Overdraft Facility Meaning, Features, and How it Works

- What Is an Overdraft Facility?

- Types of Overdraft Facility

- Key Features of an Overdraft Facility

- Overdraft Facility Interest Rates and Charges in India

- Eligibility Criteria for Overdraft Facility

- How Does an Overdraft Facility Work?

- Overdraft Facility vs Business Loan: Key Differences

- Documents Required for Overdraft Facility

- Manage Short-Term Cash Gaps with Confidence

- Frequently Asked Questions

Rahul planned to buy an iPhone and have it delivered on the same day he received his salary. But the delivery tracker showed it would arrive a day earlier. Now, he has no money to pay the delivery agent and is very tense. He does not want to borrow money from a friend, and he doesn't want to take out a loan for one day. This is where many people feel stuck.

An overdraft facility helps in such moments. It allows you to use extra funds from your bank account when your balance runs low. You use it only when required and repay it once money comes in. For individuals and businesses alike, it acts as a short-term safety net rather than long-term debt.

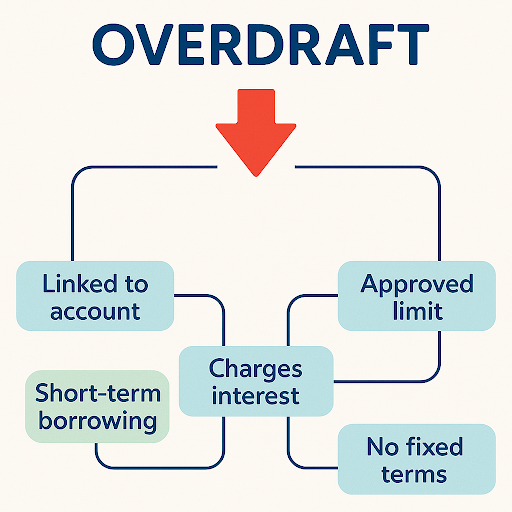

What Is an Overdraft Facility?

An overdraft facility allows you to withdraw more money than what is available in your savings or current account, up to a pre-approved limit. In simple terms, it lets you use extra funds directly from your bank account.

The meaning of the overdraft facility becomes clearer when you think of it as a temporary extension of your balance. You are not given a lump sum like a loan. Instead, the facility stays available, and you use it only when required. Once you repay the amount, the limit becomes available again.

This is why an overdraft facility differs from a loan. Loans are structured for long-term needs and come with fixed EMIs. An overdraft is flexible and short-term. You repay based on your cash flow, not a fixed monthly commitment.

For example, if an expense is large and urgent, and the gap is long-term, many people consider structured options through a Personal Loan App, which offers a fixed amount and predictable repayment. An overdraft works best when the gap is temporary.

In India, individuals often use overdraft facilities for medical expenses, education payments, or sudden household needs. Businesses use them to manage working capital or delayed client payments.

Types of Overdraft Facility

Overdrafts come in two types, depending on what you can offer and how you plan to use the funds.

1. Secured Overdraft

A secured overdraft is backed by collateral. Since the lender has security, interest rates are usually lower, and credit limits are higher. This option works well for borrowers who own assets.

There are five types of secured overdraft facilities to choose from -

Overdraft Against Property

In this type, residential or commercial property is used as security. It offers higher limits and relatively lower interest rates. This suits business owners who need flexible working capital.

Overdraft Against Fixed Deposit

Your fixed deposit acts as collateral, usually allowing a limit of up to 90% of its value. This option helps you access funds without breaking your deposit.

Overdraft Against Insurance Policy

Certain life insurance policies offer overdraft facilities based on surrender value. This provides temporary liquidity without affecting long-term policy benefits.

Overdraft Against Salary

Salaried individuals with stable income can access overdrafts linked to their salary account. Limits depend on monthly income and employer profile.

Overdraft Against Equity Shares or Mutual Funds

Here, your investments act as collateral. Limits depend on market value and asset type. This suits investors who prefer not to sell holdings during short-term needs.

2. Unsecured Overdraft

An unsecured overdraft does not require collateral. Approval depends on income stability and credit score. Interest rates are higher, but access is quicker for eligible applicants.

Each overdraft facility in India suits a different need. The right choice depends on how often you need funds and what assets you have.

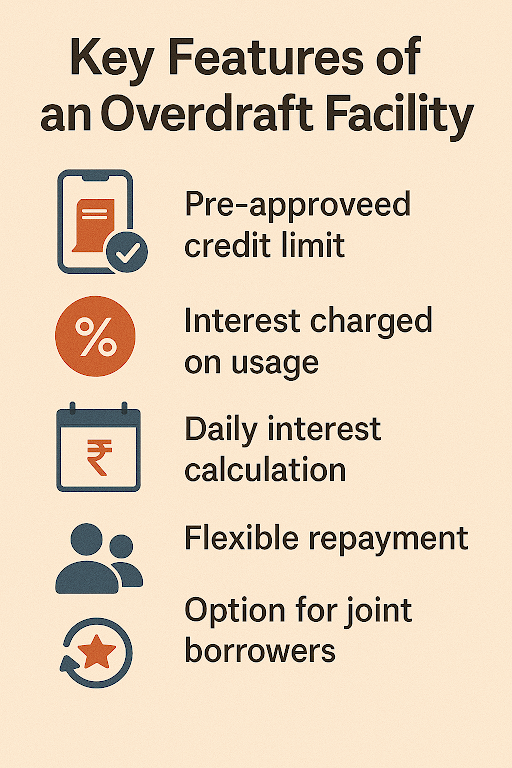

Key Features of an Overdraft Facility

The overdraft facility features are designed for flexibility and control.

- A pre-approved credit limit linked to your account

- Interest is charged only on the amount you use

- Daily interest calculation with monthly billing

- No fixed EMIs or rigid repayment schedules

- Minimal prepayment or foreclosure charges

- Option to add joint borrowers

- Credit score impact based on usage behaviour

When used responsibly, an overdraft supports cash flow instead of becoming a burden.

Overdraft Facility Interest Rates and Charges in India

The overdraft facility interest rate depends largely on how the facility is structured. Secured overdrafts usually come with lower rates because assets back the credit. Unsecured overdrafts cost more since they rely only on income and credit profile.

In India, overdraft interest rates generally fall between 9% and 18% per year. Where you land within this range depends on your credit score, income stability, collateral value, and the lender you choose.

Apart from interest, overdraft facility charges may include a processing fee at the time of setup and a renewal fee when the facility is reviewed. Some lenders may also apply penalty charges if you exceed the approved limit or delay repayments.

| Lender | Facility Type | Interest Range |

| SBI | Secured and Unsecured | 9% to 14% |

| HDFC Bank | Secured and Unsecured | 10% to 16% |

| Axis Bank | Secured and Unsecured | 11% to 17% |

| Hero FinCorp | Secured and Unsecured | Based on the borrower profile |

The key is not just the rate, but how comfortably you can manage usage and repayment.

Eligibility Criteria for Overdraft Facility

Overdraft facility eligibility depends on your financial stability and credit behaviour.

Basic requirements usually include:

- A savings or current account

- Minimum age as per lender policy

- A steady source of income

- Indian residency

Beyond this, lenders look closely at your credit score, especially for unsecured overdrafts. A stronger profile improves approval chances and interest terms.

You will also need documents such as identity proof, address proof, income proof, and recent bank statements. For secured overdrafts, collateral documents are mandatory. Businesses may need GST registration and financial records.

How Does an Overdraft Facility Work?

Understanding how the overdraft facility works helps you use it correctly and avoid unnecessary interest costs.

Step 1: A limit is set on your bank account

The lender approves a fixed overdraft limit and links it to your savings or current account. This limit is the maximum extra amount you can use when your balance falls short.

Step 2: Your account can go below zero

Once the facility is active, you can withdraw money even if your account balance is low or zero. The amount you use beyond your balance comes from the overdraft limit.

Step 3: You use only what you need

You are not required to withdraw the full limit. You can use a small amount for a short time, depending on your cash requirement. This makes the overdraft facility suitable for temporary gaps.

Step 4: Interest applies only to the used amount

Interest is calculated daily on the amount you actually use, not on the entire approved limit. If you do not use the overdraft, no interest is charged.

Step 5: Repayment happens automatically

When money comes into your account, such as salary or business receipts, the used overdraft amount gets adjusted automatically. There is no fixed EMI to follow.

Step 6: The limit becomes available again

Once you repay the used amount, the overdraft limit is restored. You can use it again whenever another short-term need arises.

Step 7: The facility is reviewed periodically

The lender reviews your overdraft usage from time to time. Responsible usage and timely repayment may lead to renewal or an increase in the limit.

Used correctly, this overdraft facility process helps manage short-term cash gaps without fixed EMIs or long-term commitment.

Overdraft Facility vs Business Loan: Key Differences

A business loan gives a lump sum with fixed EMIs. An overdraft offers flexibility.

| Aspect | Overdraft Facility | Business Loan |

| Usage | As required | One-time |

| Repayment | Flexible | Fixed |

| Interest | On the used amount | On the full amount |

| Flexibility | High | Limited |

Choose based on whether your need is ongoing or specific.

Documents Required for Overdraft Facility

The overdraft facility documents required usually include:

- Aadhaar and PAN

- Address proof

- Income proof or bank statements

- Business documents, if applicable

- Collateral documents for secured overdrafts

Manage Short-Term Cash Gaps with Confidence

An overdraft facility works best when used thoughtfully. It gives you access to funds during temporary shortages without locking you into long-term debt. When managed well, it supports cash flow and keeps your finances steady.

If you need a large sum of money for personal or business needs, Hero FinCorp offers the best paperless borrowing with just a few clicks. Apply here.

Also Read: What Is a Demand Loan and How It Works

Frequently Asked Questions

Can I get an overdraft facility without collateral?

Yes. Unsecured overdrafts are available based on income and credit score.

How is interest calculated on an overdraft facility?

Interest is calculated daily on the amount used.

What is the maximum overdraft limit?

The maximum overdraft limits depend on income, collateral, and lender policy.

Can an overdraft impact my CIBIL score?

Yes. Responsible usage helps. Misuse can hurt your score.

How quickly is an overdraft approved?

Unsecured overdrafts can be approved within a few working days.

Is there any tax benefit for overdraft users?

Interest may be deductible for business use, subject to tax rules.

Can I use overdraft through internet banking?

Yes. Most lenders support digital usage.

How is an overdraft facility different from a credit card?

An overdraft links to your bank account and charges interest only on usage.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.