Bank Reconciliation Statement: Process, Examples & Tips

- Bank Reconciliation Statement Definition and Meaning

- Step-By-Step Process to Prepare Bank Reconciliation Statement

- Bank Reconciliation Statement Example

- Bank Reconciliation Statement

- Best Practices and Tips for Accurate Bank Reconciliation

- Ensure Accurate Cash Balances Through Bank Reconciliation

- Frequently Asked Questions

Your bank balance as per the cashbook and bank statement, rarely matches. But why? For an NBFC with a high transaction volume, even a small error can lead to significant issues. The differences could be due to timing issues, bank charges, or recording errors.

How to identify these errors?

A bank reconciliation statement (BRS) helps you match your internal records with your bank statement to identify and correct errors. Let’s find out what BRS is, how to prepare it, and best practices when preparing BRS.

Bank Reconciliation Statement Definition and Meaning

A bank reconciliation statement refers to a financial account to compare internal cash records of a company with the bank records to ensure that they match. It gives you details about what you think your bank account has and the actual balance in your bank account.

Differences between cash book and bank statement balances arise due to:

- Timing differences in recording transactions

- Errors or omissions in either record

- Transactions recorded by the bank but not yet in the cash book, or vice versa

Also Read: What is a UTR Number, Example & How to Check It?

Step-By-Step Process to Prepare Bank Reconciliation Statement

To create a bank reconciliation statement, you need a structured process to ensure accuracy.

Here’s a complete guide to preparing a bank reconciliation statement:

Gather Bank Statement and Cash Book Records

Collect all the necessary records to perform bank reconciliation:

- Bank statement for the reconciliation period

- Cash book of your company

- Register that shows issued checks

- Slips and receipts of deposits

- Reconciliation statement of the previous month

Compare Balances

Compare the ending balance in your cash book and your bank statement. Initially, the balances will not match most of the time. You have to identify the differences and record them.

- Match deposits or credits

- Compare withdrawals, payments, and charges by bank

- Cross-reference activities in the bank statement with your cash book to find missing transactions or errors

- Watch out for fraudulent recordings in your bank statement

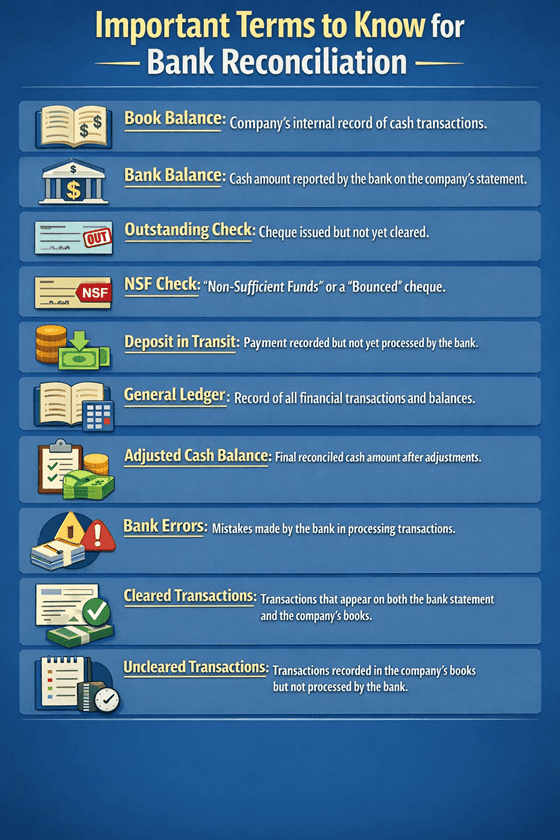

Identify Outstanding and Unrecorded Transactions

Look for transactions that are recorded in one but not in the other:

- Deposits in Transit: Money you have recorded as deposited in the bank but doesn’t appear in the bank statement. This is usually for deposits made at month end

- Outstanding Checks: Cheques you have recorded, but they haven’t been cashed by the receiver

- Bank Charges: Maintenance charges, service fees, or other charges that appear on your bank statement but not in your cash book

- NSF (Non-Sufficient Funds) Checks: Cheques that the customers returned, but the bank has deducted from your account

- Direct Deposits/Debits: Automatic transactions, such as EMI payments, that are processed in the bank but not recorded in your cash book

After identifying the transactions, make calculations and adjust both the balances:

Bank Side Adjustments:

Add deposits in transit

Subtract outstanding cheques

Cash Book Adjustments:

Add direct deposits, interest earned, and collected notes

Subtract NSF cheques, Bank charges, and automatic payments

Reconcile Adjusted Balances

After making all the adjustments, check if the revised cash book balance matches the adjusted bank statement balance. If there are errors, repeat the process.

Record the Reconciliation

Keep track of all the modifications, including the adjustment procedure, source documents, and reconciliation information. Keep a record of the mistakes and changes you made so you can refer to them later.

Read More: Loan Settlement vs Loan Closure: Key Differences, Rules & Impact

Bank Reconciliation Statement Example

Here’s the standard format for a bank reconciliation statement:

[COMPANY NAME] BANK RECONCILIATION STATEMENT [DATE] |

|

|

|

Balance per bank statement | ₹X,XXX |

Add: Deposits in transit | ₹X,XXX |

Less: Outstanding checks | (₹X,XXX) |

Adjusted bank balance | ₹X,XXX |

|

|

Balance per cash book | ₹X,XXX |

Add: Bank credits not recorded | ₹X,XXX |

Less: Bank charges not recorded | (₹X,XXX) |

Adjusted book balance | ₹X,XXX |

Adjusted book balance

₹X,XXX

Let's use a hypothetical scenario to better understand the procedure:

The following items are being prepared for a bank reconciliation by ABC Company:

- The bank statement shows a balance of ₹300,000 as of November 30, 2025.

- The company's ledger shows a total balance of ₹260,900.

- Bank statement has a ₹100 service charge

- Bank statement includes interest income of ₹20

- Vendor X issued cheques of ₹50,000 not yet cleared by the bank

- Vendor X deposited ₹20,000, but it does not appear on the bank statement

- A cheque for the amount of ₹470 issued to the office supplier was misreported in the cash payments journal as ₹370.

- The bank collected a note receivable worth ₹9,800.

- A check of ₹520 deposited by the company is charged back as NSF.

| Amount | Adjustment to books |

Ending Bank Balance | ₹300,000 |

|

Deduct: Uncleared cheques | – ₹50,000 | None |

Deduct: Uncleared cheques | + ₹20,000 | None |

Adjusted Bank Balance | ₹270,000 |

|

Ending Book Balance | ₹260,900 |

|

Deduct: Service charge | – ₹100 | Debit expense, credit cash |

Add: Interest income | + ₹20 | Debit cash, credit interest income |

Deduct: Error on check | – ₹100 | Debit expense, credit cash |

Add: Note receivable | + ₹9,800 | Debit cash, credit notes receivable |

Deduct: NSF check | – ₹520 | Debt accounts receivable, credit cash |

Adjusted Book Balance | ₹270,000 |

|

Bank Reconciliation Statement

After reconciling entries, here’s how the bank reconciliation statement is prepared:

Bank Reconciliation Statement |

|

|

ABC Company Bank Reconciliation Statement Month Ended November 30, 2025 |

|

|

Cash balance as per the bank statement, November 30, 2025 |

| ₹300000 |

Add: Deposit in transit |

| ₹20000 |

|

| ₹320000 |

|

|

|

Deduct: Outstanding Cheques |

| (₹50000) |

Adjusted cash balance |

| ₹270000 |

|

|

|

Balance as per depositor’s record, November 30, 2025 |

| ₹260900 |

Add: Receivable collected by the bank | ₹9800 |

|

Interest earned | ₹20 | ₹9820 |

|

| ₹270720 |

Deduction: NSF cheque | (₹520) |

|

Service charges | (₹100) |

|

Error on the cheque | (₹100) | (₹720) |

|

|

|

Adjusted cash balance |

| ₹270000 |

Read More: Different Types of Personal Loans in India

Best Practices and Tips for Accurate Bank Reconciliation

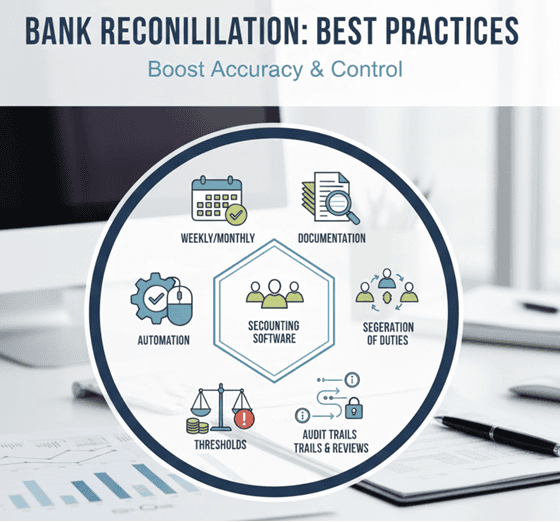

Here are the best procedures for creating a bank reconciliation statement in order to keep correct records and spot inconsistencies early:

Regular Reconciliation Frequency

Delays in reconciliation make it difficult to spot cash flow errors in a timely manner. Prepare a bank reconciliation statement monthly. If your business has a higher volume of transactions, prepare a BRS weekly. Set specific dates and prepare a BRS to catch errors and differences on time.

Maintain thorough Documentation

- Record every adjusted transaction or correction:

- Screenshots or copies of the supporting documentation

- Justifications for each modification you make, together

- Name of the person who completed the reconciliation and the date it was completed

- Clear notes for any recurring errors or unusual patterns

Use Accounting Software for Automation

As your NBFC grows, the volume and complexity of transactions increase. The manual reconciliation process has an error rate of 5-10%. To avoid this, use accounting software for automation. These solutions can match transactions, find out discrepancies, and flag errors for review.

Segregation of Duties

- Segregate duties to ensure strong internal controls. The person who performs reconciliation should not be the one who:

- Manages cash payments or deposits

- Signs cheques to authorise payments

- Has access to online banking

- Ensure that a manager or supervisor reviews all the adjustments.

Establish Materiality Thresholds for Discrepancies

You do not need to perform checks for every small discrepancy. Set clear thresholds for:

When differences need immediate attention

When they should be noted and monitored

Audit Trails and Reviews

- Maintain a clear path of every transaction from initiation to recording:

- Organise filing systems

- Use consistent reference numbers

- Maintain supporting documents

Tip: Link BRS modifications to the supporting papers using digital document management systems.

Ensure Accurate Cash Balances Through Bank Reconciliation

A bank reconciliation statement is an internal control tool for making sure your cash records are accurate.

Compare the cash book with the bank statement to identify and correct errors. Create a regular schedule, monitor documentation, assign tasks, and use automation to improve accuracy and efficiency.

A personal loan, in this regard, offers the necessary assistance anytime your business needs funds to manage disrupted cash flows. With Hero FinCorp, you can access flexible financing options designed to help you stay financially stable and focused on growth.

So why wait? Explore our loan options and take the next step with confidence!

Frequently Asked Questions

What is the purpose of a bank reconciliation statement in NBFCs?

It ensures accuracy of cash balances, supports regulatory compliance, and ensures strong internal controls in NBFC operations.

How often should businesses in India prepare bank reconciliation statements?

Businesses should prepare BRS monthly. In case of large transaction volumes, prepare a BRS every week.

What are outstanding cheques, and how do they affect the reconciliation?

They are cheques issued but not yet cleared by the bank, causing temporary balance differences.

Are bank reconciliation statements able to identify fraud?

You can identify anomalies, including missing deposits, altered checks, and unauthorised withdrawals. This helps identify errors and fraud.

What distinguishes account reconciliation from bank reconciliation?

Account reconciliation verifies that the accounting records and financial statements are in agreement. The aim of bank reconciliation is to match the bank statement with the cash account in your business's accounting records.

Does bank reconciliation in India require the use of accounting software?

No, accounting software is not required for bank reconciliation; nonetheless, it saves time and minimizes errors.