What Is APR & How Is It Calculated?

Say you've spotted a low interest rate and think you’ve struck gold? Well, not so fast. While interest rates grab attention, they only show part of the picture. The real secret to borrowing smart is understanding your APR (Annual Percentage Rate).

Whether you’re covering tuition fees, tackling a sudden home repair, or consolidating debt, knowing your APR gives you the true cost of your loan: fees, charges, and all.

Read on as we break down what APR really means and the simple steps to calculate it before you sign on the dotted line.

What Is APR In a Personal Loan?

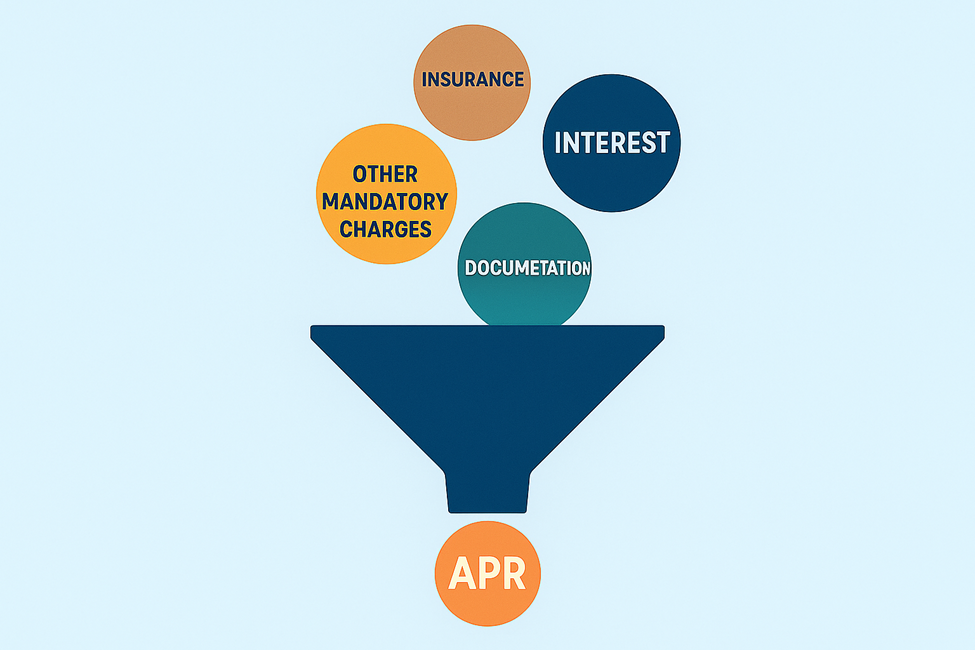

The APR (Annual Percentage Rate) is the total annual cost associated with an amount by way of loan that you are applying for. Interest rate, processing charges, documentation charges, insurance premiums, and any other incidental expenses are all included in the said term.

Simply put, it's everything you’ll actually pay for the borrowed amount, expressed as a percentage. If the interest rate is the movie ticket at the theatre. APR is the ticket, popcorn, and taxes.

Why Does APR Matter When Applying For A Personal Loan?

If you have expenses from every direction, the last thing you need is a “gotcha” moment with your personal loan.

Here’s how APR saves you stress (and money):

● Avoids Surprise Costs: You will know precisely what you are spending, including any hidden fees.

● Makes Comparisons Easier. Two lenders may provide 12% interest, but one may demand ₹3,000 in additional expenses. APR exposes this.

● Keeps Your Budget Intact: Knowing the true cost upfront allows you to design EMIs that match your monthly income.

With the right repayment schedule, all that's left is to check your loan eligibility in minutes with Hero FinCorp's personal loan tool.

How Do I Calculate APR?

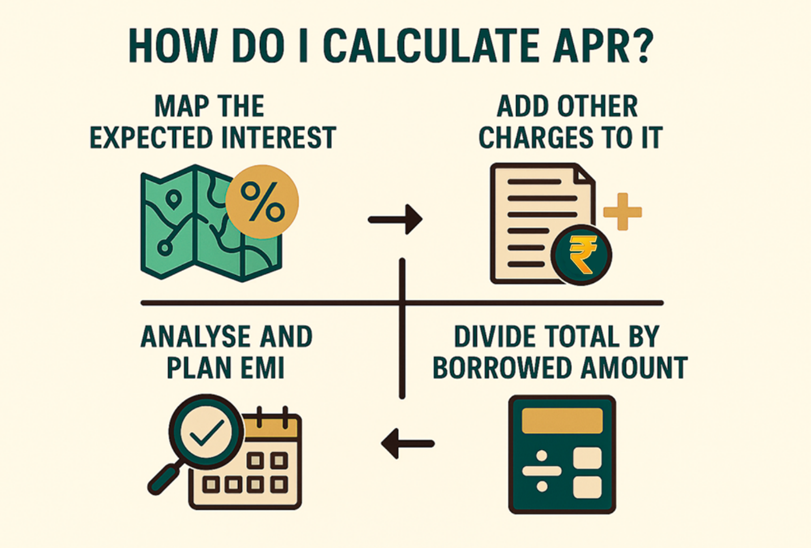

APR is far simpler to calculate than it sounds.

Here's a step-by-step on how to arrive at a loan's APR:

Step 1: Map the Expected Interest

Let's say you borrowed ₹150,000 for 1 year at 19% interest.

Here’s what that means:

● Interest: ₹28,500 (19% of ₹150,000 )

● Total Loan Cost: ₹178,500 (Add interest to the loan amount)

While this may seem like an EMI of ₹14,875/month, it's not the full picture.

Step 2: Add Up Other Charges

Next, include all the extra fees the lender adds. These are often not highlighted upfront:

● Processing Fee: ₹4,500

● Documentation Charges: ₹1,000

● Loan Insurance: ₹2,500

● Total: ₹8,000

Now, add that interest to get:

● ₹36,500 is the total cost of the loan (interest of ₹28,500 plus additional costs of ₹8,000).

● When all fees of ₹36,500 are added together, the total cost borrowed is ₹186,500.

Step 3: Calculate The APR from the Total Cost

Now, if the total cost for the loan is Rs. 36,500, dividing this by the initial loan amount of Rs. 150,000, this would imply that the APR on your personal loan is 24.33%.

Step 4: Analyse

With an APR of 24.33%, there has been a change in the EMI from Rs. 14,875 to Rs. 15,542 per month. A little difference like this can creep into your budget and ruin it when you comprise the expenses towards EMI, tuition, and household bills.

APR keeps you in control. It tells you the full cost before you commit. Plus, using the Hero Digital Lending App makes it easy to get funds in just minutes.

APR Tells You What the Interest Rate Doesn’t

Focusing on appealing interest rates runs the danger of blinding you to hidden fees and other charges. APR is the torch that illuminates the true cost of borrowing.

Transparency in personal loans facilitates stress-free borrowing and appropriate budgeting. At Hero FinCorp, we help you borrow more intelligently and minimise guesswork.

To ensure complete clarity, use Hero FinCorp's APR-based loan calculator and apply for a personal loan today!

Frequently Asked Questions

1. Why do banks advertise interest rates and not APR?

Since interest rates look lower and more attractive, APR includes fees, so it’s more honest but less flashy. That’s why you need to calculate it.

2. What constitutes a "good" APR in India?

A competitive APR is determined by your credit score, income level, and loan length. Personal loan APRs at Hero FinCorp begin at 19%, with clear conditions to help you plan ahead.

3. Can APR be negotiated?

You can’t negotiate APR directly. That said, improving your credit score, choosing shorter tenures, or skipping optional fees helps.

4. Do I always have to calculate APR myself?

Not always. Some lenders disclose it, but to be safe, use a loan calculator or simply ask your lender. Hero FinCorp offers clarity on all costs upfront.

Disclaimer: The information provided in this blog post is intended for informational purposes only. The content is based on research and opinions available at the time of writing. While we strive to ensure accuracy, we do not claim to be exhaustive or definitive. Readers are advised to independently verify any details mentioned here, such as specifications, features, and availability, before making any decisions. Hero FinCorp does not take responsibility for any discrepancies, inaccuracies, or changes that may occur after the publication of this blog. The choice to rely on the information presented herein is at the reader's discretion, and we recommend consulting official sources and experts for the most up-to-date and accurate information about the featured products.