What Is FCRA?

- What Is FCRA? Understanding the Foreign Contribution (Regulation) Act

- The Core Objectives and Purpose of FCRA Law in India

- Historical Context and Enactment of FCRA 2010

- Key Provisions and Chapters of FCRA Law (FCRA 2010)

- FCRA Registration: Obtaining and Managing Your Certificate

- Strict Controls on FCRA Accounts, Intimation, and Audit

- Penalties and Offences under FCRA Law

- FCRA Compliance: Essential Guidelines for Organizations

- Amendments and Key Changes to FCRA Law

- The Mandatory FCRA Account and Its Implications

- Who Needs to Comply with FCRA Law? Entities and Prohibitions

- HeroFincorp's Perspective on Financial Transparency and FCRA Law

- Frequently Asked Questions

Green Roots is an NGO in rural India that is focused on sustainable farming. A well-wisher from a foreign country wants to donate £10,000 for building a new irrigation system. Without understanding the FCRA, Green Roots might simply accept the transfer into its regular bank account.

Six months later, they could face frozen accounts, heavy penalties, or even a total ban on operations. In India, every penny from a foreign source is regulated by a specific legal watchdog: the Foreign Contribution (Regulation) Act.

What Is FCRA? Understanding the Foreign Contribution (Regulation) Act

The FCRA's meaning is simple. It is a law that monitors and regulates how individuals, associations, and companies in India accept and use foreign contributions.

A foreign contribution can be:

- Currency: Any donation or transfer of money, foreign or Indian, from a foreign source.

- Articles: Any gifted item (like computers or vehicles) whose value exceeds a specific limit (currently ₹25,000).

- Securities: Foreign shares, bonds, or debentures.

Essentially, the FCRA law ensures that foreign funds do not influence India’s social, political, or religious fabric in a manner that harms the national interest.

Also Read: What is the Fair Credit Reporting Act?

The Core Objectives and Purpose of FCRA Law in India

The primary purpose of the FCRA is to safeguard the "sovereign democratic republic" of India. The government wants to ensure that foreign funding is used strictly for its declared purpose. It could be social, educational, or cultural and is not diverted for:

- Anti-national activities or disrupting public order.

- Influencing elections or political processes.

- Illegal conversions or creating communal disharmony.

Historical Context and Enactment of FCRA 2010

Here is how the FCRA has evolved over the years:

1976: Origins

- Enacted during the Emergency era.

- The primary objective was the prevention of foreign interference in Indian elections and political affairs.

Evolutionary Gap

The 1976 Act became outdated as the global financial landscape changed, requiring tighter controls.

2010: Total Overhaul

- Repealed the 1976 Act and enacted FCRA 2010.

- Introduced more rigorous compliance and reporting standards.

Key Changes in 2010

- Registration Validity: Shifted from permanent status to a 5-year renewal cycle.

- Oversight: Established a structured audit and monitoring mechanism.

- Authority: Centralised control under the Ministry of Home Affairs (MHA).

Short on funds? Download our instant loan app and apply for a loan in minutes!

Key Provisions and Chapters of FCRA Law (FCRA 2010)

The FCRA 2010 is divided into several chapters that define who can receive money and how they must report it.

Regulating the Acceptance of Foreign Contributions and Hospitality

- Hospitality: If you are a high-ranking official or politician travelling abroad on a foreign invitation, you must seek prior MHA permission for foreign hospitality, be it boarding or lodging.

- Usage Cap: Organizations cannot spend more than 20% of their foreign funds on administrative expenses such as salaries, rent, etc. This ensures 80% goes to the actual cause.

Also Read: What is the Transfer of Property Act (TPA)?

FCRA Registration: Obtaining and Managing Your Certificate

To legally receive foreign funds, an entity needs an FCRA certificate.

- Eligibility: The entity must have been in existence for 3 years and have spent at least ₹15 lakhs on its core activities.

- Registration vs. Prior Permission: Long-term NGOs apply for registration, which is valid for 5 years. New organisations can apply for Prior Permission for a specific project from a specific donor.

- FCRA Renewal: You must apply for renewal 6 months before your 5-year term expires.

Strict Controls on FCRA Accounts, Intimation, and Audit

- The SBI Account: Every organisation must open a designated "FCRA Account" at the State Bank of India (SBI), Main Branch, New Delhi. All foreign funds must land here first.

- FCRA Audit: Associations must maintain separate books of accounts for foreign funds and file an Annual Return (Form FC-4) within 9 months of the financial year-end.

Penalties and Offences under FCRA Law

Violations of fcra law are taken very seriously:

- Seizure: Any article or currency received in violation can be confiscated.

- Imprisonment: Offences can lead to jail time of up to 5 years.

- Cancellation: Fraudulent registration or misutilisation leads to the permanent cancellation of the FCRA license.

Need funds fast? Check your eligibility in minutes with Hero FinCorp’s loan eligibility calculator now!

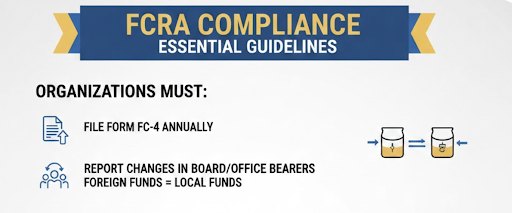

FCRA Compliance: Essential Guidelines for Organizations

Maintaining FCRA compliance is an ongoing process. Organisations must:

- File Form FC-4 annually, even if zero foreign funds were received.

- Report any change in the Board of Directors or office bearers to the MHA.

- Ensure foreign funds are never mixed with local funds.

Amendments and Key Changes to FCRA Law

The latest FCRA rules (2020/2022 amendments) introduced two massive shifts:

- No Transfers: An FCRA-registered NGO can no longer "sub-grant" or transfer foreign funds to another NGO, even if the second one also has an FCRA license.

- Aadhaar Requirement: It is now mandatory to provide Aadhaar numbers for all key office bearers.

The Mandatory FCRA Account and Its Implications

The FCRA SBI account rule was designed to centralise monitoring. By funnelling all foreign money through a single branch in Delhi, the MHA can track the "trail of money" in real-time, significantly reducing the risk of money laundering.

Who Needs to Comply with FCRA Law? Entities and Prohibitions

Not everyone is allowed to take foreign money. The law draws a clear line:

| Allowed (With Registration) | Strictly Prohibited |

|---|---|

| Registered Trusts & Societies | Candidates for Election |

| Section 8 Companies | Members of Legislatures (MPs/MLAs) |

| Educational/Religious Institutions | Journalists, Columnists, or News Media |

| Social Welfare Organizations | Government Servants & Judges |

HeroFincorp's Perspective on Financial Transparency and FCRA Law

Just as businesses must follow KYC and AML (Anti-Money Laundering) norms, NGOs must adhere to FCRA to ensure that development in India remains self-determined and secure.

At Hero Fincorp, we believe that financial transparency is the bedrock of a healthy economy. While we focus on empowering businesses through financing, we recognise that FCRA compliance is vital for the integrity of the social sector. Get in touch with us for more info!

Frequently Asked Questions

What kind of organisations are required to register under FCRA?

Registration is required for any NGO, Trust, or Society intending to accept foreign donations for cultural, economic, educational, religious, or social programs.

What happens if an organisation fails to comply with FCRA?

The MHA can suspend the registration for 180 days, cancel it entirely, or prosecute the office bearers in case of non-compliance.

Can an individual accept foreign contributions?

Yes, but only for personal use (gifts under ₹25k) or for specific purposes like scholarships/medical treatment, provided they follow reporting rules for large amounts.

How does FCRA differ from PMLA?

FCRA regulates the source and use of foreign money for specific social purposes. PMLA (Prevention of Money Laundering Act) is a broader criminal law aimed at preventing the conversion of any "proceeds of crime" into legal assets.

Does HeroFincorp assist with FCRA registration?

No, HeroFincorp provides financial services and business loans. For FCRA registration, you should consult a legal expert or the official MHA portal.

Disclaimer: The information provided in this is for informational purposes only. While we strive to present accurate and updated content, travel conditions, weather, places to visit, itineraries, budgets, and transportation options can change. Readers are encouraged to verify details from reliable sources before making travel decisions. We do not take responsibility for any inconvenience, loss, injury, or damage that may arise from using the information shared in this blog. Travel involves inherent risks, and readers should exercise their judgment and caution when implementing recommendations.