What is Loan Amortization and How It Works?

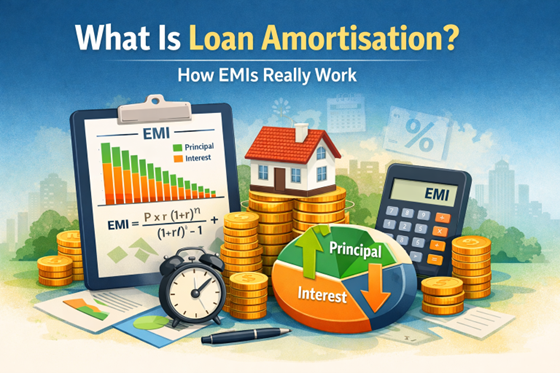

Most borrowers know their EMI amount. Very few understand what actually happens to that money every month. One part pays interest. The other reduces the loan. The proportion between the two keeps changing over time.

This changing split is called loan amortisation. It quietly determines how expensive your loan really is. When you understand it, you make smarter repayment and prepayment decisions. When you ignore it, interest continues to eat into your money without you noticing.

What Is Loan Amortisation?

Loan amortisation is the process of repaying a loan through fixed, regular installments.

Essentially, each EMI installment consists of two parts. One covers the interest charged for that month. The other reduces the outstanding loan amount.

In the early months, most of your EMI goes towards interest. As the loan balance falls, the interest portion reduces. Now, a greater share of the installment goes into principal repayment. This pattern continues until the loan is fully paid off.

Amortisation Formula and Calculation

Most Indian loans use the standard EMI formula for amortisation:

EMI = P × r × (1 + r)ⁿ ÷ [(1 + r)ⁿ − 1]

Where:

- P = Loan principal

- r = Monthly interest rate (annual rate ÷ 12)

- n = Total number of EMIs

This loan amortisation formula ensures your EMI stays fixed. You make a standard installment, and the interest-principal mix changes each month.

For example, if you take a ₹5 lakh loan at 19% annual interest for 3 years, the monthly interest rate is about 1.58%, and the tenure is 36 months. Using the formula, the EMI comes to roughly ₹18,400, which remains fixed while the interest portion gradually decreases and the principal repayment increases each month.

How Does Loan Amortisation Work?

Loan amortisation spreads repayment across the loan tenure while gradually shifting the burden from interest to principal.

Here's how it works for a ₹15 lakh personal loan at 19% interest for 3 years. The EMI instalment remains approximately ₹55,200 per month, while the interest share decreases and the principal repayment increases with each passing month.

This is how loan amortisation works:

| Stage in Loan | What's Happening | Interest Portion | Principal Portion | Outstanding Loan |

|---|---|---|---|---|

| Loan Start (Month 0) | Loan is disbursed | – | – | ₹15,00,000 |

| First EMI (Month 1) | Interest on full loan | ~₹23,750 | ~₹31,450 | ~₹14,68,550 |

| Second EMI (Month 2) | Interest reduces slightly | ~₹23,200 | ~₹32,000 | ~₹14,36,550 |

| Third EMI (Month 3) | Principal share rises slowly | ~₹22,700 | ~₹32,500 | ~₹14,04,050 |

| … | Same EMI continues every month | … | … | … |

| After 6 Months | Balance steadily declines | ~₹20,800 | ~₹34,400 | ~₹12,95,000 |

| … (1 year passes) | EMI pattern repeats | … | … | … |

| Month 12 (1 Year) | Interest meaningfully lower | ~₹17,600 | ~₹37,600 | ~₹10,80,000 |

| … | System keeps shifting | … | … | … |

| Month 18 (Midpoint) | Interest & principal closer | ~₹14,000 | ~₹41,200 | ~₹7,50,000 |

| … | Principal starts dominating | … | … | … |

| Month 24 (2 Years) | Majority goes to principal | ~₹9,800 | ~₹45,400 | ~₹4,30,000 |

| … | Interest keeps shrinking | … | … | … |

| Month 30 | EMI largely principal | ~₹5,500 | ~₹49,700 | ~₹1,90,000 |

| Final EMIs | Interest almost negligible | ~₹1,500 → ₹0 | Nearly full EMI | ₹0 |

Advantages of Loan Amortisation

Knowing how amortisation works changes how you borrow and repay.

Here are the real benefits of loan amortisation:

- Better budgeting because you know how much of your EMI actually reduces debt

- Smarter prepayment decisions because you can save more interest early in the loan

- Clear view of interest load so you understand the true cost of borrowing

- Improved tax planning since interest deductions depend on the loan structure

- Better loan comparison because a lower EMI does not always mean a cheaper loan

How Prepayment Affects Your Amortisation Schedule

Suppose you prepay ₹2 lakh on the same ₹15 lakh loan after 1 year. Your outstanding drops sharply. Because interest is calculated on the remaining balance, all future EMIs contain less interest.

You can either reduce the EMI or shorten the tenure. In both cases, you pay far less interest overall. Prepayment works best when done early, when interest makes up most of your EMI.

Additionally, prepayment shifts the amortisation curve in your favour much faster. Since early EMIs are interest-heavy, even a single lump-sum prepayment in the first year can eliminate several months' worth of interest that would otherwise be paid later. This not only reduces your total loan cost but also accelerates equity build-up, giving you greater financial flexibility sooner.

With the Hero FinCorp personal loan calculator, you can instantly see how your EMI, tenure, and interest change!

How Amortisation Shapes Your Loan Cost

Loan amortisation shows you where your money actually goes. It shows how interest declines and ownership increases with each EMI. When you understand it, you borrow smarter, prepay at the right time, and save more.

At Hero FinCorp, we help you see this clearly before you commit. With our personal loan calculator, you can instantly understand how your EMI, tenure, interest rate, and prepayments affect the total loan cost.

Also, if you need funds, we offer flexible loan options designed to match different needs-choose the one that fits you best and apply today!

Frequently Asked Questions

Is my EMI the same for the entire loan tenure?

Yes. In amortised loans, EMI stays constant while interest and principal portions change.

Does amortisation apply to credit card debt?

No, amortisation does not apply to credit card debt. Credit cards follow a revolving interest model where interest is charged on the outstanding balance without a fixed repayment schedule.

How can I get my loan amortisation schedule?

Your lender provides it. You can also generate it using online EMI calculators.

Does the interest portion increase or decrease over time?

It decreases over time as the outstanding loan balance reduces with each EMI. As interest falls, a larger portion of the EMI goes toward principal repayment.

How does a loan amortisation calculator work?

It uses your loan amount, rate, and tenure to show EMI and monthly breakup.

It not only helps you understand how your loan reduces over time but also lets you see how changes in tenure or prepayments affect your total interest cost.