Deferment Period in Annuity Plans: A Complete Guide

- What is a Deferment Period in an Annuity Plan?

- Deferred vs. Immediate Annuity: The Role of Deferment

- Duration of the Deferment Period in Annuity Plans

- Factors Influencing Your Deferment Period Choice

- Benefits of Choosing a Deferred Annuity Plan

- How to Strategically Choose Your Annuity Deferment Period

- Aligning with Your Retirement Timeline and Financial Goals

- Deferred Annuity vs Immediate Annuity: Key Differences

- HeroFincorp's Role in Your Holistic Retirement Planning

- Frequently Asked Questions

- What happens if I want to start my annuity payouts before the deferment period ends?

- Are all types of annuity plans eligible for a deferment period?

- How does inflation impact the value of my annuity payouts after the deferment period?

- Can I change my deferment period once the annuity plan has started?

- What are the surrender charges if I exit a deferred annuity plan early?

- Does HeroFincorp offer specific deferred annuity products directly?

Darshan, a 45-year-old working professional, plans to retire at 60 and has a solid corpus saved up. But he worries about outliving his savings.

If he buys an annuity plan today but doesn't need the income for another 15 years, he enters what is known as a deferment period. By waiting, he allows his money to grow. This ensures that when he finally hangs up his boots, his monthly pension is much larger than if he had started it today.

So, if you are looking to build a tension-free retirement in India, let's understand the deferment period to build a better corpus for a secure future.

What is a Deferment Period in an Annuity Plan?

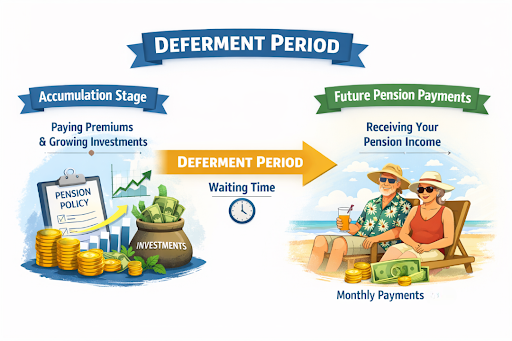

The deferment periodmeansthe "waiting time" between buying your policy and receiving your first pension payment. During this phase, you are in the "accumulation" stage. You pay your premiums, and the insurance company invests that money.

What is a deferment period in simple terms?

- The Wait: A gap where no payouts occur.

- The Growth: Your money gathers interest and bonuses.

- The Payout: The annuity deferment period ends when your regular income starts.

Deferred vs. Immediate Annuity: The Role of Deferment

The choice depends on your timing. An immediate annuity plan is like a "pay and get" system; you pay a lump sum and start getting paid next month. This is perfect for someone retiring tomorrow.

A deferred annuity plan is for those who still have years of service left. It uses the deferment period to compound your wealth, making it a favorite for long-term retirement planning.

Duration of the Deferment Period in Annuity Plans

The deferment period duration is flexible,ranging from 1 to 20 years. It usually aligns with your vesting Age, the age you want your pension to start (typically between 55 and 70 years).

Factors Influencing Your Deferment Period Choice

To choose a deferment period, look at your "income gap." If you have a child’s wedding in five years or a home loan to close, you might choose a deferment period that ends exactly when those liabilities disappear, giving you fresh cash flow right when you need it most.

Benefits of Choosing a Deferred Annuity Plan

Why wait for your money? There are several advantages of a deferment period:

- Power of Compounding: Money left untouched grows exponentially.

- Higher Returns: The longer the wait, the higher the "annuity rate" offered by the bank or insurer.

- Discipline: It prevents you from spending your retirement corpus on short-term luxuries.

One of the primary benefits of a deferred annuity is that it locks in your future income at current terms, protecting you from falling interest rates in the future.

Also Read: What is Personal Loan Deferment?

Amplified Growth and Enhanced Future Payouts

The most significant perk is higher annuity payouts. Because the insurer manages your funds for a decade or more, the growth during deferment allows them to provide a much larger monthly check than an immediate plan ever could.

Tax Benefits and Tax-Free Accumulation During Deferment

There are notable annuity tax benefits. During the deferment years, the internal growth of your investment is generally not taxed. This tax-free growth annuity structure ensures that 100% of your earnings stay invested to build your future wealth.

How to Strategically Choose Your Annuity Deferment Period

Smart retirement planning deferment requires balancing your current needs with future dreams.

- Check Your Age: If you are 40, a 15-20 year period is ideal.

- Estimate Expenses: Will you need more money at 60 or 70 years?

- Inflation: Pick a longer period to ensure your corpus is large enough to beat rising costs.

Aligning with Your Retirement Timeline and Financial Goals

Your retirement timeline should dictate the plan. If your financial goals include early retirement at 50, your deferment must be structured to end exactly then, ensuring no "dry spell" in your income.

Deferred Annuity vs Immediate Annuity: Key Differences

| When Payouts Start | After the deferment ends | At Present |

|---|---|---|

| Best for | Early planners (30s-50s) | Current retirees (60+) |

| Corpus Growth | High due to compounding | No growth phase |

| Investment | Single or regular premiums | Single lump sum only |

HeroFincorp's Role in Your Holistic Retirement Planning

The secret to a secure retirement isn't just saving; it's timing. By mastering the deferment period meaning, you can turn a modest sum into a lifelong safety net. Start your future financial planning today to ensure your tomorrow is as comfortable as Rajesh’s!

Planning for the long term often starts with managing the present well. If you need flexible funds today to keep your financial plans on track, Hero FinCorp’s personal loan options can help you bridge that gap thoughtfully. Apply here!

Frequently Asked Questions

What happens if I want to start my annuity payouts before the deferment period ends?

Most plans are designed for a fixed term. If you try to start payouts early, it is usually treated as a "surrender" or "early vesting." This often results in heavy penalties and a significantly smaller monthly pension than originally promised.

Are all types of annuity plans eligible for a deferment period?

No, all types of annuity plans are not eligible for a deferment period. Only Deferred Annuity plans have this feature. Immediate Annuity plans do not have a deferment period because they are designed to start paying you an income almost as soon as you pay the premium.

How does inflation impact the value of my annuity payouts after the deferment period?

Inflation reduces the purchasing power of your money over time. To protect yourself, it is wise to choose a longer deferment period to build a massive corpus or opt for an increasing annuity where the payout grows slightly every year.

Can I change my deferment period once the annuity plan has started?

Generally, no. Once the policy is issued and the "free-look" period (usually 15–30 days) ends, the deferment duration is locked in. It is critical to choose a timeline that matches your retirement goals from day one.

What are the surrender charges if I exit a deferred annuity plan early?

Surrender charges in the early years of a policy can be quite high, sometimes taking a large chunk of your invested principal. These charges usually decrease the longer you stay in the plan.

Does HeroFincorp offer specific deferred annuity products directly?

HeroFincorp focuses on providing retail and business financing solutions. While we don't sell annuity products directly, we provide financial solutions for retirement, like debt consolidation, that help you keep your retirement savings safe.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.