for everyone to understand.

| Rating | Meaning | Category Standing |

|---|---|---|

| 5 Stars | Very Good | Top 10% of funds in that category |

| 4 Stars | Above Average | The next 20% of funds |

| 3 Stars | Average | The middle 40% of funds |

| 2 Stars | Below Average | The next 20% of funds |

| 1 Star | Poor | The bottom 10% of funds |

The Strategic Advantage of Relying on CRISIL for Your Financial Decisions

Using a CRISIL rating or CRISIL ranking helps you make decisions based on facts rather than "gut feelings" or clever marketing. It helps you:

- Filter the Best: Instantly narrow down thousands of options to the top 10% or 20%.

- Verify Safety: Confirm if the company you are lending to is actually as stable as they claim to be.

- Stay Updated: Since rankings change, they serve as a "nudge" to review your portfolio every few months.

Note:You can find the latest what is CRISIL reports on their official website or on major financial news platforms.

HeroFincorp and CRISIL: Commitment to Informed Financial Solutions

At Hero Fincorp, we value the same principles of transparency and data-backed safety that CRISIL promotes. By keeping a close eye on CRISIL rating trends and industry research, we ensure that our financial solutions are grounded in reality. This commitment to "informed finance" is what allows us to offer responsible lending and build lasting trust with our customers.

Pro Tip: Don't just chase 5-star funds. Check if the fund has maintained at least a 3 or 4-star rating consistently for several years. Stability is often better than a one-time spike in performance.

Hero FinCorp and CRISIL: Commitment to Informed Financial Solutions

At Hero FinCorp, lending is built on transparency, discipline, and a strong understanding of risk. Aligning with the principles reflected in CRISIL ratings, Hero FinCorp focuses on responsible credit assessment, clear disclosures, and sustainable financial practices.

CRISIL’s independent evaluation framework underscores the importance of data-driven decisions, prudent risk management, and long-term stability, values that guide Hero FinCorp’s lending approach.

By combining market insights with customer-centric solutions, Hero FinCorp ensures borrowers receive financial support that is both reliable and well-structured.

If you are planning a major expense or need funds to manage changing priorities, exploring a personal loan from Hero FinCorp can be a practical next step.

Apply online and make a confident, informed financial decision today!

Frequently Asked Questions

What is the primary difference between a credit rating and a mutual fund ranking by CRISIL?

A credit rating checks if a company can pay back a loan, while a mutual fund ranking compares a fund's investment performance against its rivals.

Does CRISIL rate companies in all sectors of the Indian economy?

Yes, from giant steel plants and banks to smaller NBFCs and IT firms, CRISIL covers almost every sector.

Are CRISIL ratings mandatory for all listed companies in India?

Not for all, but for companies issuing certain debt instruments like "Non-Convertible Debentures" (NCDs), a rating is usually required by law.

How often are CRISIL ratings and mutual fund rankings updated?

Mutual fund rankings are updated every quarter (3 months), while company credit ratings are monitored year-round and updated as needed.

Can a CRISIL rating change over time, and what triggers such changes?

Absolutely. A rating might drop if a company takes on too much debt, or it might go up if its profits and management improve significantly.